Uniswap trading volume explodes 161%! Is $17 UNI’s next stop?

- UNI’s breakout from an ascending channel and rising volume hinted at bullish momentum.

- Strong on-chain metrics and increased whale activity supported a potential climb to $17.

Uniswap’s [UNI] recent performance shows strong momentum, with its DEX volume surging by 161.3% and price climbing 7% to $9.53 at press time.

This boost in trading volume reflected heightened interest in UNI, suggesting bullish momentum as it nears critical resistance levels.

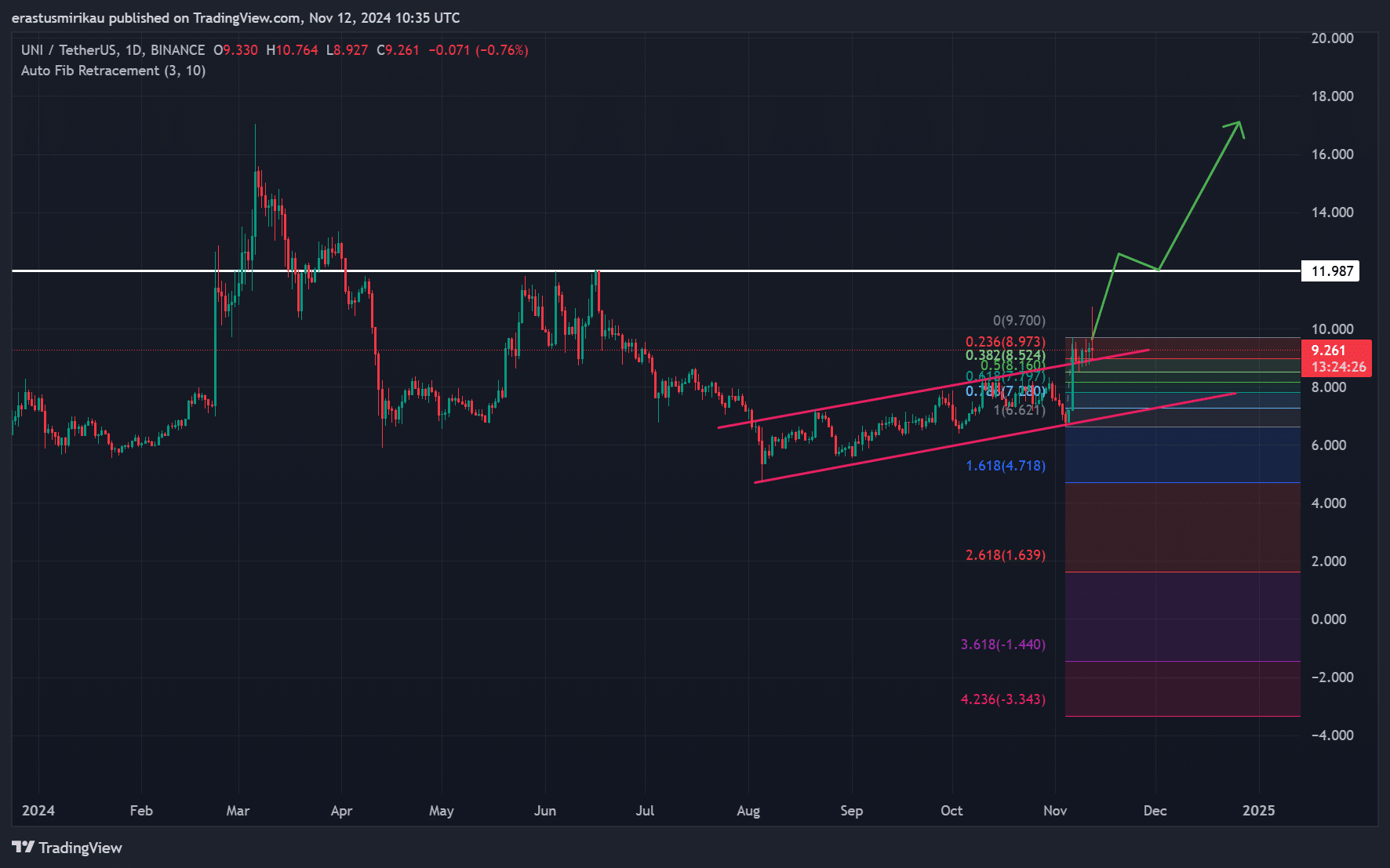

UNI has broken out from a bullish ascending channel and appears poised for further growth.

Bullish path for UNI

UNI’s recent breakout from an ascending channel signaled a potential trend reversal, capturing bullish sentiment.

At press time, the token targets the crucial resistance level at $11.98, a threshold that, if breached, could lead to a notable upside.

This level represents a key psychological barrier, and breaking it would likely accelerate the rally, opening the path toward a target of $17.

Additionally, the Fibonacci retracement tool offers insights into UNI’s possible support and resistance levels.

After surpassing the 0.236 Fibonacci level at $8.973, UNI aims for the next resistance levels in line with the 0.382 and 0.5 Fibonacci retracement levels, respectively.

A sustained push past these levels could confirm a robust upward trend, aligning with the bullish channel breakout.

Therefore, maintaining momentum above these retracement levels will be critical to sustaining UNI’s upward movement.

On-chain data supports UNI’s rally

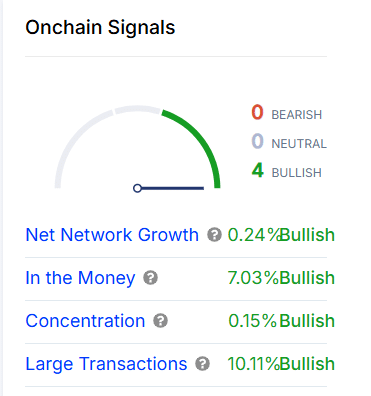

On-chain metrics further bolstered UNI’s bullish outlook. Net network growth showed a 0.24% increase, signaling moderate expansion in Uniswap’s network and a potential influx of new users.

Meanwhile, the “In the Money” metric was up 7.03%, suggesting that a significant portion of Uniswap holders were in profit, which generally supports positive sentiment.

Moreover, the concentration metric, which reflects holdings by large addresses, has increased by 0.15%.

This uptick indicates that “whales” are either holding or increasing their positions, often viewed as a sign of confidence in the token’s future.

Large transactions have also surged by 10.11%, pointing to heightened activity from institutional or high-value investors, reinforcing market optimism.

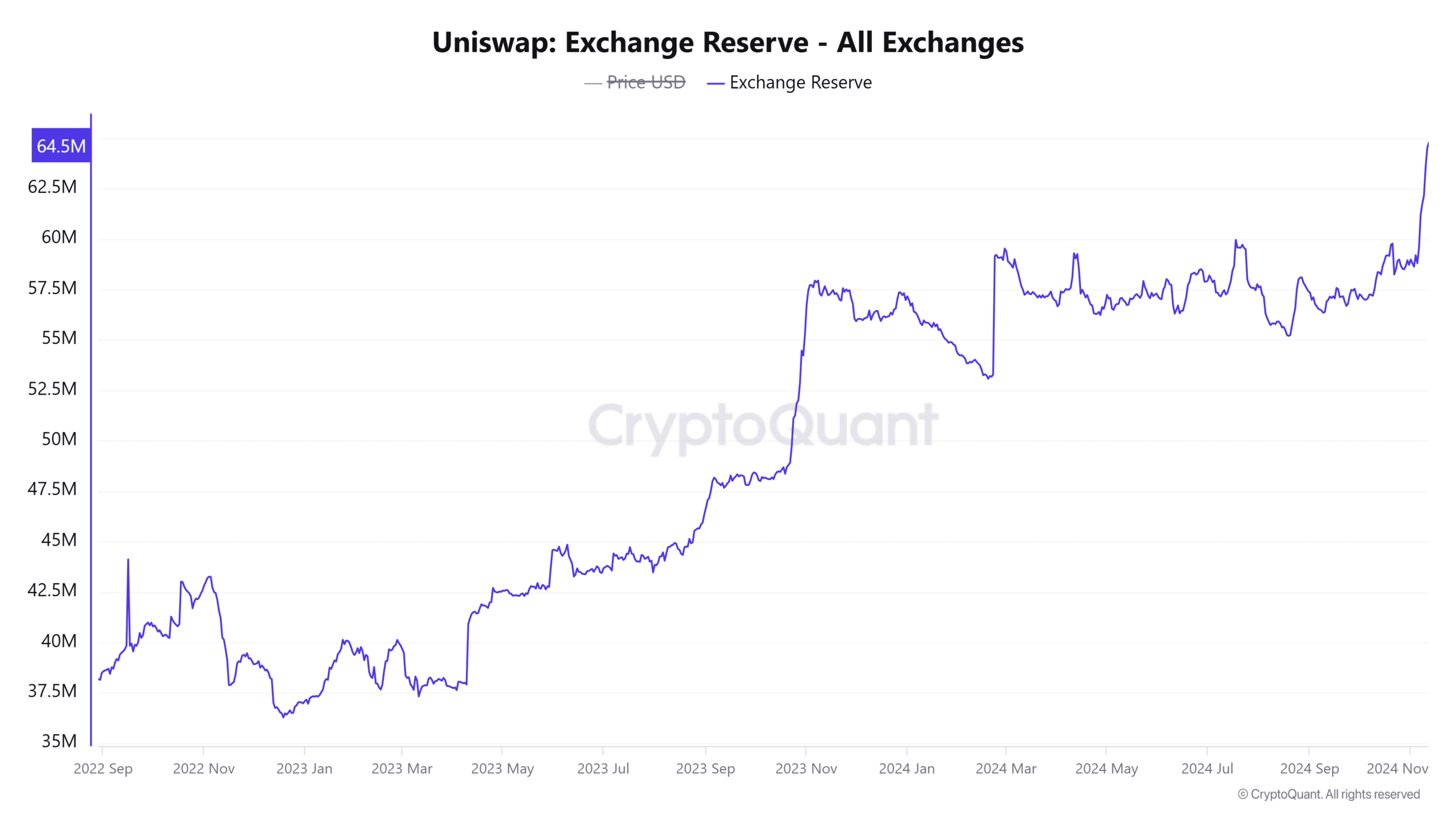

Slight caution as exchange reserves climb

However, one factor that may temper the bullish enthusiasm is the slight increase in UNI’s exchange reserve, up by 0.97% over the past 24 hours to 64.5 million UNI.

A rising exchange reserve often signals increased selling pressure as more tokens are deposited on exchanges, potentially leading to greater supply available for selling.

Therefore, while on-chain indicators reflect strength, the increase in exchange reserves could indicate caution.

Read Uniswap’s [UNI] Price Prediction 2024–2025

With strong on-chain metrics and a bullish chart setup, Uniswap looks primed for continued growth. The recent breakout and positive on-chain signals suggest that a move toward $11.98 and beyond is within reach.

If UNI can overcome this resistance, it has a clear path toward the $17 target, solidifying its bullish momentum.