Uniswap rises 11%, recovery on the way?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- UNI recorded gains of 11.3% to reverse recent losses.

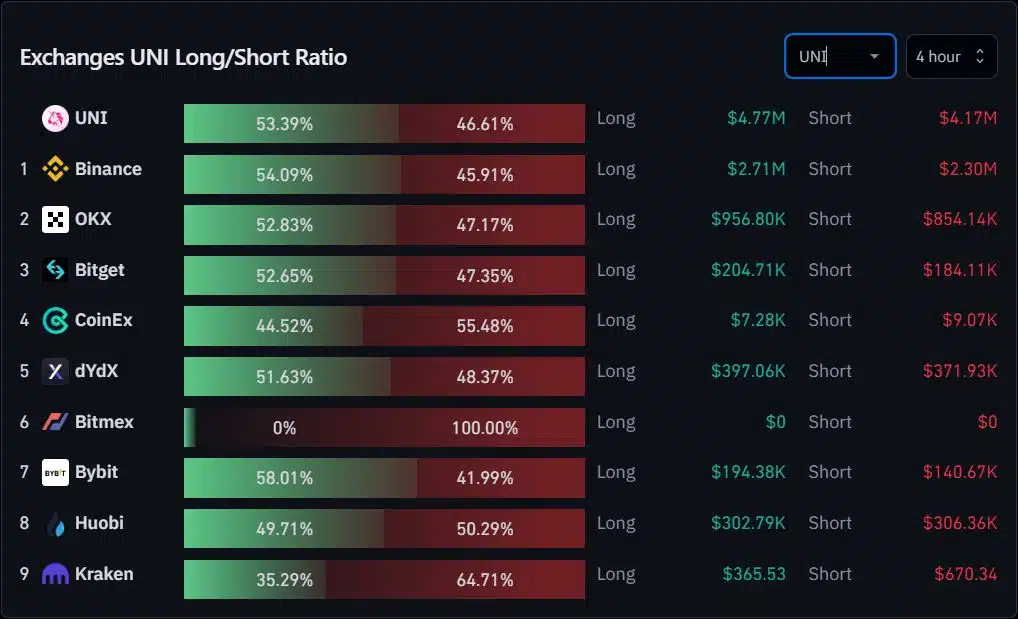

- Bulls encouraged by 53.3% advantage on long/short ratio.

Uniswap [UNI] slowly showed signs of recovery despite a 21% price dip over the past 24 hours. The price sharply bounced off the key support at $3.63 and recorded gains of 11.3% to trade at $4.07, as of the time of writing.

Realistic or not, here’s UNI’s market cap in BTC’s terms

With Bitcoin [BTC] and the entire crypto market still reeling from a week-long correction, the signs looked good for a Uniswap recovery in the short term.

Bulls display unwavering tenacity to encourage near-term recovery

UNI’s market structure has been bearish since the price got rejected at the $6.37 resistance level on 19 April. The intense selling pressure saw bears claim the $5.72 support level before bulls found respite at $4.87 support.

From 8 May to 4 June, Uniswap was stuck in a tight range, with buyers and sellers striving for a significant break. This saw price range between the lower/upper limits of $4.87 and $5.34.

The bullish defense of $4.87 was broken on 5 June with another wave of shorting activity. This took UNI to the $3.63 support level, a level last seen in June 2022 with a bullish order block on the daily timeframe, signaling the buying pressure at this level.

The four-hour timeframe showed the swift recovery by UNI bulls with five bullish candles in a row. Reclaiming the minor resistance of $4.51 could spur more bullish momentum. However, another price rejection at that level could see more bearish activity to erase the bullish gains.

How much are 1,10,100 UNIs worth today?

Meanwhile, the RSI climbed out of the oversold zone and stood at 30 while the CMF experienced a sharp reversal from negative territory. Both signaled significant buying pressure in progress for UNI.

Possibility of short-term recovery boosted by longs advantage

The futures market reacted positively to UNI’s bullish reversal. Data from Coinglass showed that buyers held a 53.3% advantage in the long/short ratio. This hinted that market speculators were actively priced in for a near-term recovery for Uniswap.