Uniswap: Will sellers exploit this roadblock?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- UNI has been suppressed below $4.5 in September.

- Demand for UNI in the derivatives segment improved.

Uniswap [UNI] sellers have been exploiting the $4.5 roadblock to seek gains. At press time, UNI fronted a price reversal and traded at $4.34. But the roadblock had a confluence with 50-EMA (Exponential Moving Average) on the 12-hour timeframe and could attract sellers.

Read Uniswap’s [UNI] Price Prediction 2023-24

Will sellers re-enter the market at this hurdle?

The roadblock at $4.5 aligned with a previously invalidated bullish order block (OB) on the H12 timeframe. Besides, the 50-EMA (Exponential Moving Average) retreated towards the end of September, leading to the price rejection during the trading session on 27 September.

So, the roadblock confluence of $4.5 and 50-EMA could lead to another price rejection. If so, a drop to the short-term support of $4.2 could give short sellers a potential 4.5% gain.

However, a convincing cross above the roadblock will invalidate the bullish thesis. In such a case, UNI could aim at $4.8 or $4.9, especially if BTC reclaims $27k and surges.

But the latter could be far-fetched as capital inflows into the UNI market were muted, as shown by CMF laboring below zero. However, the RSI fluctuated near the equilibrium level, suggesting a possible range-bound extension below $4.5.

Demand for Uniswap improved in the derivatives market

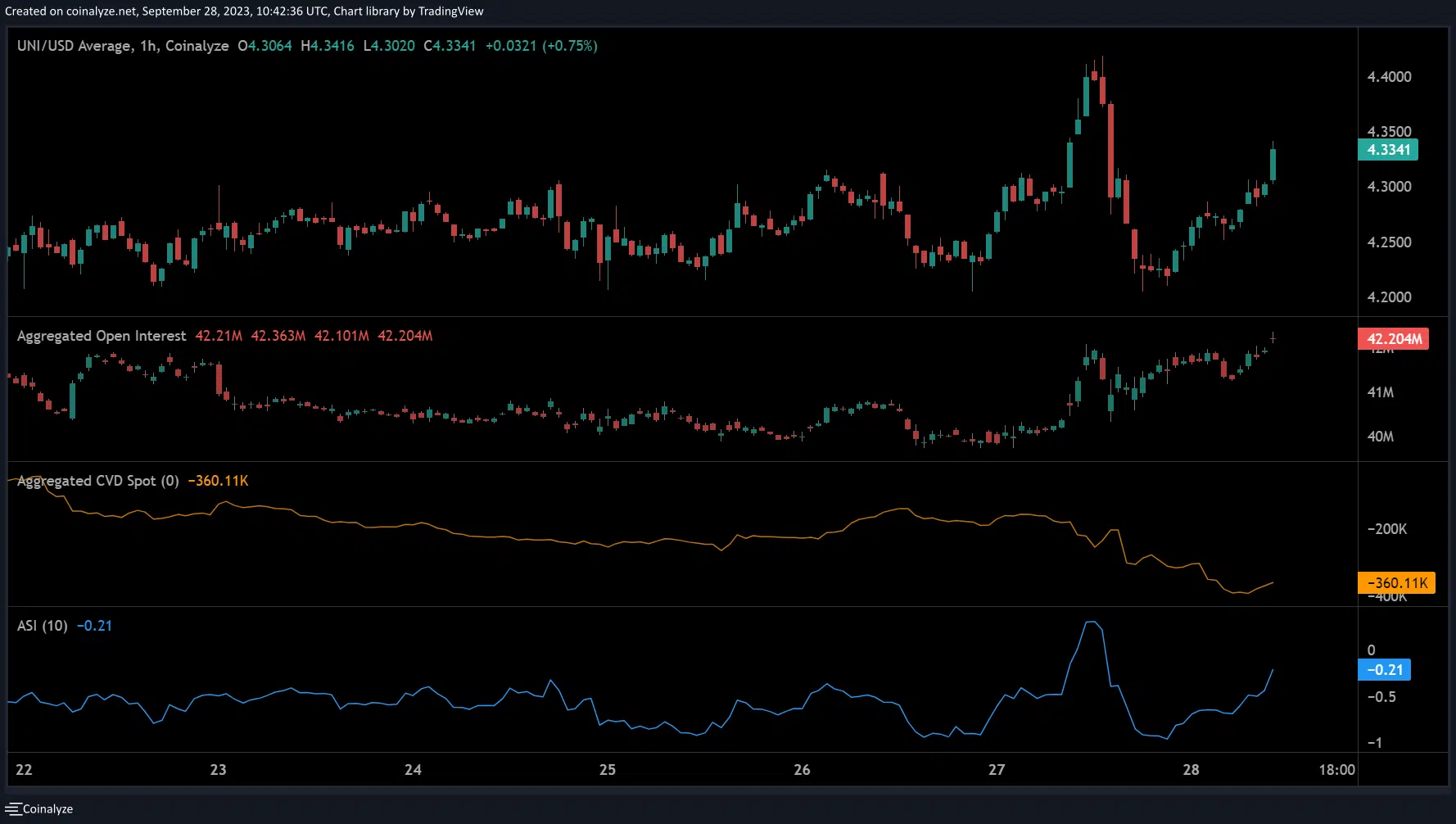

There was an improvement in demand for UNI in the derivatives market, as shown by the rising Open Interest (OI). The rise in demand depicted a mild bullish momentum, further confirmed by the rising Accumulative Swing Index (ASI).

For perspective, ASI tracks the strength of price swings, and a positive reading reiterates a long-term uptrend and vice versa.

How much are 1,10,100 UNIs worth today?

The improving ASI indicates a reversal was underway, but the negative reading shows the trend was yet to reach a long-term uptrend. In addition, the CVD (Cumulative Volume Delta) was negative despite the uptick seen at the press time, showing sellers still had market leverage.

So, sellers could still benefit if the price action falters at the $4.5 hurdle.