Uniswap set to solidify its position as leading DEX; community approves…

- Community members have voted in support of Uniswap v3 deployment on the BNB Chain.

- With the deployment, the DEX will benefit from BNB Chain’s large user base.

In spite of opposition from its largest investor Andreessen Horowitz (a16z), the deployment of Uniswap v3 on the BNB Chain has been approved by community members, with Wormhole serving as the cross-chain bridge for the new version of the platform.

Read Uniswap’s [UNI] Price Prediction 2023-2024

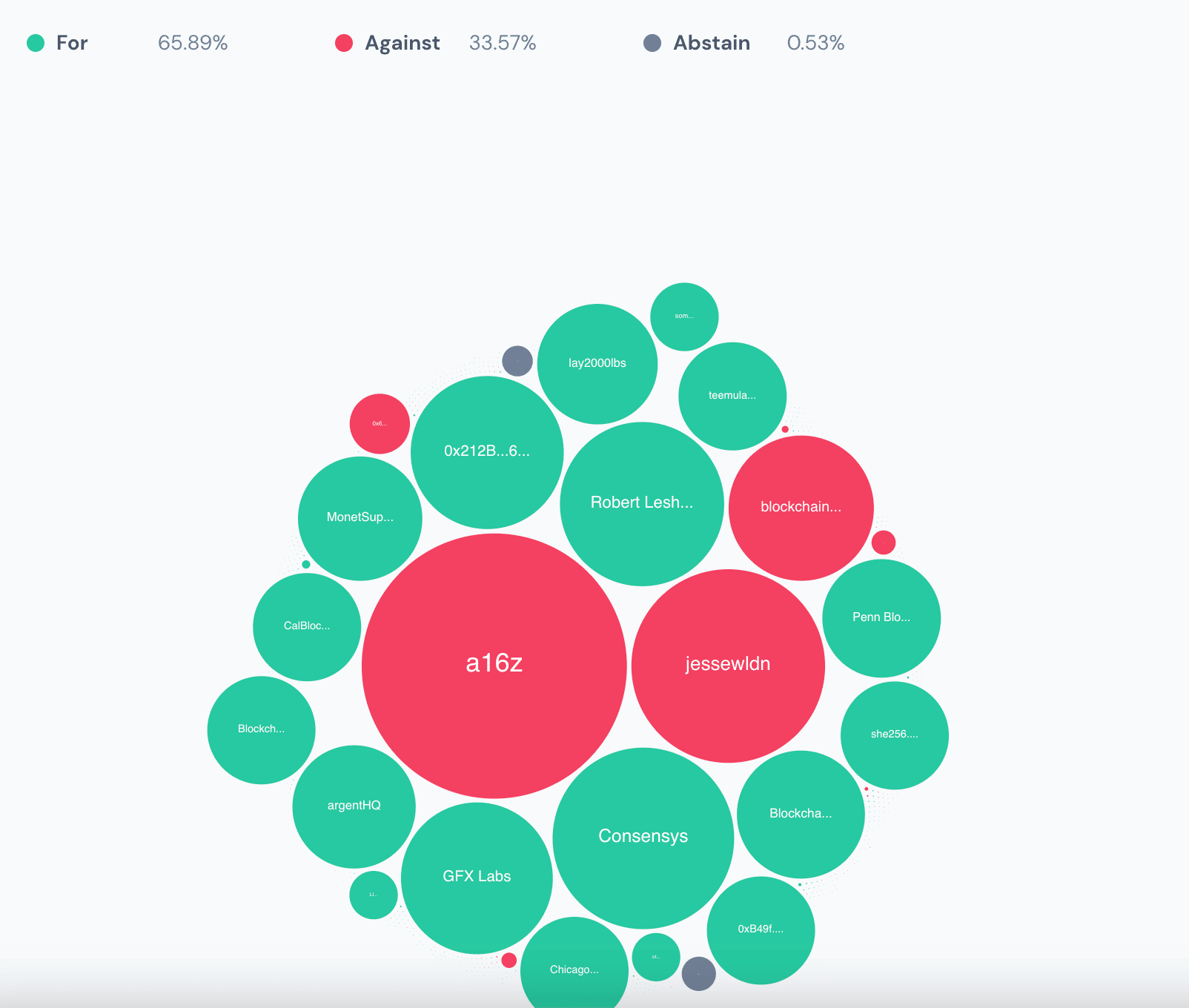

According to data from Tally, a total of 500 addresses participated in voting on the controversial proposal. These addresses cast a combined 84.8 million votes, with 65.89% of the votes supporting the proposal, 33.57% opposing it, and only 0.53% abstaining.

The two most prominent objectors to the proposed deployment were a16z and Jesse Walden, who collectively used 23 million UNI tokens to oppose the deployment of Uniswap v3 on Binance’s BNB Chain.

Uniswap’s largest investor, a16z, was the lead dissenter against the use of Wormhole as the cross-chain bridge. a16z had pushed for its portfolio company, LayerZero, to be used as the cross-chain bridge. The Uniswap community, however, did not choose LayerZero to be Uniswap’s Ethereum-to-BNB bridge service.

Porter Smith, a partner at a16z Crypto, had cited the $326 million hack of the Wormhole platform last year as the main reason for the firm’s opposition to Wormhole being used as the cross-chain bridge.

The firm also expressed concerns about the process used by the DAO to assess different bridge options.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Uniswap intends to solidify its position as the number one DEX

With a go-ahead given to deploy its V3 on BNB Chain, Uniswap will benefit from the network’s large user base. BNB Chain is popular for its large user base, and the deployment of Uniswap V3 on its platform could bring new users to the Uniswap platform.

This could increase liquidity and make the platform more accessible to a wider range of users.

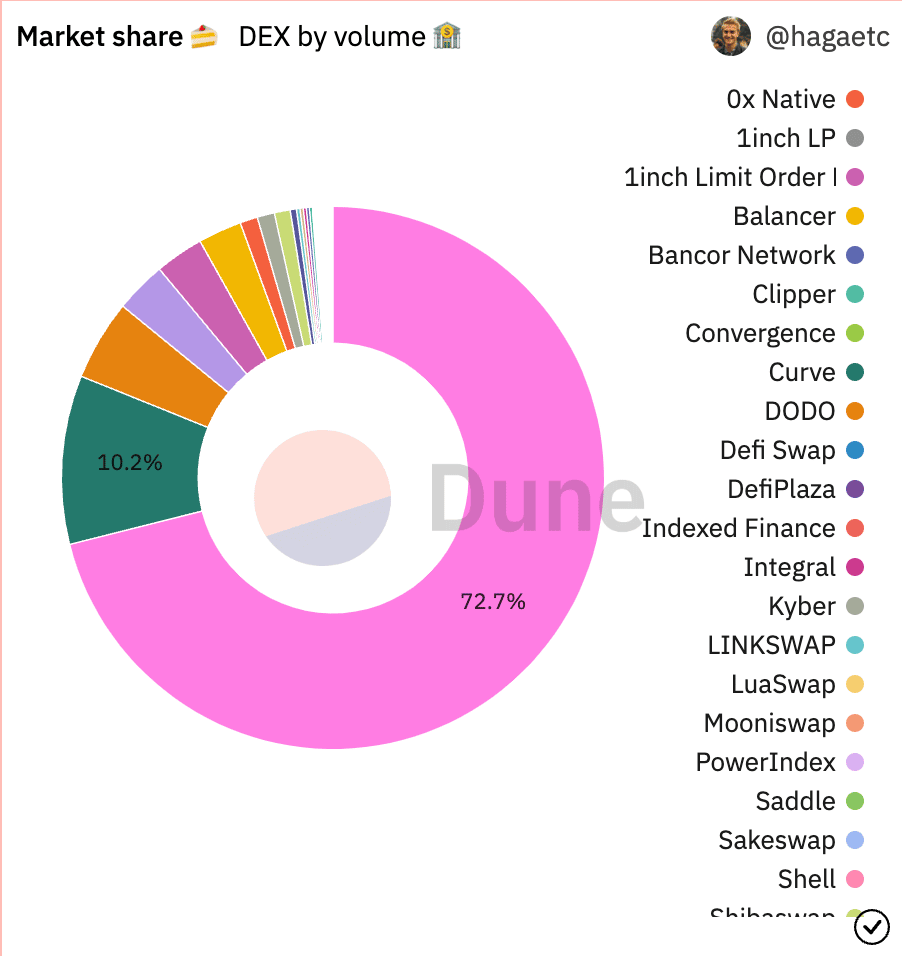

As of this writing, in the decentralized exchange (DEX) vertical of the crypto world, Uniswap has the largest market share, per data from Dune Analytics.

In the last week alone, Uniswap controlled 73% of the entire market volume of the DEX ecosystem. By deploying on BNB Chain and leveraging the network’s security and large user base, the DEX’s market share is expected to increase.

According to DefiLlama, the total value of assets locked (TVL) within the Uniswap V3 smart contract was $2.82 billion. Of all Uniswap’s three deployments, V3 has the highest TVL and is functional on more chains.

By deploying on BNB Chain, the DEX will experience a boost in asset deposits, leading to an expansion of its TVL as the year progresses.