Uniswap’s [UNI] recovery blocked: Will bulls find footing in key demand zone

![Uniswap’s [UNI] recovery blocked: Will bulls find footing at key demand zone?](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-34.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- UNI faced price rejection at the descending trendline.

- Bulls could be hopeful if a key demand zone is retested and defended.

Unsiwap’s [UNI] recent recovery attempts have to contend with a few obstacles. Besides Bitcoin [BTC] fluctuating around $28k, UNI has faced price rejection at a month-long descending trendline.

At press time, UNI had dropped to $5.854 support. A breach below it and subsequent retest of the key demand zone could offer bulls new buying opportunities.

Read Uniswap’s [UNI] Price Prediction 2023-24

Will the $5.854 support hold?

The $5.228 – $5.511 range has been a key support and demand zone in 12-hour and lower timeframe charts. Two previous retests led to recovery, and a repeat of the trend may result in a rebound and discounted buying opportunity.

A breach below $5.854 could attract increased sell pressure. Therefore, UNI may drop to the demand zone of $5.228 – $5.511 before a likely rebound from aggressive buying at these levels. The retest and an uptrend confirmation could offer new buying opportunities with targets at $5.854 and the descending trendline around $6.1.

A close below the support range at $5.235 will invalidate the above thesis. The next likely support in such a downswing scenario will be $4.964.

Meanwhile, the RSI faced rejection at the 60 mark and dropped below its equilibrium – denoting a dip in buying pressure. If confirmed, a pending bearish MA crossover could expose UNI to more sell pressure. Moreover, OBV (On Balance Volume) declined, indicating a drop in demand for UNI in the past few days.

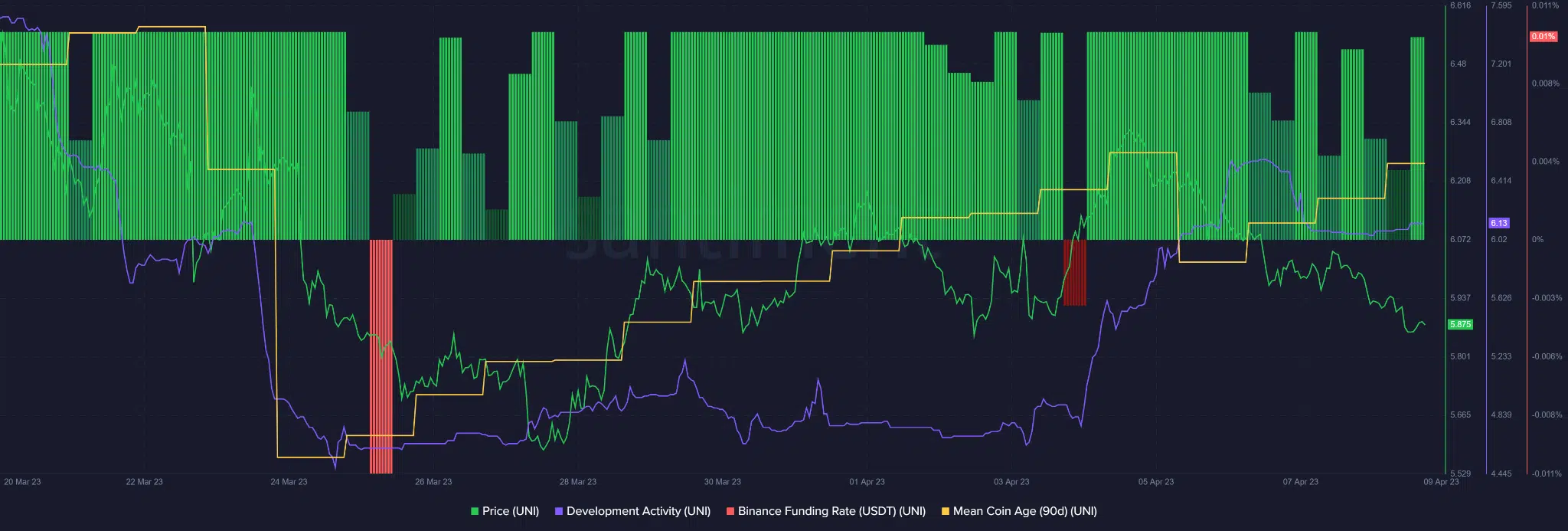

The funding rate was positive and mean age rose

How much are 1,10,100 UNIs worth today?

UNI’s funding rate at the time of writing was positive. In addition, it enjoyed a relatively positive standing in the past few days – a bullish signal. Besides, the rising mean coin age shows a wide accumulation of UNI tokens, a sign of a likely rally.

Moreover, the development activity increased and could boost investor confidence. But investors should track BTC before making moves.