Uniswap retests previous mid-range level, bulls can watch for these levels

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- UNI’s recent strong rally saw it clear the $5.211 obstacle.

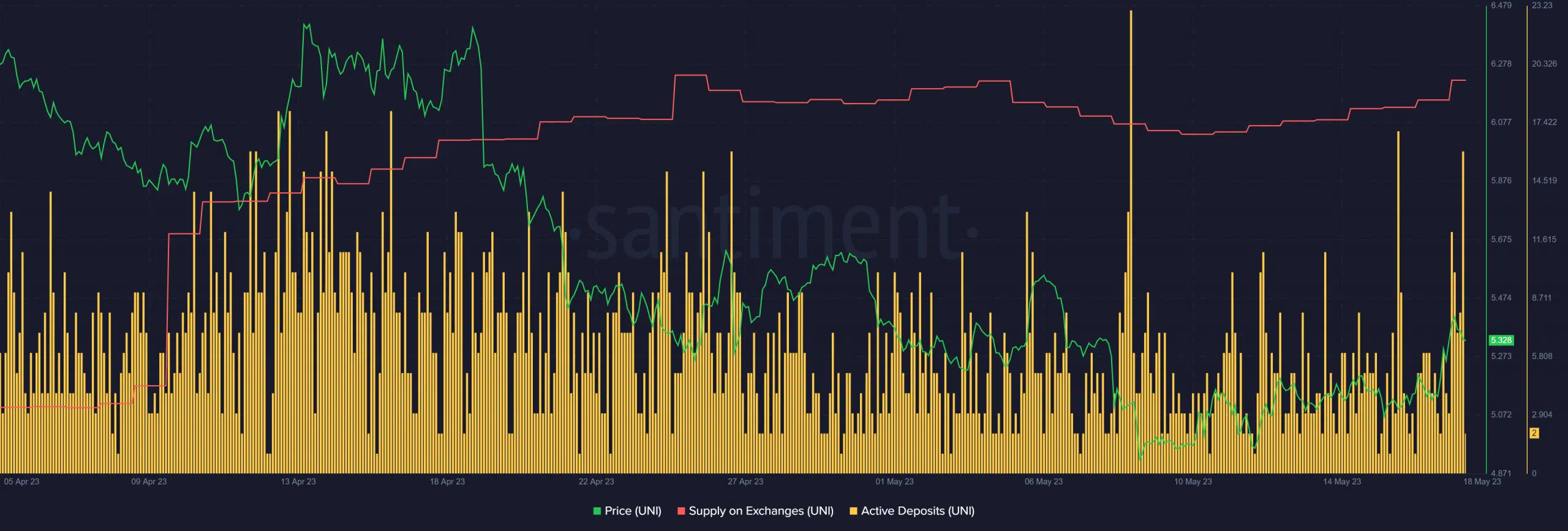

- Spikes in active deposits confirmed the sellers’ action.

Unsiwap [UNI] appreciated on 17 May, hiking about 6% from $5.11 to $5.43. The move was partly influenced by Bitcoin [BTC] reclaiming the $27k price zone.

On the other hand, plans to deploy Uniswap V3 on Polkadot’s parachain, Moonbeam, are in full gear and could offer investors more gains if the proposal improves UNI’s traction.

Read Uniswap’s [UNI] Price Prediction 2023-24

However, as of press time, UNI saw price rejection after hitting the previous short-term median range of $5.41. The impulse move on 17 May left behind a market imbalance that could act as an entry for a long position if the uptrend direction continues.

A likely retest of the FVG?

The strong rally on 17 May, left an FVG (fair value gap) zone of $5.179 – $5.246 (white zone). The zone also aligns with a key support level in late April/early May and March swing lows.

Below the FVG zone lays the previous short-term range lows (yellow) of $5.211. Therefore, the area can act as a strong bullish stronghold. A pullback retest in the area could see UNI rally to retest the short-term mid-range of $5.408 or the range highs of $5.686.

If that’s the case, buying at the FVG level could offer a good risk ratio, especially if the rally retests the range highs.

A session close below the range low of $5.131 will be an invalidation. Such a downswing could tip sellers to devalue UNI to $5 or $4.95.

Meanwhile, the RSI and CMF rallied but had downticks at press time, indicating that the strong capital inflows and buying pressure eased in the past few hours.

Elevated short-term selling pressure

According to Santiment, there were spikes in active deposits, indicating an increase in short-term selling pressure. The trend was confirmed by the spike in UNI’s supply on exchanges, as more UNI tokens were moved for offloading.

Is your portfolio green? Check UNI Profit Calculator

There was also considerable whale activity at press time, highlighting the significance of UNI’s current price levels. Traders should track BTC’s price action alongside whale action before making moves.