Uniswap leads market rebound with a surge: Can UNI stay above $6?

- Uniswap has surged by more than 6% in the last 24 hours amid rising trading volumes.

- UNI’s Open Interest has surged by more than 11% as bullish sentiment grows.

The cryptocurrency market is showing signs of a rebound after suppressed weekend action. Bitcoin [BTC] has bounced back above $58,000 and altcoins are following suit. Uniswap [UNI] was leading the market recovery with a nearly 6% gain.

UNI was trading at $6.06 at the time of writing. The gains come amid rising market interest in the altcoin. Data from CoinMarketCap showed that UNI trading volumes have jumped by over 60% in the last 24 hours.

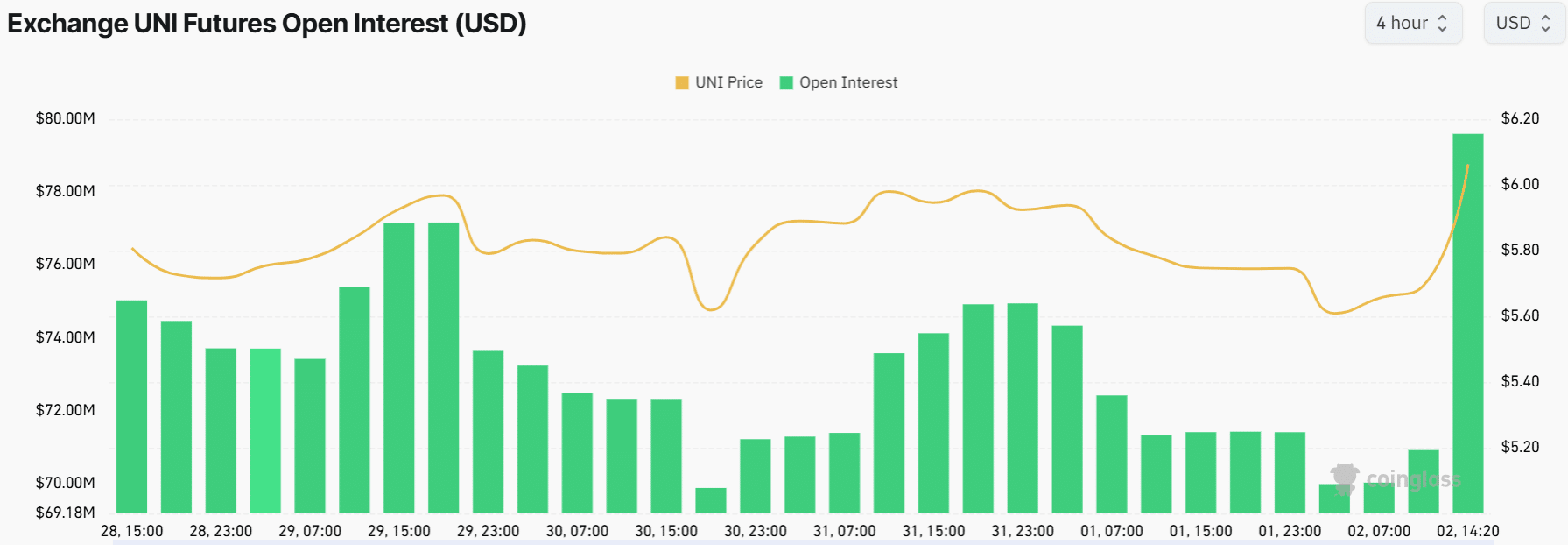

Besides the rising interest in the spot market, the futures market is also showing a spike in trading activity.

Coinglass shows a significant surge in Open Interest (OI). In the last 24 hours, Uniswap OI has increased by 11% to $79 million.

Such an increase tends to show a bullish momentum, especially if it coincides with rising prices.

However, will UNI extend its gains or will the bears regain control?

Bullish indicators emerge

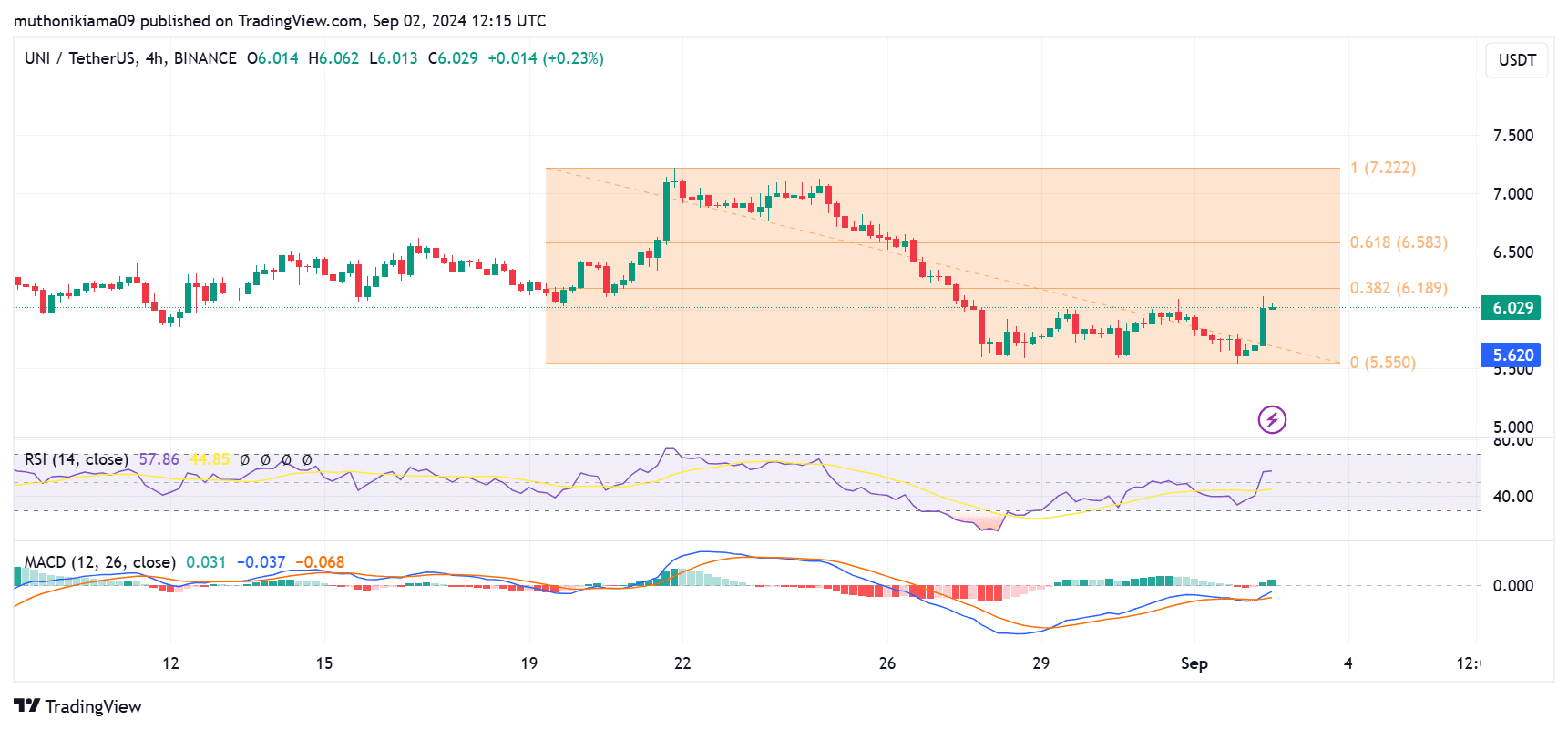

Several technical indicators confirm that UNI is in a bullish momentum.

The Relative Strength Index (RSI) is showing a bullish reversal with a sharp upward move. Moreover, it has crossed above the signal line, an indicator that buyers have overwhelmed sellers and taken control of the price action.

The bullish thesis is further confirmed by the Moving Average Convergence Divergence (MACD) line that has moved above the signal line. The MACD histogram bars have also shifted to green showing the dominance of the bulls.

However, to confirm the strength of the uptrend. The MACD line needs to cross above the zero line.

If the bullish momentum continues, bulls will target the next key resistance level at $6.18. Breaking this level will pave the way for further gains.

On the other hand, if this uptrend fails, UNI may drop lower to test the crucial support level at $5.62. The coin has held this support level since last week.

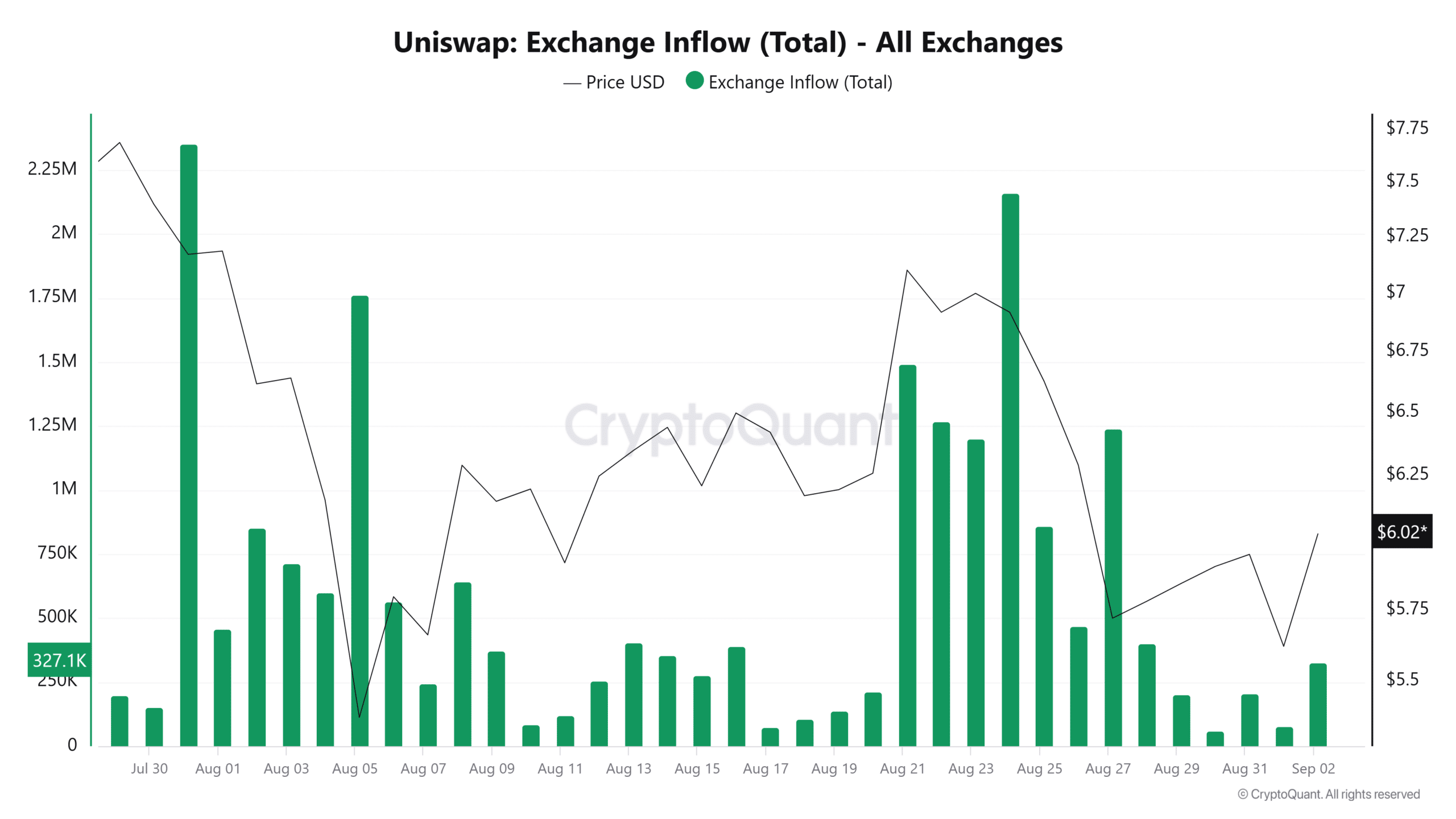

The recent rise in UNI prices could have been caused by the exhaustion of sellers. Data from CryptoQuant shows that UNI exchange inflows hit a monthly high on August 24.

Is your portfolio green? Check out the UNI Profit Calculator

These inflows have since slowed down, with buyers now having room to drive further gains.

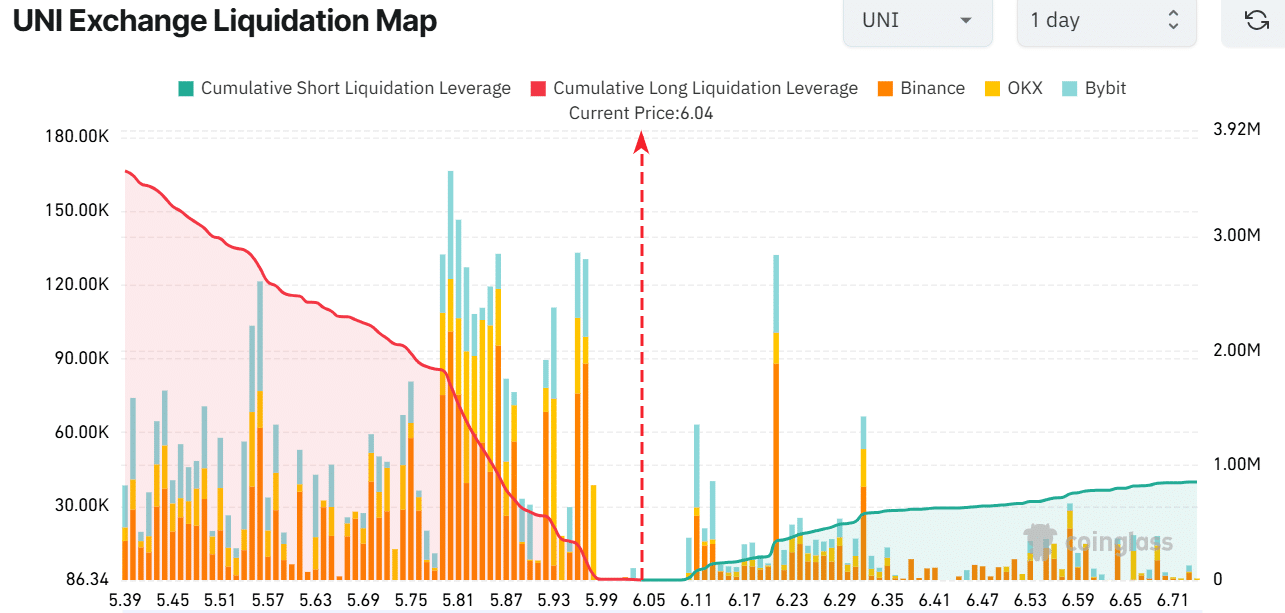

One of the key levels to watch on UNI is $6.21. A large number of short positions are at risk of being liquidated if UNI rises to this price. This situation would trigger a short squeeze that will support further gains.