Uniswap: Investors’ sale of UNI worth $14M is a sign of…

Uniswap seems to be making headway, not in recovering prices, but in falling to the lowest imaginable levels this month. As a result, investors who have been holding out hope are slowly realizing that they might have to lose their optimism soon.

Is UNI uniquely bearish now?

Although a lot of altcoins are at single-digit multi-month lows, UNI is standing out for being at a 14-month low with the price falling to $7.49. Over the last 2 weeks, this altcoin has registered the highest decline with a figure of 36.86%.

Uniswap Price action | Source: TradingView – AMBCrypto

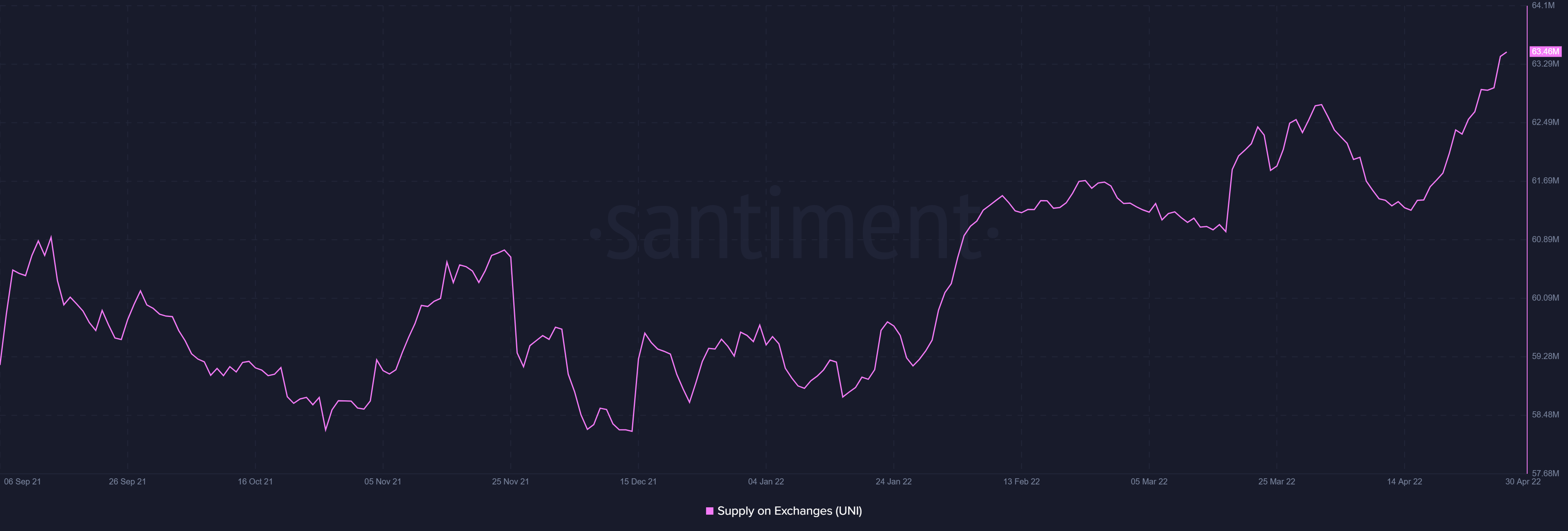

Investors have already been skeptical about UNI this year, with consistent selling seen in January and February. Some conviction returned in mid-March when UNI shot up to rally somewhat. Alas, it didn’t last long as since mid-April, investors have switched back to their selling mode and sent over 2 million UNI into exchanges.

Uniswap supply on exchanges | Source: Santiment – AMBCrypto

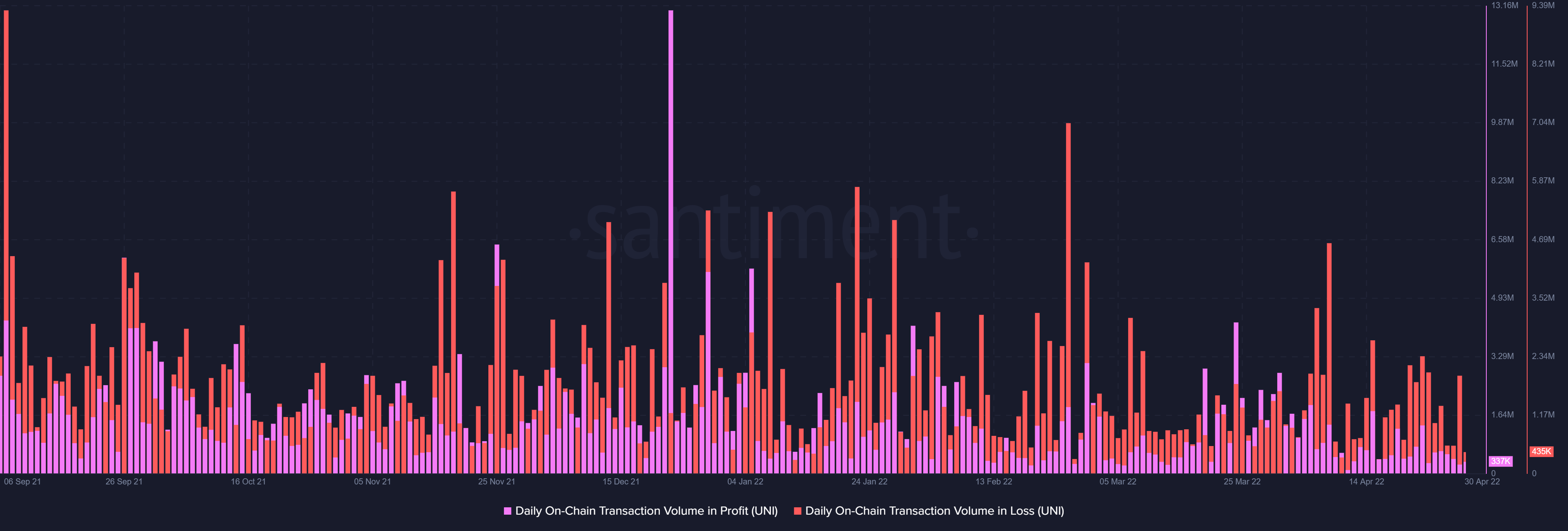

Since late November, investors have only been conducting transactions in losses. The only day transactions were in profit was 23 December, when UNI was up by 12% in 24 hours.

That day, 13 million UNI recorded gains that have never been seen since.

Uniswap transactions in loss | Source: Santiment – AMBCrypto

However, even among these UNI holders, the ones to suffer the most are the 17k holders who bought their holdings when UNI was at its all-time high.

The likelihood of these investors recording some gains and profits again, ergo, seems very improbable.

Uniswap all-time highers | Source: Intotheblock – AMBCrypto

Furthermore, at press time, the Relative Strength Index for Uniswap was oversold. Technically, when an asset’s RSI is at this position, it usually changes the active trend and makes a run for recovery.

However, Uniswap historically has endured a few more weeks of bearishness after touching this zone. This is why whether or not prices recover over the next few days, UNI will return to the price level it is at.

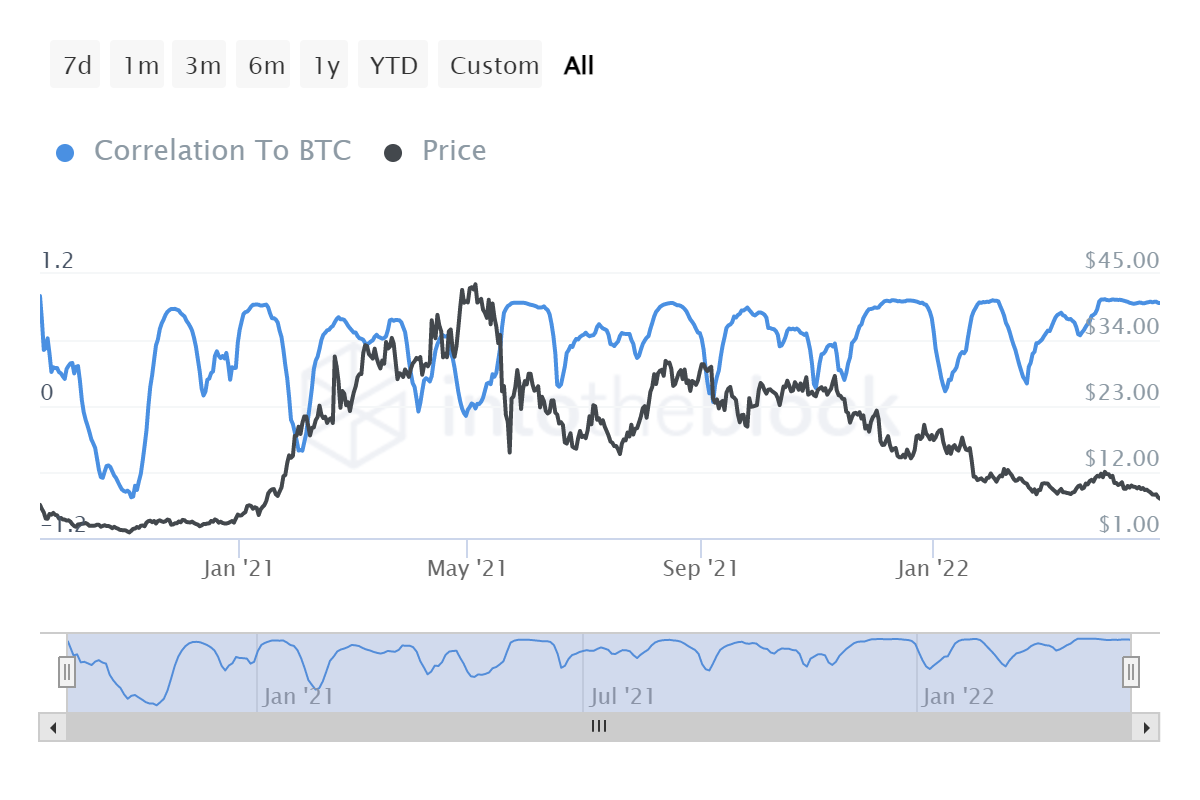

It might get some support from Bitcoin if the king coin decides to rally and cement $40k as support since Uniswap and Bitcoin share a correlation of 0.97. This, on the contrary, could also be the cause of Uniswap’s bane.

Uniswap’s correlation to Bitcoin | Source: Intotheblock – AMBCrypto