Uniswap [UNI] protocol witnesses high activity, could this be the reason

![Uniswap [UNI] protocol witnesses high activity, could this be the reason](https://ambcrypto.com/wp-content/uploads/2023/04/AMBCrypto_An_image_of_a_bustling_marketplace_with_vendors_and_s_50f90787-c7a7-4a16-be86-5b8ea298b6a7-e1682061640125.png)

- Uniswap’s daily activity on the protocol rose and reached new highs.

- Revenue generated by the protocol continued to decline, as liquidity removed from the protocol increased.

Uniswap [UNI] has been a prominent player in the decentralized exchange (DEX) sector for the past few months. Recently, there has been a notable increase in its user activity.

Read Uniswap’s [UNI] Price Prediction 2023-2024

A rise in activity

According to data provided by Token Terminal, Uniswap observed a substantial surge in daily active users, with the press time figure hovering close to 85,000, marking a notable high since May 2021.

This upswing in user activity can potentially be attributed to the burgeoning popularity of memecoins, which are now experiencing significant market demand.

Even though the daily activity on Uniswap increased, the median trade size being made on the protocol declined dramatically.

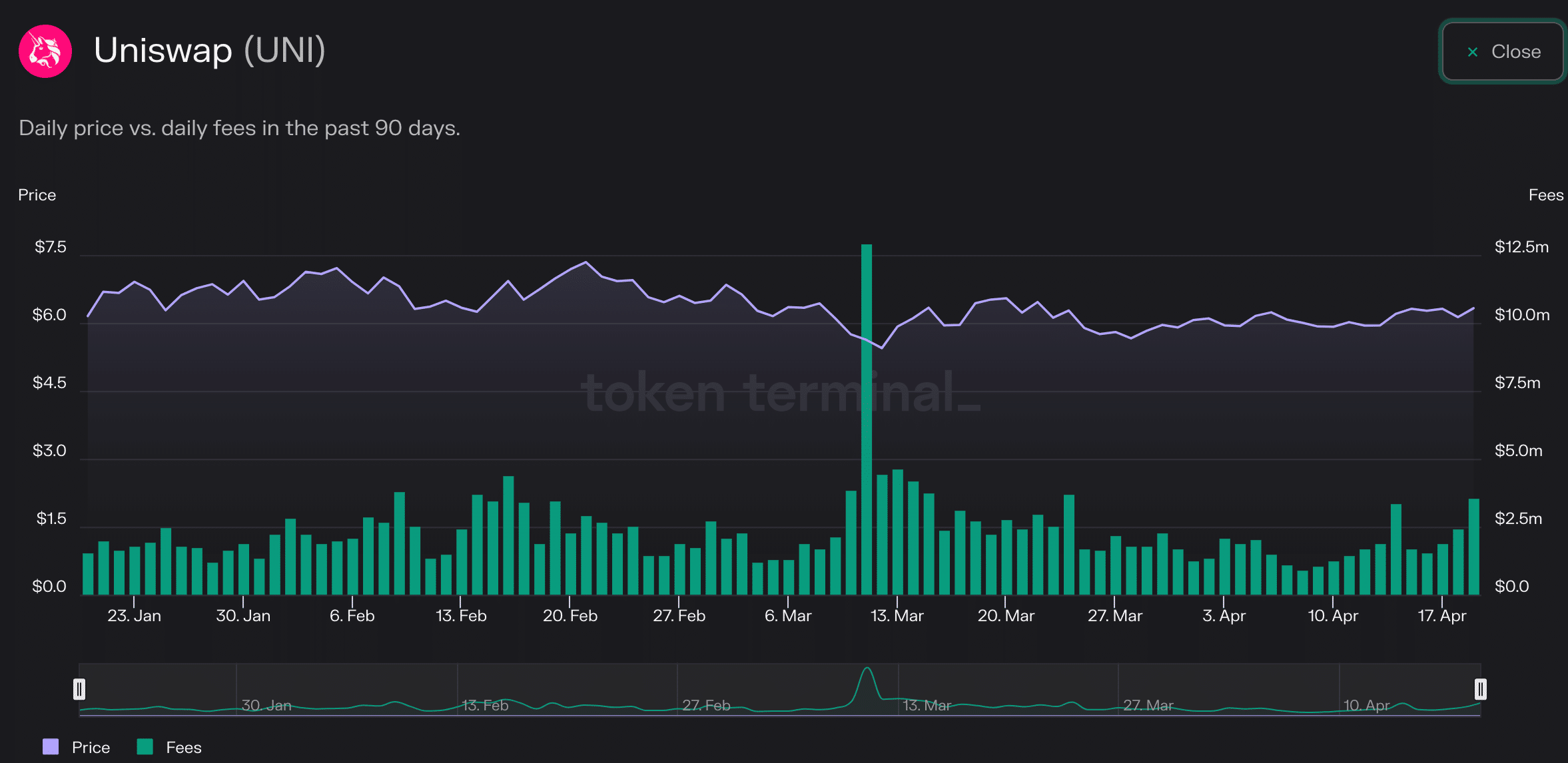

The decline in median trade size could be one reason why fees and revenue collected by the protocol decreased despite the high activity on the network.

Token Terminal’s data further showed that the fees collected by Uniswap fell by 31.9% over the last month. Coupled with that, the revenue generated by Uniswap fell by 0.43% in the same period according to Messari’s data.

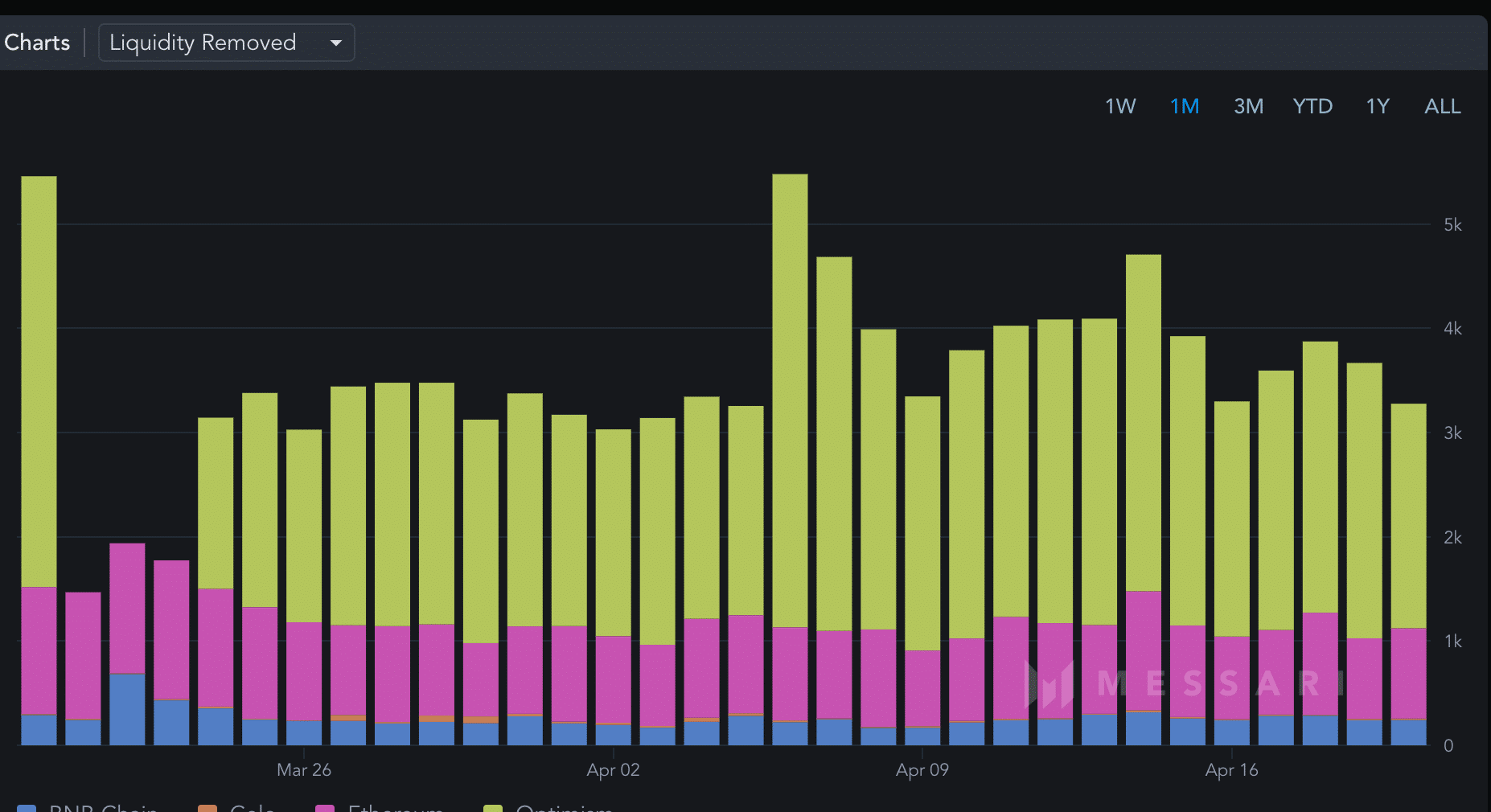

Moreover, the liquidity removed from the Uniswap protocol has also increased. When there is less liquidity on Uniswap, it means that there are fewer assets available for trading.

This can result in less trading activity and wider price differences between buy and sell orders. Hence, only a few people might use the platform, and it will be harder to find trading pairs. It can harm the platform’s growth and stability in the long run.

However, these factors haven’t impacted the efforts made by the protocol to make improvements.

According to Uniswap’s 19 April tweet, Uniswap routers have burnt a large amount of ETH. Over the last month, 11,589 ETH were burned by Uniswap routers.

When it comes to burning ETH (and a lot of other things ?) we’re #1 ?

DYK the Uniswap Routers have burned 11,589 ETH in the past 30 days ? pic.twitter.com/6d041deWTo

— Uniswap Labs ? (@Uniswap) April 18, 2023

Realistic or not, here’s UNI market cap in BTC’s terms

What are UNI holders up to?

Coming to the UNI token, it was observed that the network growth had declined significantly over the past three months. This implied that new addresses have started to lose interest in UNI at the time of writing.

However, the supply held by top exchange addresses continued to increase, showcasing that whale interest in the token remained strong. Despite the high whale interest, the price of UNI continued to fall over the last few days.