Uniswap’s make-or-break moment: Will $13.20 support hold firm?

- UNI must hold the $13.20 support to confirm reversal amid bearish momentum.

- Market optimism grew with rising active addresses, lower exchange reserves, and liquidation imbalances.

Uniswap [UNI] has generated significant attention after triggering a TD Sequential buy signal on its 4-hour chart, sparking optimism for a potential recovery.

Trading at $13.17 at press time, down 11.89% in 24 hours, UNI finds itself at a critical crossroads.

The $13.20 support level is essential for the token to stabilize and reverse its recent downtrend. Therefore, traders are closely monitoring whether this signal can provide the momentum UNI needs to bounce back.

UNI price analysis: Will support levels hold?

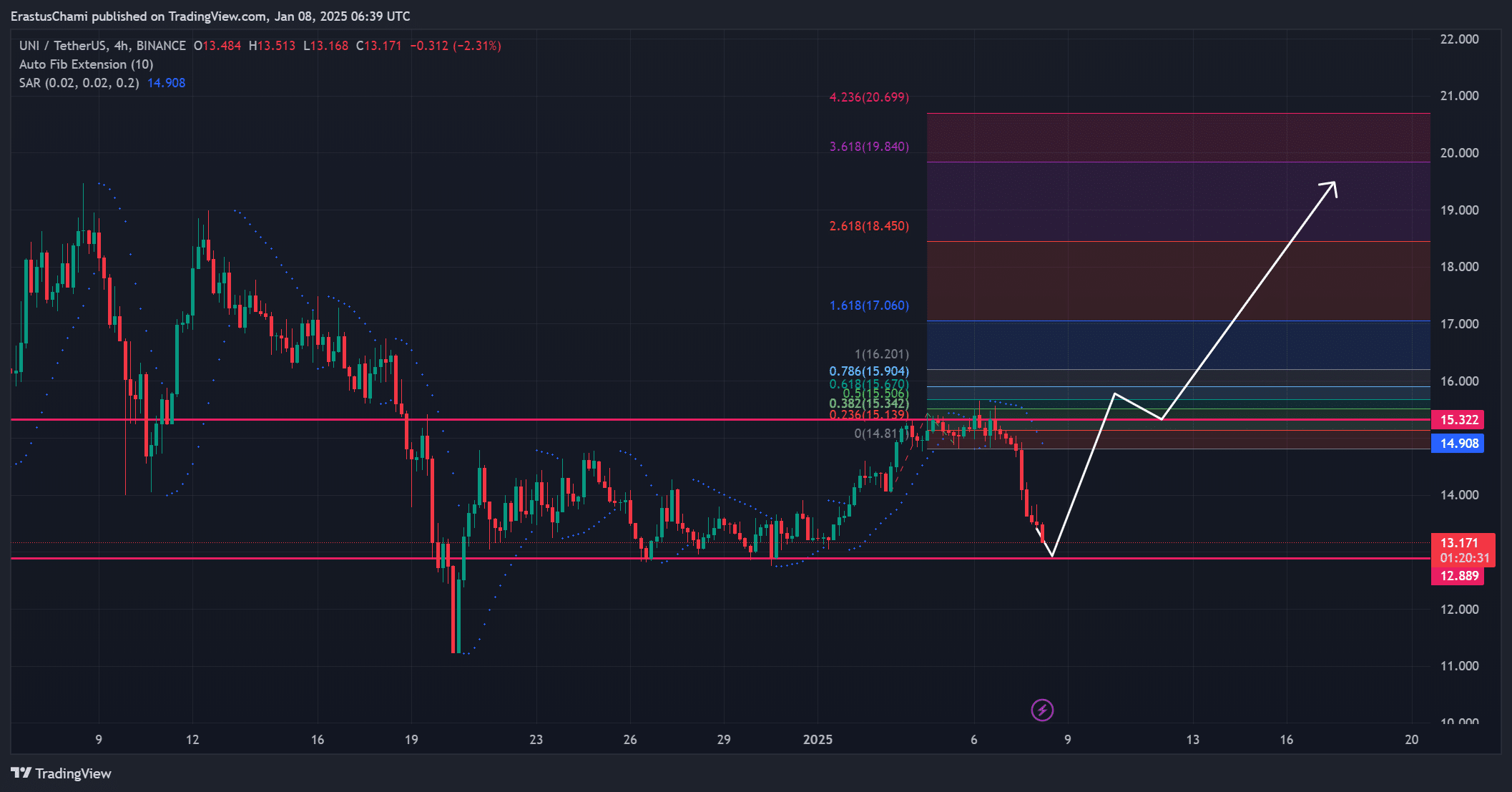

UNI has faced strong selling pressure, as indicated by its sharp decline from $15.32 to its current price range.

Fibonacci retracement levels highlighted resistance at $15.90 and $17.06, which UNI must clear to regain upward momentum.

However, the parabolic SAR, at $14.90 at press time, suggests that the bearish trend will continue unless the $13.20 support holds firm.

A failure to maintain this zone could lead to further declines toward $12.88, raising concerns among investors. Therefore, all eyes are on whether buyers can reclaim dominance at this crucial level.

Cautious optimism lingers

On-chain metrics for UNI presented a mixed outlook, with slight improvements in network activity offering cautious optimism.

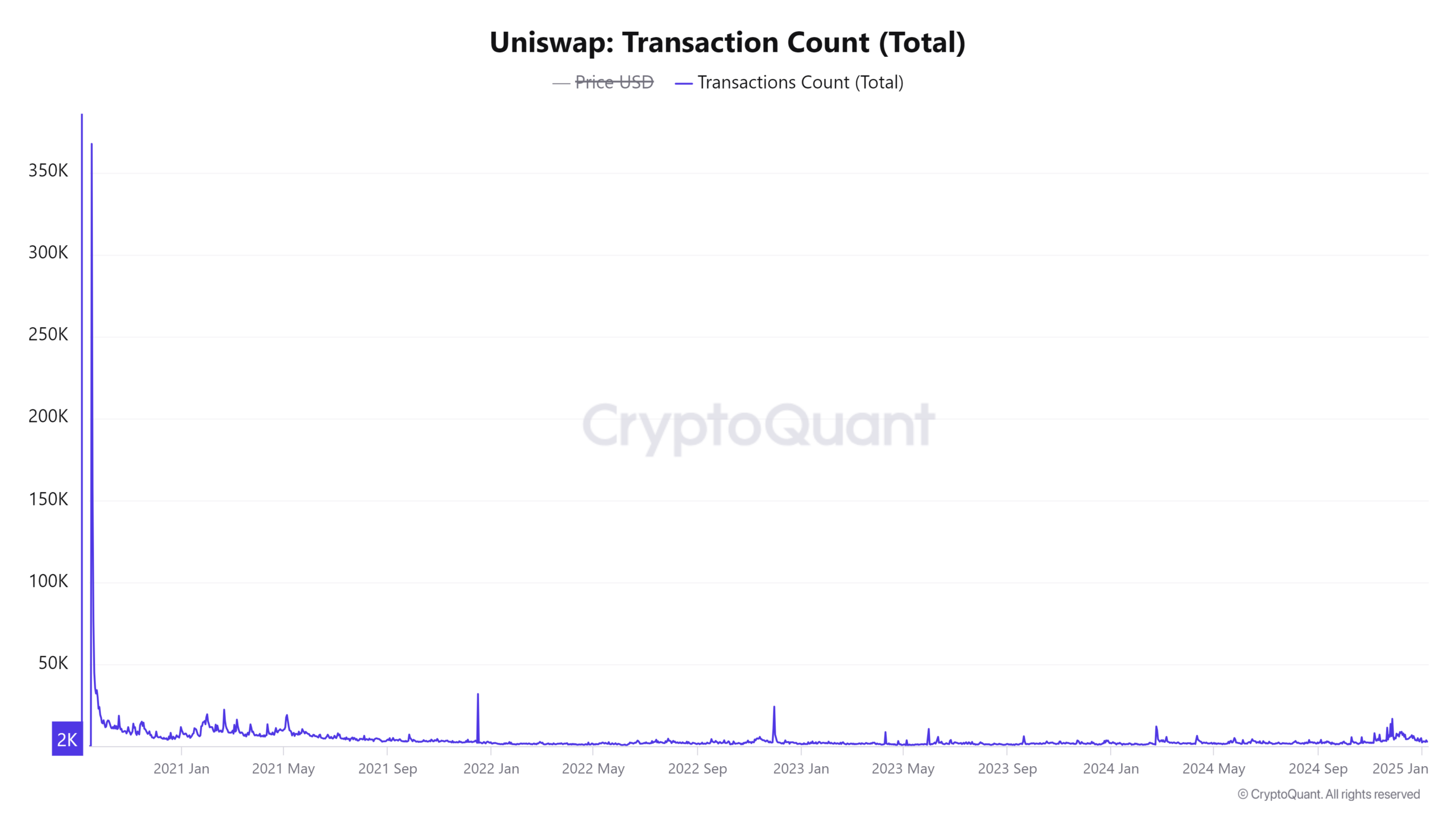

Active addresses have increased by 1.12% over the last 24 hours, signaling a modest rise in user engagement.

Additionally, transaction counts rose by 1.01%, reflecting incremental growth in network usage. However, these increases are relatively minor and may not indicate a strong reversal in sentiment.

Therefore, while fundamentals show some resilience, they are not yet strong enough to spark a definitive recovery.

Declining exchange reserves mean…

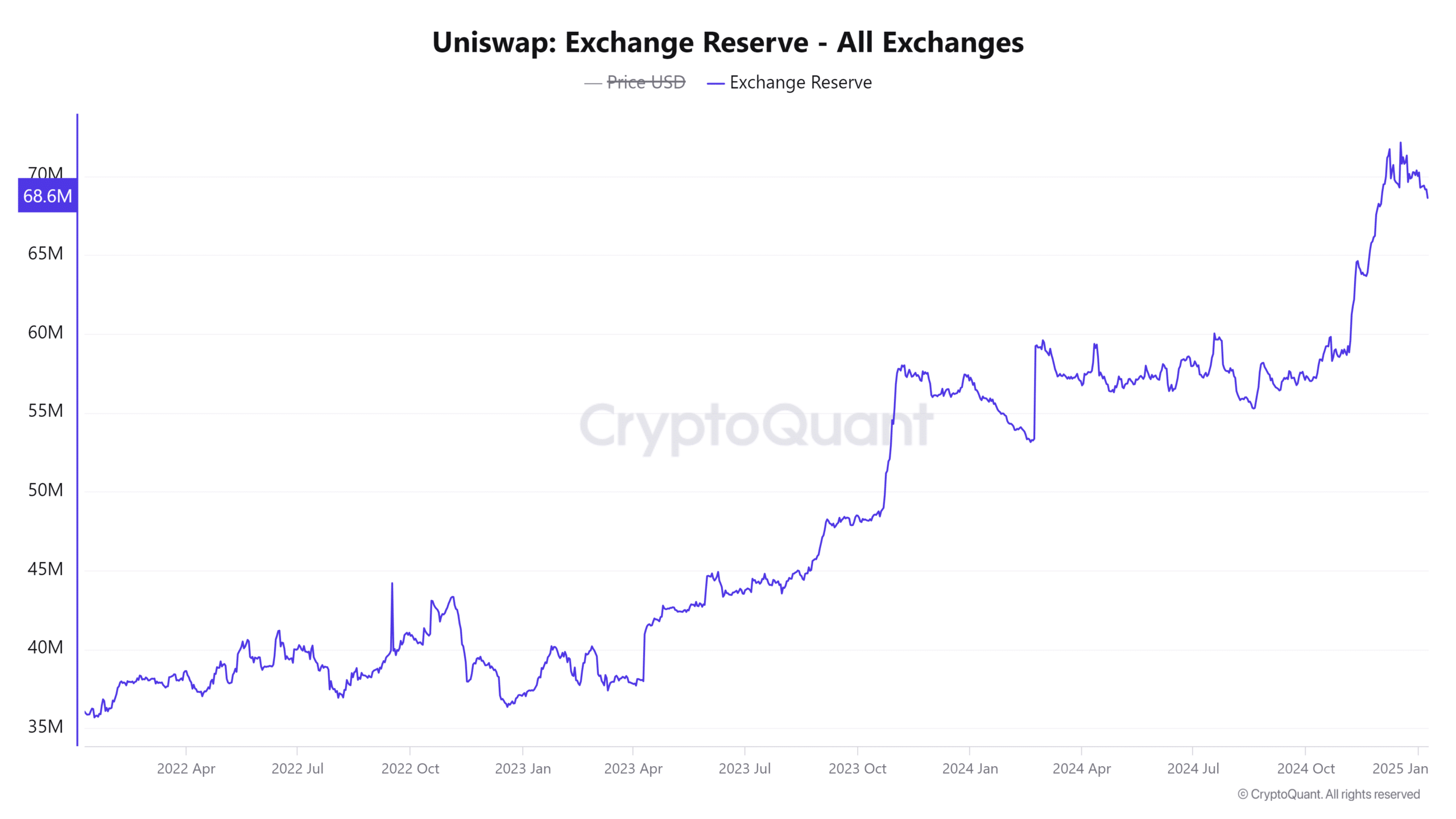

UNI’s exchange reserves have decreased by 0.75% in the past 24 hours, sitting at 68.63 million tokens at press time. This suggests lower selling pressure, as fewer tokens are available for trading on exchanges.

However, it also reflects cautious market sentiment, with holders choosing to wait rather than actively buy or sell.

Therefore, while this trend is slightly positive, it remains uncertain whether it can drive sustained upward momentum.

Liquidation data highlights market uncertainty

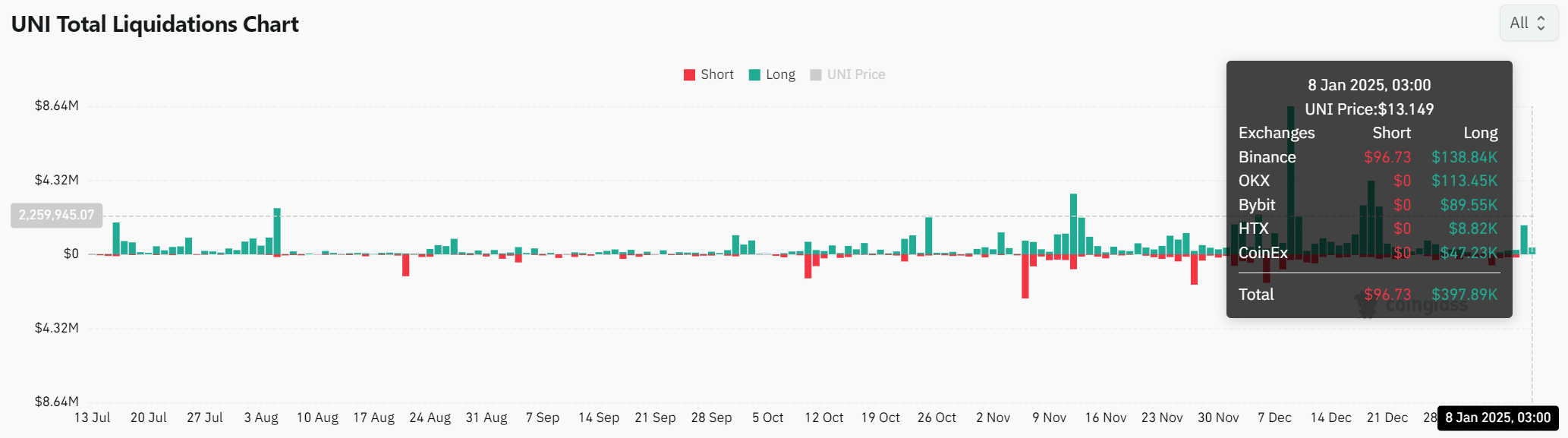

Liquidation data provided further insights into market sentiment. The long liquidations totaled $397.89K, significantly outweighing $96.73K in shorts.

This imbalance reflected cautious optimism among buyers, who appeared to anticipate a rebound.

However, with UNI still facing strong resistance levels, the market remains divided on whether a recovery is imminent. Therefore, traders should proceed with caution while monitoring key price levels.

Can Uniswap reclaim bullish momentum?

UNI’s rebound potential hinges entirely on whether the $13.20 support level holds.

Read Uniswap’s [UNI] Price Prediction 2025–2026

Although the TD Sequential signal and on-chain metrics suggest a possible recovery, the broader bearish trend remains a significant hurdle.

If $13.20 fails, further declines are likely. Therefore, while optimism exists, UNI must decisively hold its support to regain upward momentum.