Uniswap [UNI] investors’ ubiquitous panic witnessed the best…

The crypto market is the only space where a loss of $70 billion is probably not a big deal given that the total valuation of all cryptocurrencies is well over $1.26 trillion.

Although up until a month ago the same value was closer to $2 trillion, the first week of this month alone undid the rally of February.

Uniswap loses control

As the broader market was affected, individual coins stood no chance either, and every cryptocurrency crashed by at least 30% on 9 May and 11 May.

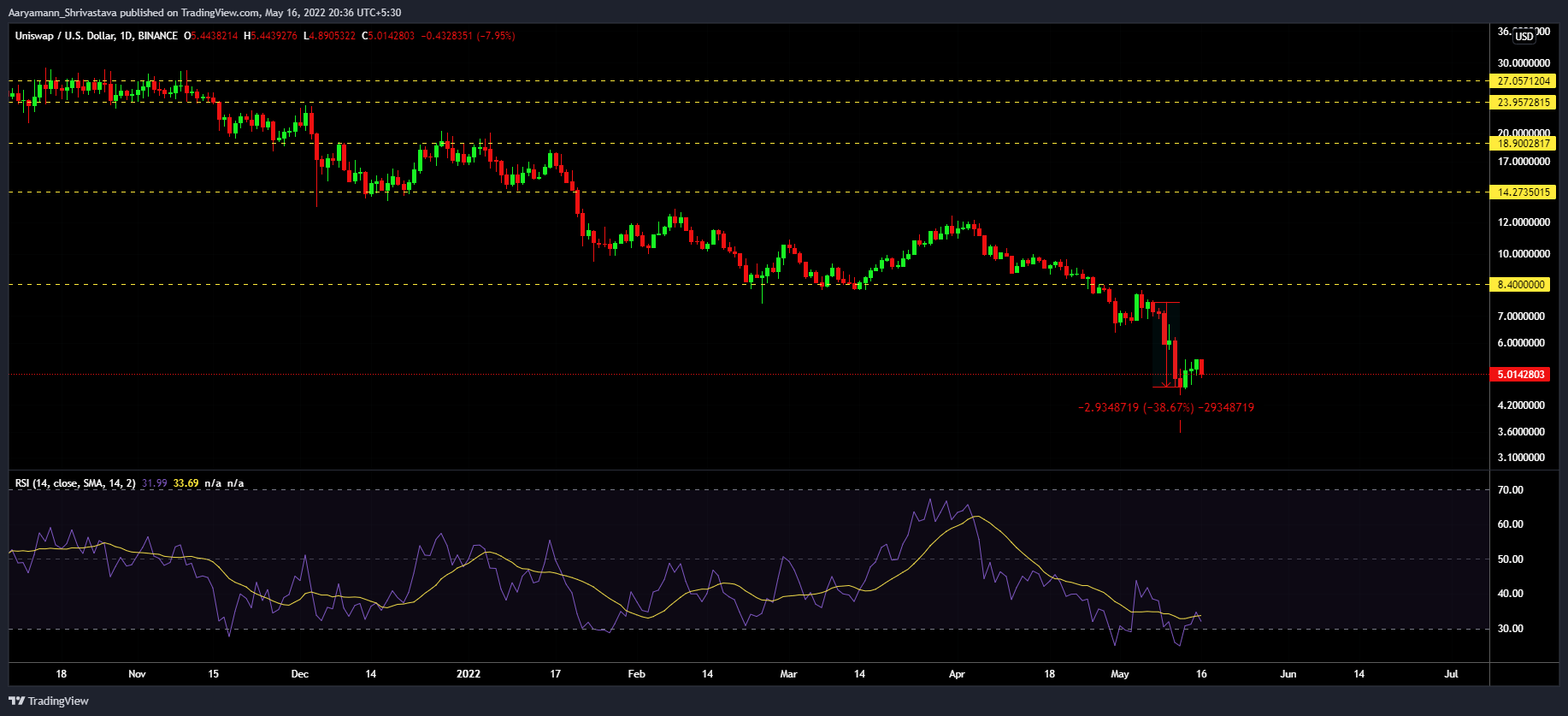

Uniswap was no exception either as the altcoin fell to the lows of $5.31 which was a 19.40% decline in the last seven days.

Uniswap price action | Source: TradingView – AMBCrypto

This crash unlike previous crashes was not a good bet for anyone as losses hit investors from all directions, overwhelming some to even quit the crypto space entirely.

Many investors sold off their holdings to prevent further losses.

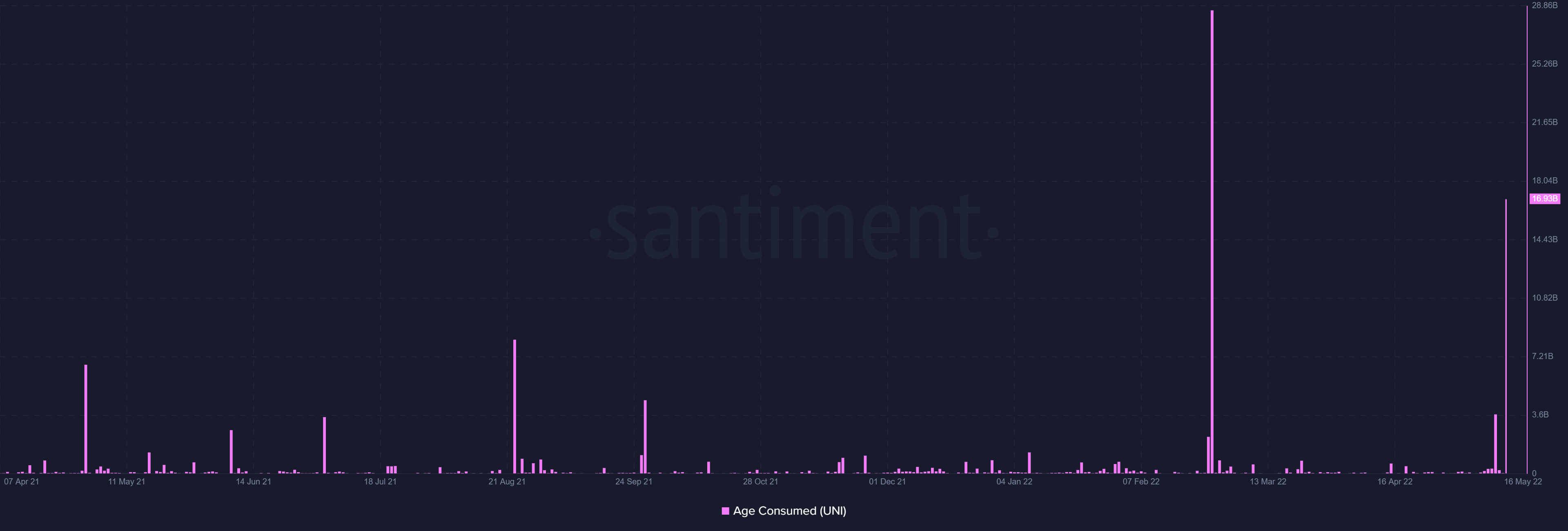

Some Uniswap holders followed the second path and sold about 700k UNI worth $3.5 million. Curiously, among this cohort were also sellers (the long-term HODLers) who are known for HODLing their way through a bear market.

As this group of investors witnessed such losses, they resorted to dumping some of their holdings out of sheer panic and in the process consumed 16.93 billion days.

Uniswap LTH selling | Source: Santiment – AMBCrypto

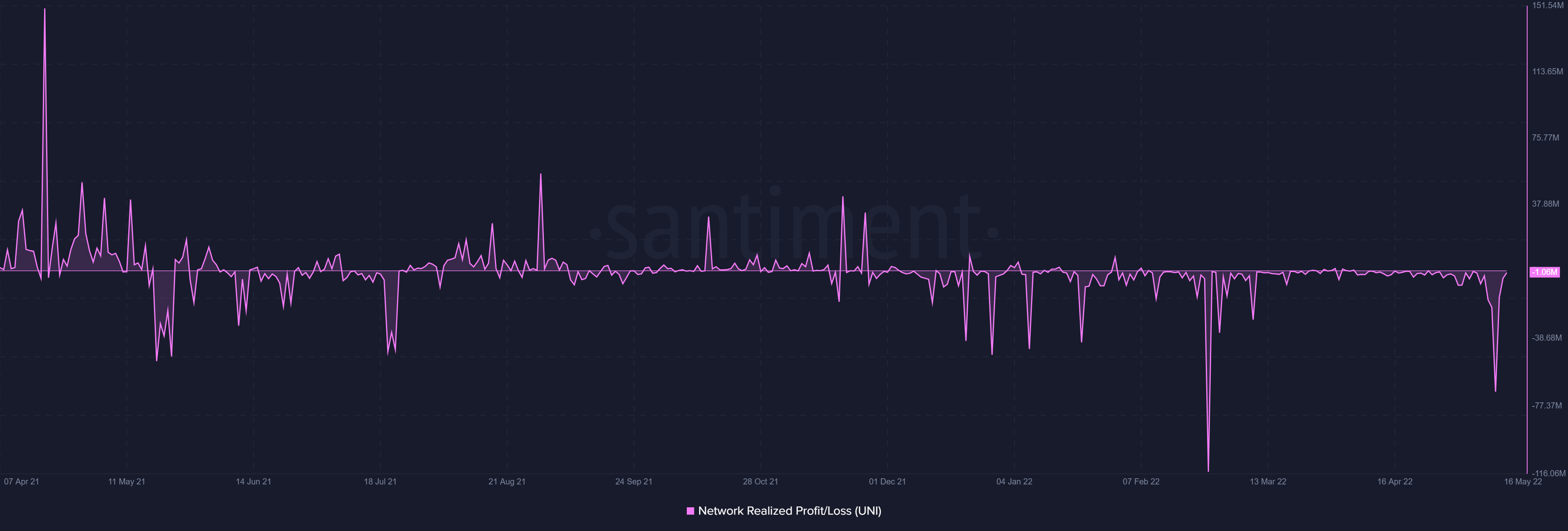

13 May also marked the day when investors moved their UNI around as the total transactions conducted on-chain involved 19 million UNI worth $96 million which were resting in losses.

However, the overall on-chain realized losses on that particular day exceeded 69 million UNI which in all were worth over $353 million that day.

Uniswap network-wide losses | Source: Santiment – AMBCrypto

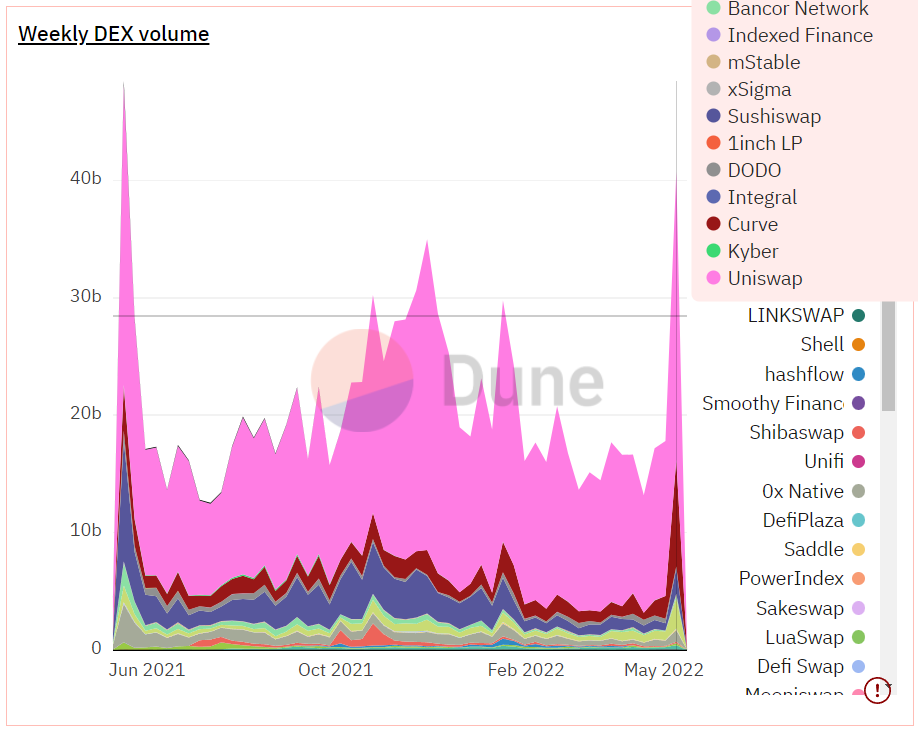

But it’s not just the spot market that took a hit, Uniswap, being a DEX also noted a spike in transaction volumes in the week concluding 9 May. In all, Uniswap observed a movement of $24.54 billion against the generally low figures of $11 billion to $15 billion.

Total DEX weekly volume | Source: Dune – AMBCrypto

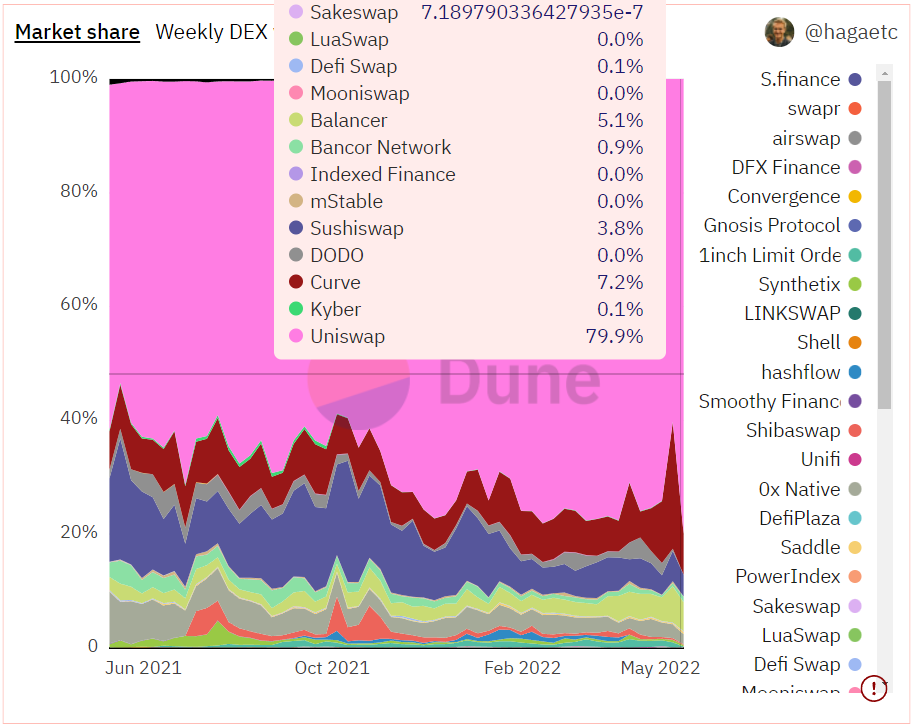

However, other DEXes lost their dominance on the market as investors resorted to HODLing which increased Uniswap’s hold over the market to 79.9%, which in a way is a win for Uniswap.

DEX dominance distribution | Source: Dune – AMBCrypto