Uniswap trading volume rises 126% – Will this help UNI reach $12?

- UNI’s price rose by 8.4% over the past 24 hours.

- Uniswap’s trading volume increased by 126% amidst increased buying activity.

Uniswap [UNI], like most altcoins, has experienced extreme volatility over the past week. The crypto market has fluctuated to heightened levels throughout August.

Despite this volatility, UNI’s prices have surged over the past seven days amidst increased trading volume.

As of this writing, UNI was trading at $6.99 after reporting an 11.11% increase on daily charts. Amidst the surge, trading volume has increased by 126% to $178.6 million.

Prior to this increase, Uniswap had experienced a downward trajectory, hitting a low of $4.7.

Despite the recent surge, Uniswap prices have remained below the June 2024 high of $11.5, with market analysts eyeing an uptick above $8.

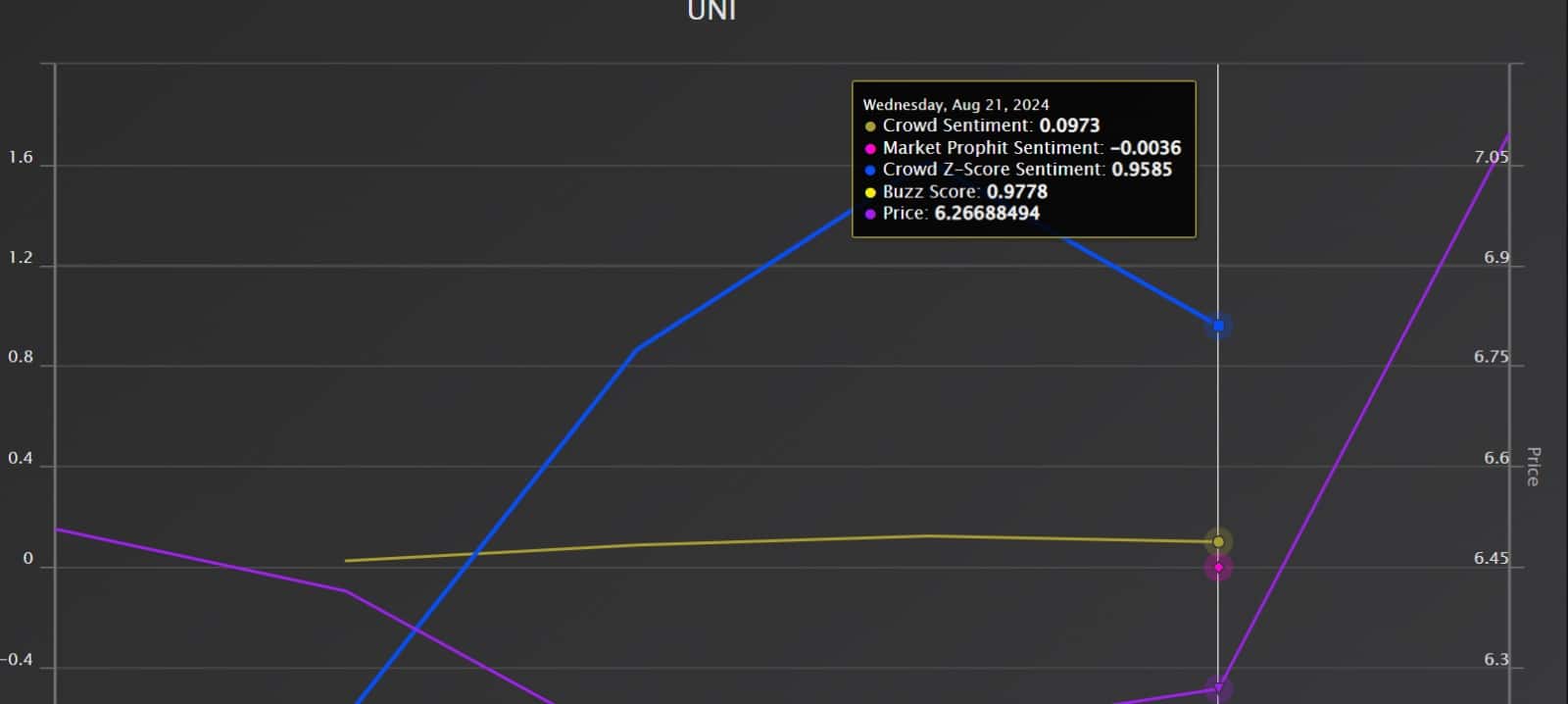

Prevailing market sentiment

The current market conditions have traders eyeing a buying opportunity, which positioned the altcoin for further gains. Inasmuch, analyst Nite predicted a 21.62% surge on their X (formerly Twitter) page, saying,

“$UNI Buy Signal Confirmed on Daily. 21% move to overhead resistance.”

According to Nite, if UNI maintains its level above $6, it will experience a sustained rally. Further, AMBCrypto’s analysis of Market Prophit showed that the altcoin was enjoying positive market sentiment at press time.

According to Market Prophit, Uniswap’s crowd sentiment was positive at 0.09, with a buzz score of 0.97.

Uniswap: What price charts suggest

Over the past 24 hours, UNI’s price saw an 8.8% increase, breaking out of its descending channel. AMBCrypto’s analysis showed that the crypto was enjoying a strong upward movement at press time.

Also, the Simple Moving Average (SMA), at $6.4, was above daily prices at $6.99. This suggested that Uniswap was experiencing buying pressure, resulting in an uptrend.

Also, the CMF was positive at 0.15, further conforming to increased buying pressure.

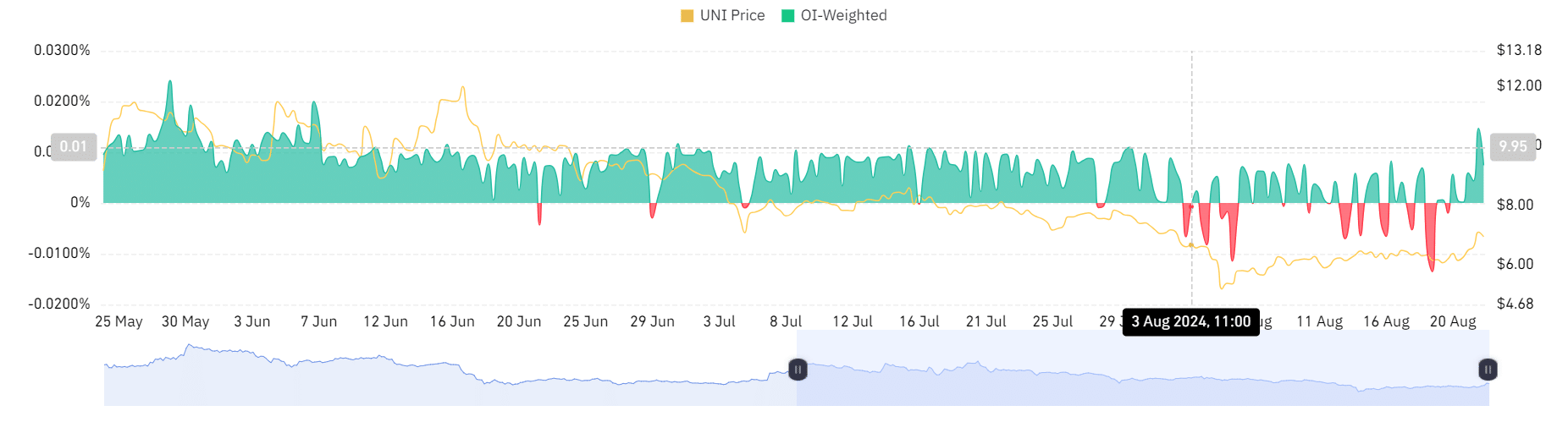

Looking further, Coinglass data showed that the OI-Weighted Funding Rate has been positive for the last 48 hours. This meant that more traders were going long (betting on prices to increase).

The positive Funding Rate implied that long-position holders were willing to pay a premium to hold their positions.

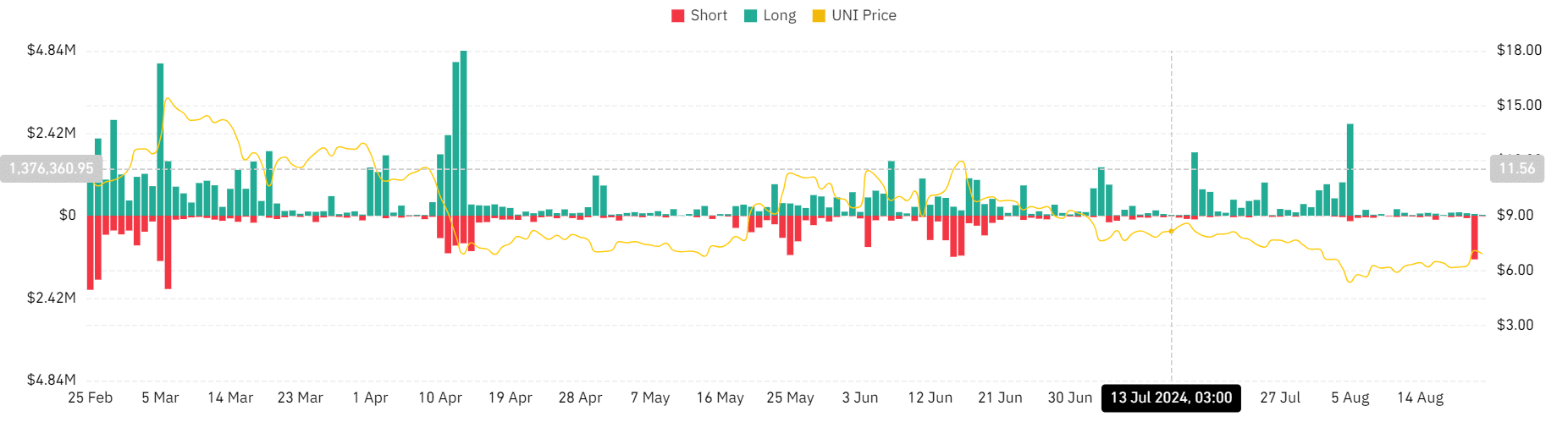

Equally, long position liquidations have decreased since the 5th of August, when it hit $2.6 million to $26k at press time.

Is your portfolio green? Check out the UNI Profit Calculator

This further proved the higher demand for long positions, with investors betting prices to increase.

Therefore, if the prevailing market condition holds, UNI will attempt its previous resistance level of $8. A breakout from this level would give the altcoin enough strength for a rally towards $12.