Uniswap [UNI] caught in firing line as BUSD FUD threatens to reverse gains

- Transaction fees on Uniswap nosedived as users stayed away.

- Whales stayed faithful to UNI as it was one of the most purchased tokens.

Uniswap[UNI] saw its Binance USD [BUSD] holdings deplete sharply as traders holding the dollar-pegged stablecoin looked for the quickest ways to exit the market.

Realistic or not, here’s UNI’s market cap in BTC’s terms

According to a tweet by Glassnode, BUSD liquidity on the largest decentralized exchange in the crypto space dipped to a one-month low.

? $BUSD Liquidity on Uniswap just reached a 1-month low of $631,143.20

Previous 1-month low of $632,177.56 was observed on 04 February 2023

View metric:https://t.co/aTcUpCu12y pic.twitter.com/oKj9uqX4U4

— glassnode alerts (@glassnodealerts) February 14, 2023

The crypto market felt the pinch of an aggressive clampdown on the crypto market participants just as it was about to recover from the depths of 2022 bear market.

Will Uniswap take a U-turn?

The Uniswap community was upbeat after getting a go-ahead for the deployment of its latest version V3 on the BNB Chain. The prospect of benefiting from Binance Chain’s [BNB] large user base caused a surge in many of its key performance indicators (KPIs). However, the gains could be at risk of getting reversed.

According to data from Token Terminal, the daily active users on the DeFi protocol dropped in the last three days. Even bigger was the drop in transaction fees. After hitting a three-month high of $3.6 million recently, the metric plunged by almost 50%.

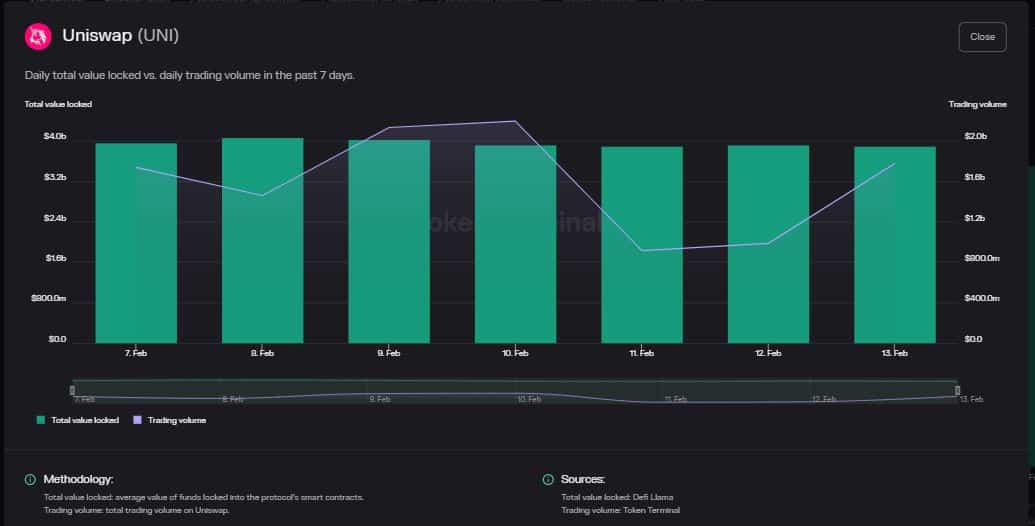

The drop in transaction fees could be aligned to the decrease in the protocol’s decline in trading volume. However, the total value locked (TVL) remained on a flat trajectory without showing major changes in its behavior.

It wasn’t clear whether the negativity surrounding BNB and BUSD had a domino effect on Uniswap’s performance due to the aforementioned partnership. BNB lost 10% of its value on Monday, as per data from CoinMarketCap.

Will whales show ‘UNI’ty?

Despite the dip in key indicators, large addresses expressed interest in the native token. According to WhaleStats, UNI was one of the top purchased tokens among the big Ethereum [ETH] whales.

JUST IN: $UNI @Uniswap now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

We've also got $GRT, $SHIB, $MATIC, $APE & $AAVE on the list ?

Whale leaderboard: https://t.co/N5qqsCAH8j#UNI #whalestats #babywhale #BBW pic.twitter.com/utVkWlNTVx

— WhaleStats (tracking crypto whales) (@WhaleStats) February 14, 2023

Read Uniswap’s [UNI] Price Prediction 2023-2024

The demand by whales could keep UNI intact. At the time of writing, UNI was up 1.68% from the previous day to be valued at $6.29, data from CoinMarketCap pointed out.

According to Dune Analytics, Uniswap was the undisputed leader of the DEXes, capturing almost 75% of the market share at the time of writing. Hence, any blemishes on it could start reflecting on the wider market as well.