Uniswap tops these charts as OP goes on a rally

- Uniswap v3’s volume declined both on Ethereum and Optimism.

- On-chain metrics looked bullish, and open interest also shot up.

Uniswap [UNI] surprised investors over the last few days as its price action turned bullish. In fact, the token also became one of the most bullish projects on Polygon [MATIC]. Thanks to the price uptick, its performance on the social front improved drastically.

Most Bullish Polygon Projects On Social Media$UNI @Uniswap$MATIC @0xPolygonLabs$HEX @HEXcrypto$ATA @automatanetwork$LINK @chainlink$ELON @DogelonMars$RNDR @rendertoken$SUSHI @SushiSwap$SAND @TheSandboxGame$AAVE @AaveAave#onPolygon pic.twitter.com/CafpfRD4SX

— Polygon Daily ? (@PolygonDaily) July 30, 2023

Read Uniswap’s [UNI] Price Prediction 2023-24

However, the network’s usage registered a decline over the last few weeks, both on Ethereum [ETH] and Optimism [OP]. Will UNI’s price action be enough to lure more users onto the network and help increase its usage over the coming days?

A check on Uniswap’s state

While the token’s price went up, Uniswap v3’s performance took a back seat as a few stats declined. For instance, after spiking in mid-July, Uniswap v3’s volume started to decline both on ETH and OP.

Interestingly, while the number of trades went down on OP, the metric registered a spike on Ethereum, which was promising. Its TVL on both blockchains, however, has remained pretty stable over the past few weeks.

Apart from the network’s performance, UNI investors were having a comfortable week as its price turned bullish. As per CoinMarketCap, UNI was up by more than 7% in the last seven days.

At the time of writing, it was trading at $6.44 with a market capitalization of over $3.7 billion. Thanks to the bullish price action, UNI was not only one of the top gainers on Polygon but also on Avalanche [AVAX].

Top Gainers in Avalanche Ecosystem last 24H$UNI @Uniswap $FITFI @stepapp_ $MKR @MakerDAO $BAT @AttentionToken $AXL @axelarcore $AAVE @AaveAave $SUSHI @sushiswap $OOE @OpenOceanGlobal $BAL @Balancer $COMP @compoundfinance #Avalanche #AVAX $AVAX pic.twitter.com/QzZ5xzCnoM

— AVAX Daily ? (@AVAXDaily) July 30, 2023

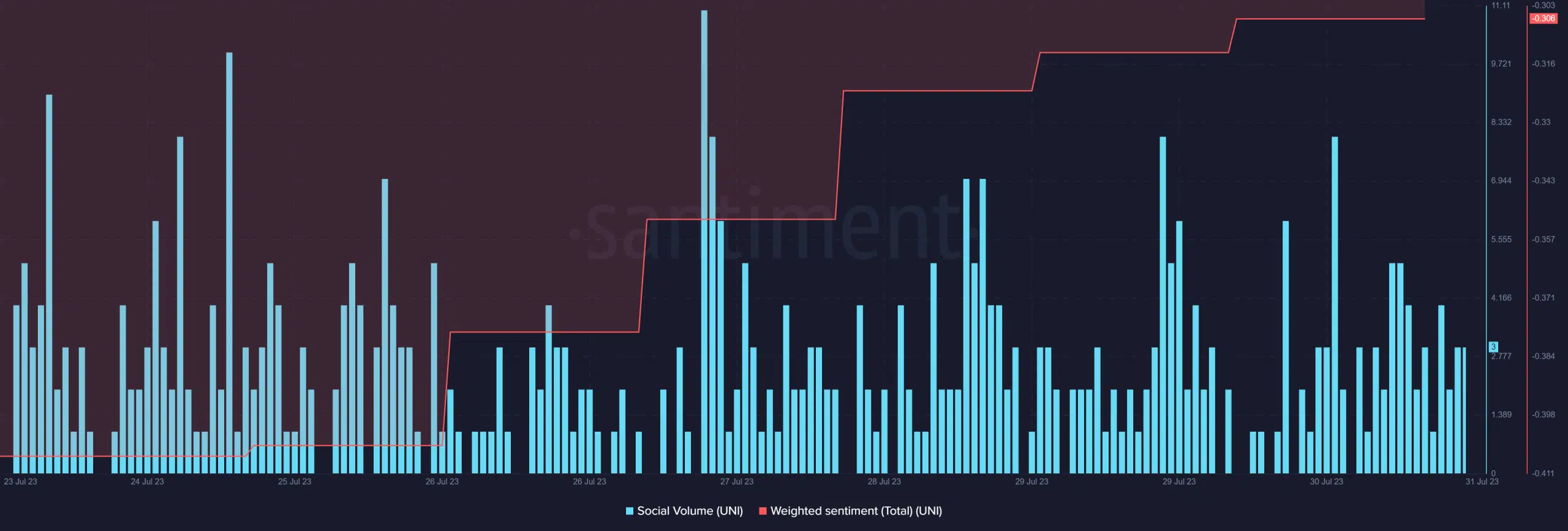

With the hike in the token’s price, its social metrics also increased. For example, positive sentiment around UNI went up, as evident from the rise in its weighted sentiment. Additionally, its social volume also remained relatively high, reflecting its popularity in the crypto space.

Is your portfolio green? Check out the UNI Profit Calculator

Uniswap’s chart might remain green in the short-term

Things on the metrics front also looked bullish as its price shot up. UNI’s net deposits on exchanges were low compared to the last seven days. During the rally, Uniswap’s supply on exchanges declined while its supply outside of exchanges increased, which is typically bullish. Whale activity around the token has also increased in the last few days.

The good days might not end soon as Coinglass revealed another bullish metric. As per the data, Uniswap’s open interest increased. A rise in the metric usually means new money is coming into the market for that option. Therefore, the chances of UNI’s bull rally continuing further seemed likely to happen.