Uniswap investors may want to consider these levels after UNI’s 192% rally

Uniswap [UNI] delivered quite an interesting performance in the last few weeks. This is especially the case in the last seven days, during which it achieved a consecutively bearish performance. UNI’s performance this week was rather expected after the strong upside it achieved after bottoming out in June.

To put things into perspective, UNI rallied by as much as 192% from its lowest price level in June. A cool down or retracement is inevitable after such a performance. It tanked by 30% from its peak in July, to its latest low point.

As of 19 August, UNI traded at $7.02 after a slight recovery from its 24-hour low of $6.89. The latter is an important price level because it sits on the 0.3382 Fibonacci retracement level. The same level provided support when the price encountered its mid-rally relief retracement in the week after mid-July. It also provided some support at the start of May.

The slight retracement as witnessed on 19 August can be considered as a good sign that the 0.382 Fibonacci line that might act as the next support level. If that fails, then the price might continue on its bearish trajectory. The next support level in case of such an outcome is at the $5.56 price zone which aligns with the 0.236 Fibonacci level.

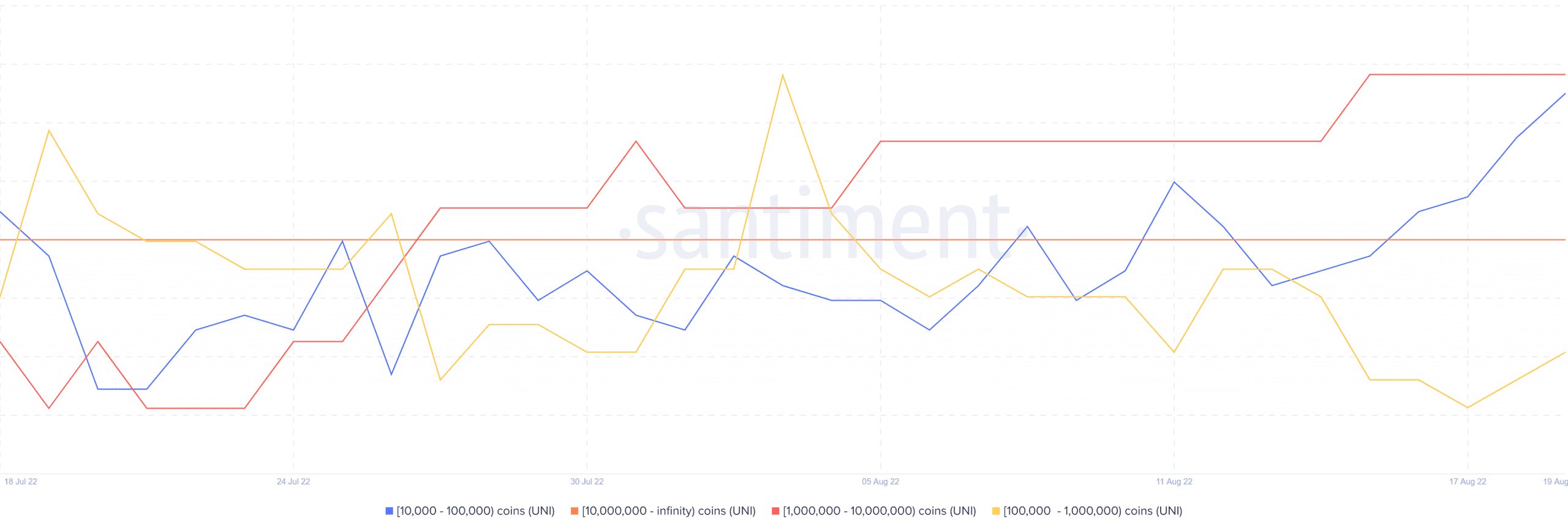

There are more signs suggesting that the $6.89 price level will provide support for the latest downside. For example, UNI’s supply distribution by balance of addresses confirms that whales are currently not selling. Some categories of large holders have been accumulating in the last few days.

Addresses holding between 10,000 and one million coins have increased significantly even as prices drop. This suggests that there is some accumulation taking place at the discounted prices. This observation is collaborated by an increase in exchange outflows compared to inflows.

What does this mean for UNI’s short-term performance?

The answer is that UNI might bounce back from the current support level (the 0.382 Fibonacci level). The bearish cease fire as of 19 August, and slight uptick indicates that the support levels are strong.

Accumulation confirmed by on-chain metrics point towards the above expected outcome. However, caution is warranted as the weekend approaches, because the volatile nature of the market might trigger an extended selloff. This means there is still a chance that UNI might lose its current support depending on market forces.