Uniswap update: Will the upbit listing spark a UNI breakout?

- UNI is approaching a critical breakout, testing the $8.66 resistance level after a strong rally.

- Social dominance and rising open interest signal increased trader confidence for further upside.

Uniswap [UNI] has shown an impressive short-term rally, following the news of its listing on South Korea’s Upbit exchange. The price has surged by over 6%, with trading volumes soaring more than 110%.

With UNI trading at $8.16 at press time, the critical question is whether this momentum will continue, pushing the price above the crucial resistance level of $9.67 and towards higher targets.

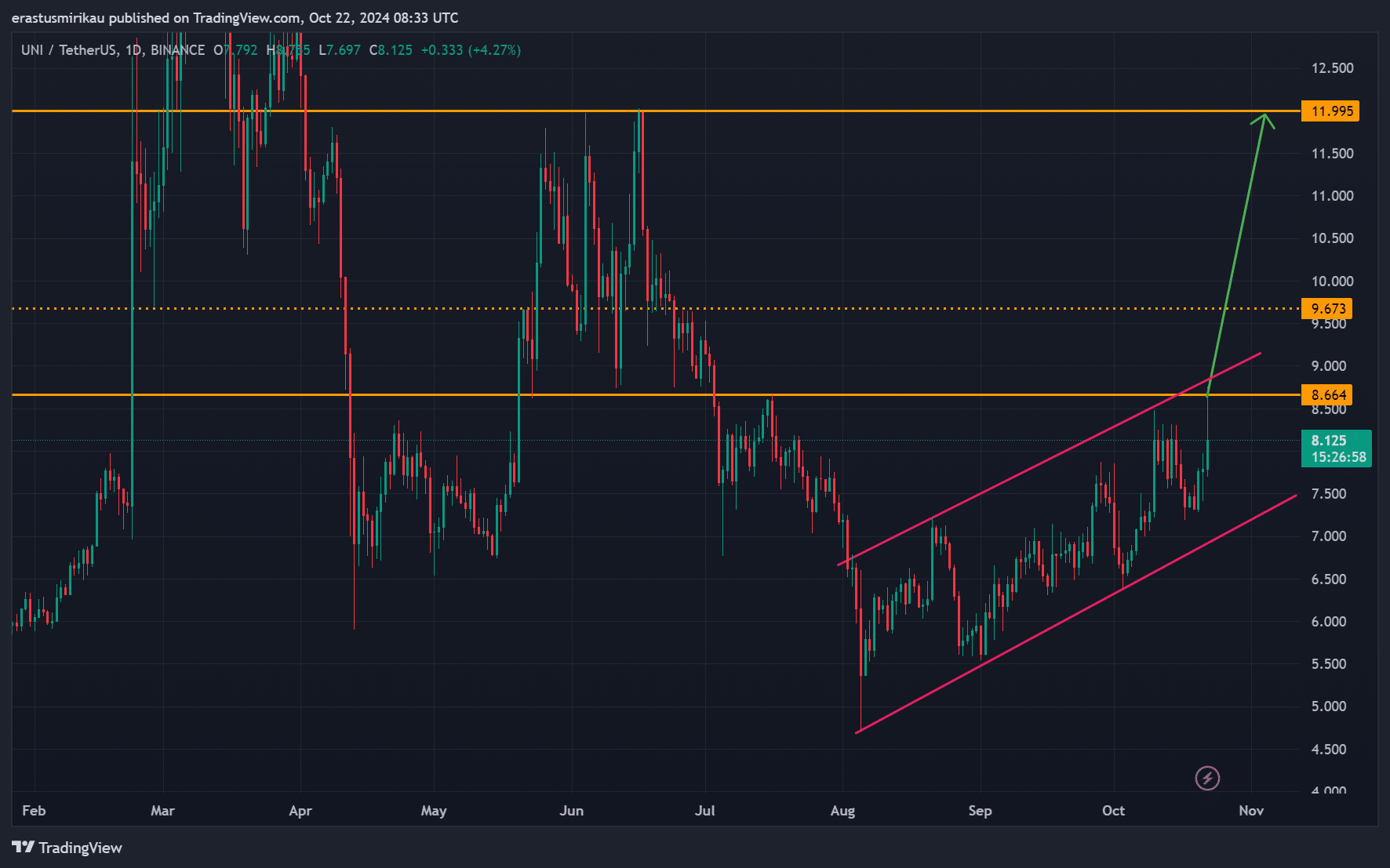

UNI chart analysis: Is a breakout imminent?

The daily chart reveals that Uniswap is approaching a potential breakout from its ascending channel. Currently, the token is testing the key resistance at $8.66, a level that has held back previous attempts to move higher.

Breaking this barrier would set the stage for UNI to challenge the $9.67 resistance.

If that level is breached, the next target could be $11.99. However, should Uniswap fail to break the $8.66 level, a pullback to the support area around $7.50 could follow, especially if the broader market weakens.

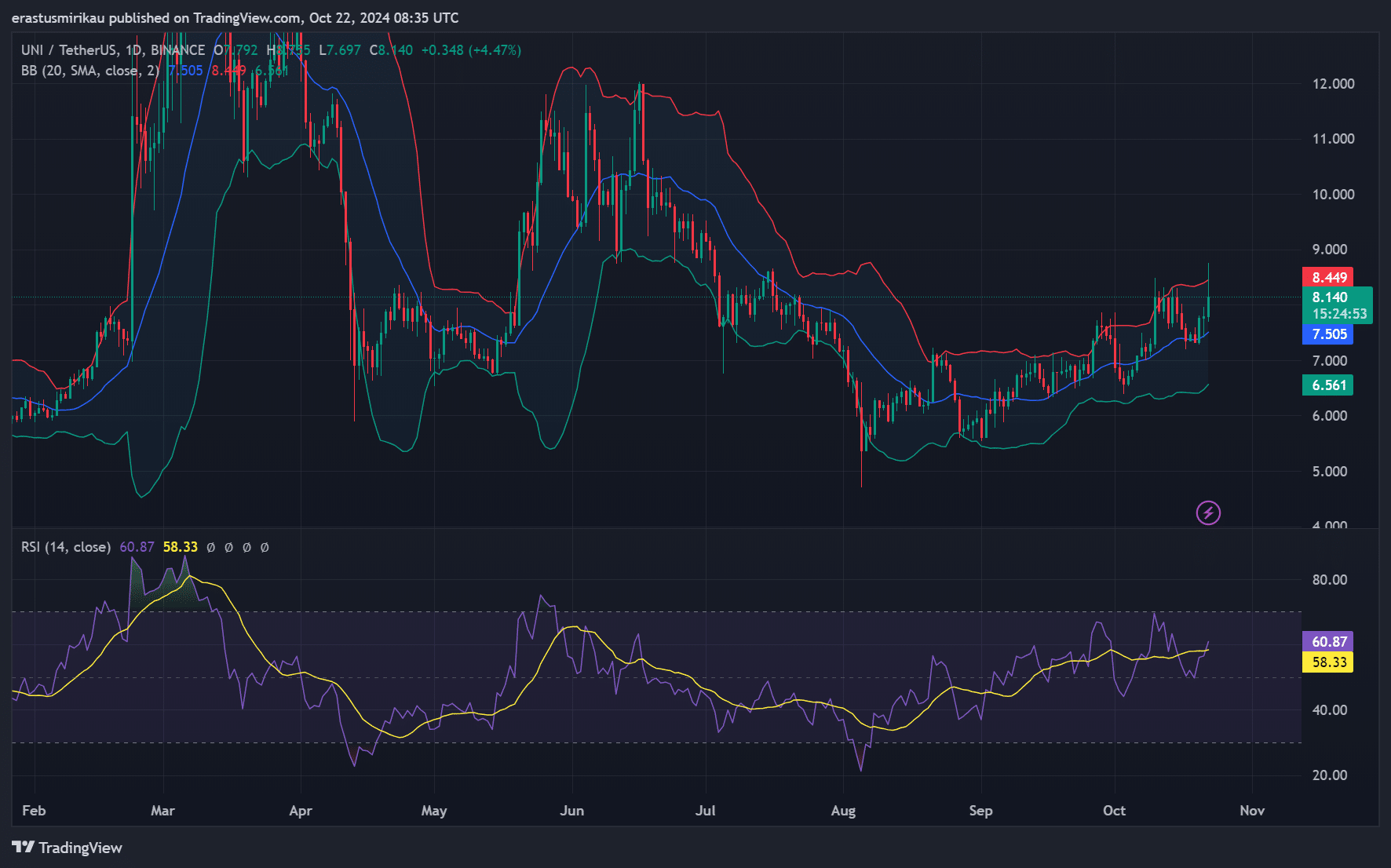

UNI technical indicators: How do BB and RSI align?

From a technical perspective, the Bollinger Bands show that Uniswap is pushing toward the upper band, indicating increasing volatility and potentially more upside. Additionally, the Relative Strength Index (RSI) stands at 60.87, just below the overbought territory.

This suggests that while the bulls still have room to push prices higher, there’s a risk of the momentum stalling if the RSI approaches the 70 mark, which could lead to a short-term correction.

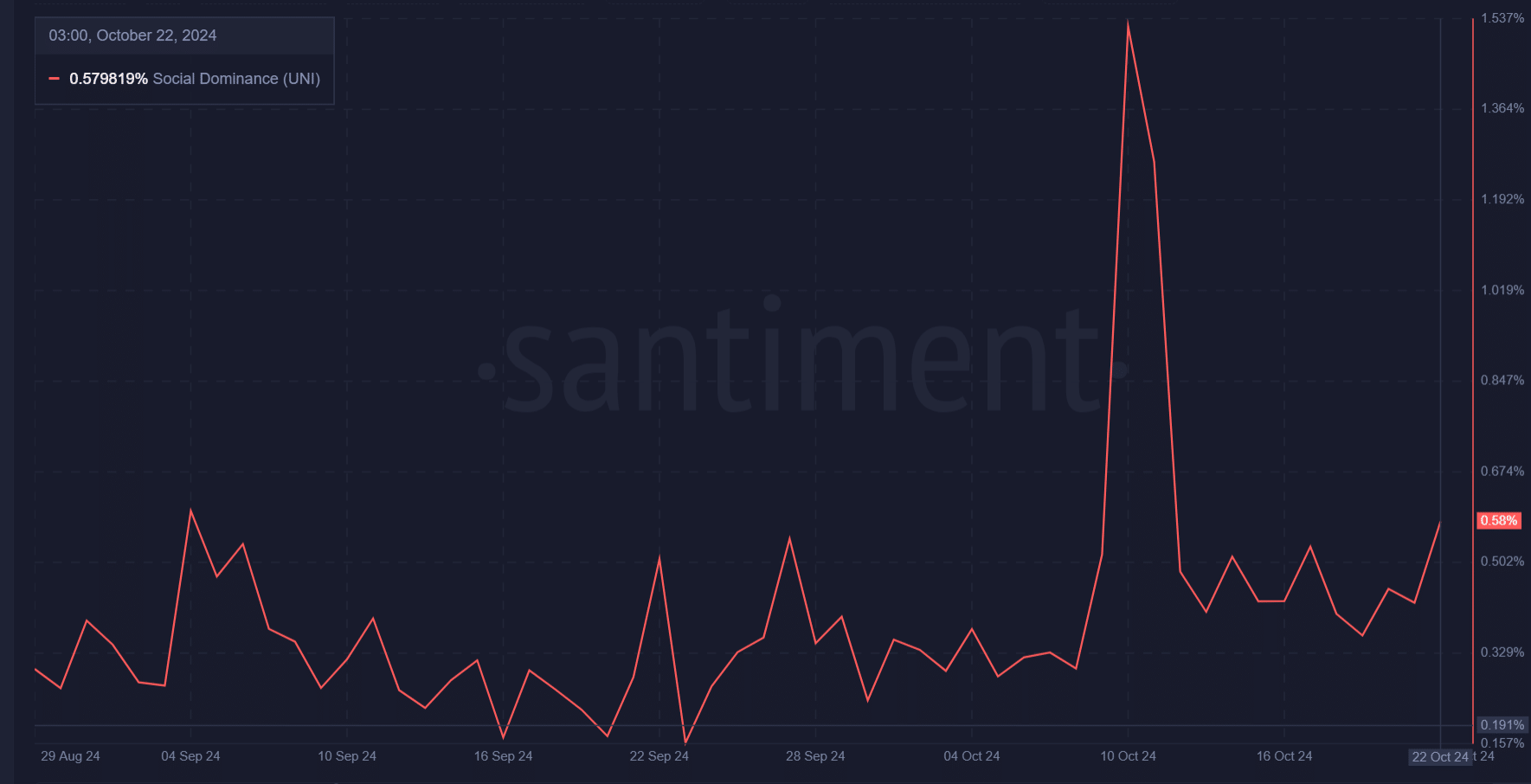

UNI social dominance: What does sentiment suggest?

UNI’s social dominance has increased to 0.579%, indicating a growing presence in community discussions and trader sentiment. This uptick follows a significant spike earlier in the month, reflecting the ongoing interest surrounding Uniswap’s Upbit listing and recent price movements.

Consequently, the increase in social dominance suggests heightened attention from the crypto community, which could support further price gains as more traders watch UNI closely.

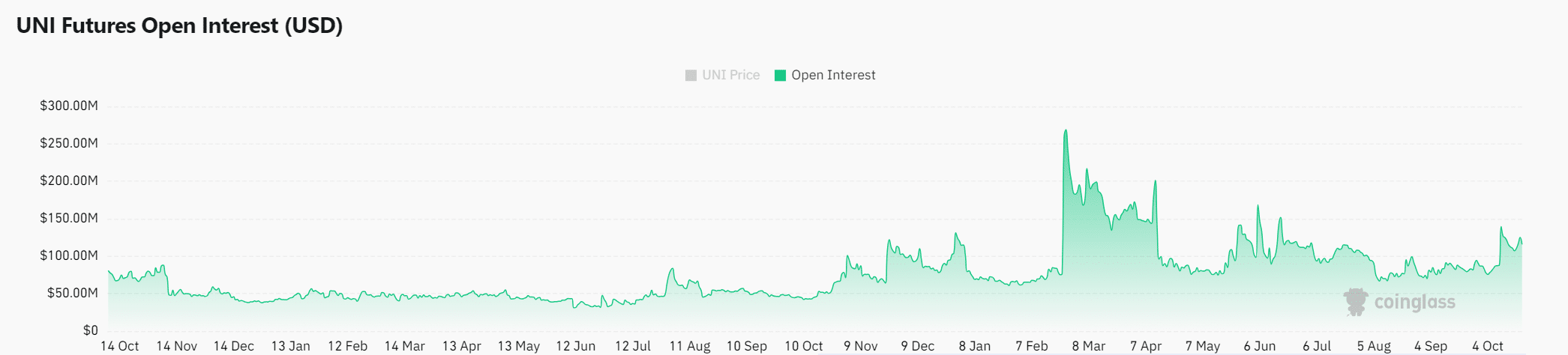

Open interest surges: Will it drive price higher?

In addition to the positive price action, open interest in UNI has jumped by 11.76%, reaching $129.94 million. This sharp increase suggests that more traders are entering the market, anticipating a larger move.

Therefore, growing open interest indicates rising confidence in a bullish continuation.

Is your portfolio green? Check out the UNI Profit Calculator

Conclusively, UNI appears well-positioned for a breakout, but it must clear the $8.66 resistance to test $9.67 and potentially head towards $11.99. With technical indicators aligning and market sentiment strong, UNI looks primed for further gains.

However, the bulls need to sustain momentum to avoid a pullback. Consequently, traders should keep a close watch on UNI’s price action in the coming days.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)