Altcoin

Uniswap: Milestone aside, 13% price plunge draws concerns

Uniswap celebrates a remarkable achievement with over 250 million swaps, showcasing its growth. TVL fluctuates, with Uniswap V3 leading at $2.7 billion.

- Uniswap achieved a significant milestone by surpassing 250 million swaps.

- UNI declined by over 13% as V3 dominated TVL.

Uniswap [UNI] has been making waves recently, as the platform crossed a significant milestone in the number of swaps. However, it’s not just the sheer volume of swaps that highlighted its growth since its launch.

How much are 1,10,100 UNIs worth today?

Uniswap sees record swaps

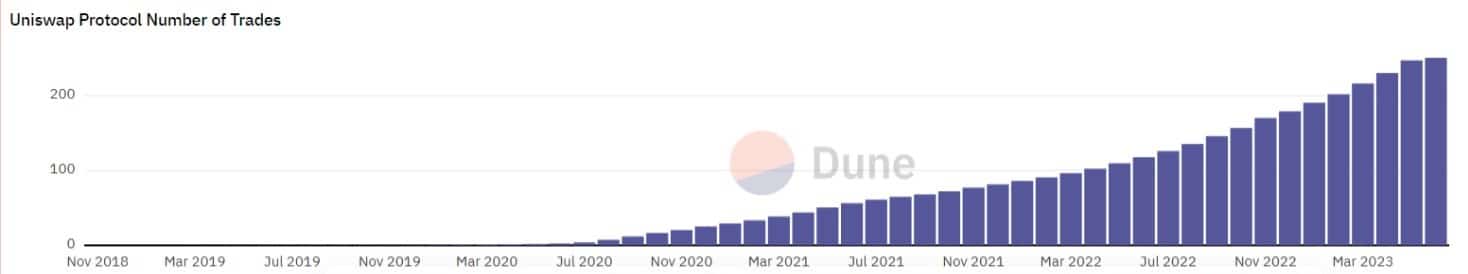

On 9 June, Uniswap reported an astounding achievement in the form of a groundbreaking number of swaps conducted on its platform. The figure, supported by data from Dune Analytics

, recently surged past the 250 million mark.As of this writing, Dune Analytics recorded approximately 250.5 million swaps, with the number steadily increasing.

Furthermore, significant milestones, including Uniswap’s V1, V2, and V3 launches, have marked Uniswap’s journey. These successive releases expanded the platform’s offerings and widened its reach.

The recent deployment of Uniswap V3 on other blockchain networks, such as Binance Chain, Polygon [MATIC], and, most recently, Arbitrum [ARB], has further amplified its presence and potential.

Uniswap’s TVL highs and lows

A closer look at the Total Value Locked (TVL) on the Uniswap platform revealed an interesting trend. Over the years, the TVL has experienced fluctuations, with a notable decline overall. As of this writing, the combined TVL of all Uniswap versions stood at over $4 billion.

The TVL graph exhibited a significant decline, punctuated by occasional uptrends. In March, there was a slight upward movement in TVL, reaching a peak of $4 billion before descending again.

Additionally, a breakdown of the TVL by different versions of Uniswap sheds light on the value distribution. Uniswap V3 had the highest TVL among the versions, amounting to approximately $2.7 billion. In contrast, Uniswap

V2 followed closely behind with a TVL of around $1.7 billion.The wild UNI run

Recent data from Santiment highlights an interesting development regarding Uniswap. The number of active addresses on the platform experienced a slight uptrend, indicating increased user engagement.

The 30-day active addresses metric hovered around 30,000 at press time, reflecting positive user activity and participation trend.

Is your portfolio green? Check out the UNI Profit Calculator

However, UNI price told a different story when observed on the daily timeframe chart. As of this writing, the token was trading at approximately $3.9, exhibiting a significant loss of over 13%.

The price had entered a strong bearish phase, characterized by a downtrend that had pushed UNI into the oversold region on the Relative Strength Index (RSI).