Uniswap: The if and but of development activity driving UNI to $18.44

Uniswap’s position as the market’s biggest DEX speaks volumes for its DeFi capabilities. Well, the same has now been verified by its developmental activities.

Uno Uniswap!

A crypto-market analytics platform recently reported that Uniswap is the most developed project on Github over the last 30 days. In fact, its developmental activity was found to be almost three times that of Solana.

Polkadot, Kusama, and Cardano followed closely in the third, fourth, and fifth positions, respectively.

Most developed crypto chains in March | Source: CryptoRank

Even though Uniswap doesn’t have anything particularly new going on in its ecosystem, perhaps being the biggest decentralized exchange (DEX) is enough to justify the need for regular development.

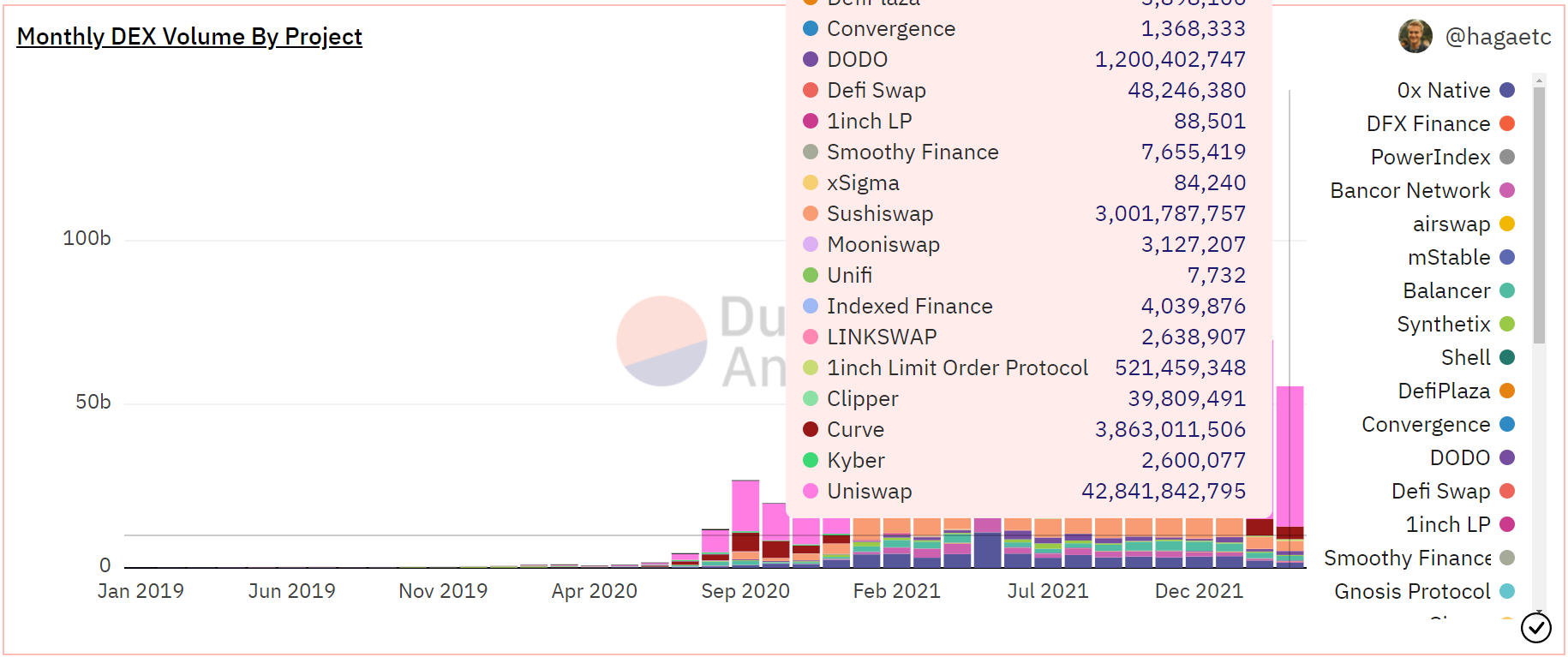

Curiously, over the months, the overall volume transacted on the DEX has been declining. And yet, Uniswap has still managed to clock in over $42.7 billion in trading volume over the month of March. It’s worth noting that the Dapp has been dominating 78% of the DEX market.

Furthermore, Uniswap’s closest competitors, Curve and SushiSwap, have registered figures of only $3.8 billion and $3 billion in trading volume, respectively.

Monthly DEX volume distribution | Source: Dune – AMBCrypto

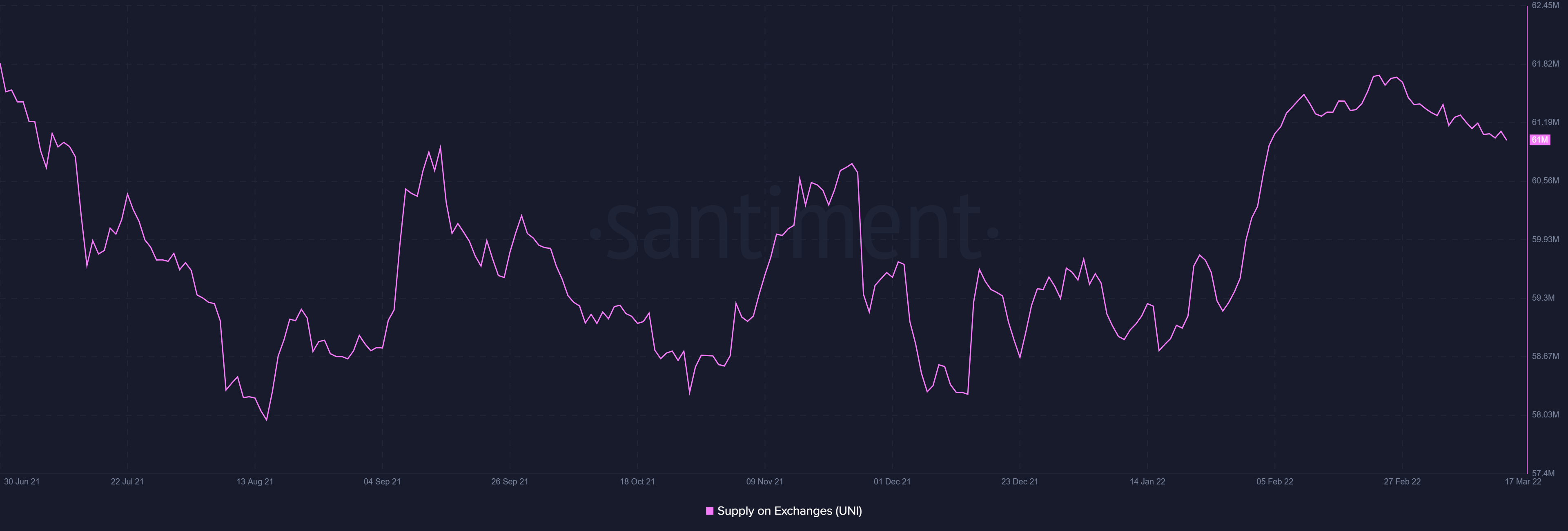

Notably, despite the decline in Uniswap’s trading volume, no particular change in investors’ behavior has been seen.

The what and ifs and buts of UNI’s network

Although the overall average on-chain transaction volume has decreased since December, the last few weeks have observed stable volumes in the lower $20 million – $30 million range.

Importantly, investors’ bullish sentiment over the month hasn’t subsided. In fact, with an increase in the price, UNI holders have gotten into a buying spree. In that context, 700k UNI worth almost $7.5 million have been bought out of exchanges in the last month alone.

Uniswap balance on exchanges | Source: Santiment – AMBCrypto

At the time of writing, Bitcoin was trading at $47,157, up by 5.57% over the last 24 hours. Also, the king coin seemed to be on the verge of breaching the critical resistance at $48,000.

Uniswap’s high (0.84) correlation with Bitcoin might just help the altcoin recover its previous losses in 2022.

Uniswap’s correlation to Bitcoin | Source: Intotheblock – AMBCrypto

UNI is still 42.73% down from its 2022 opening, and in order to recapture that zone, it will need to limit its price swings in the future.

Fortunately, at the moment, the volatility of the altcoin is considerably lower when compared to that of January 2022. This might help push UNI to $18.44 on the price charts.

Uniswap’s volatility | Source: Intotheblock – AMBCrypto