Altcoin

Uniswap’s network activity falls to a month low, but it’s not all bad news

New demand for Uniswap has climbed steadily in the last month, causing its price to log double-digit gains.

- Daily active addresses trading UNI drop to a one-month low.

- New demand for the alt token drives up its price by double digits in the past 30 days.

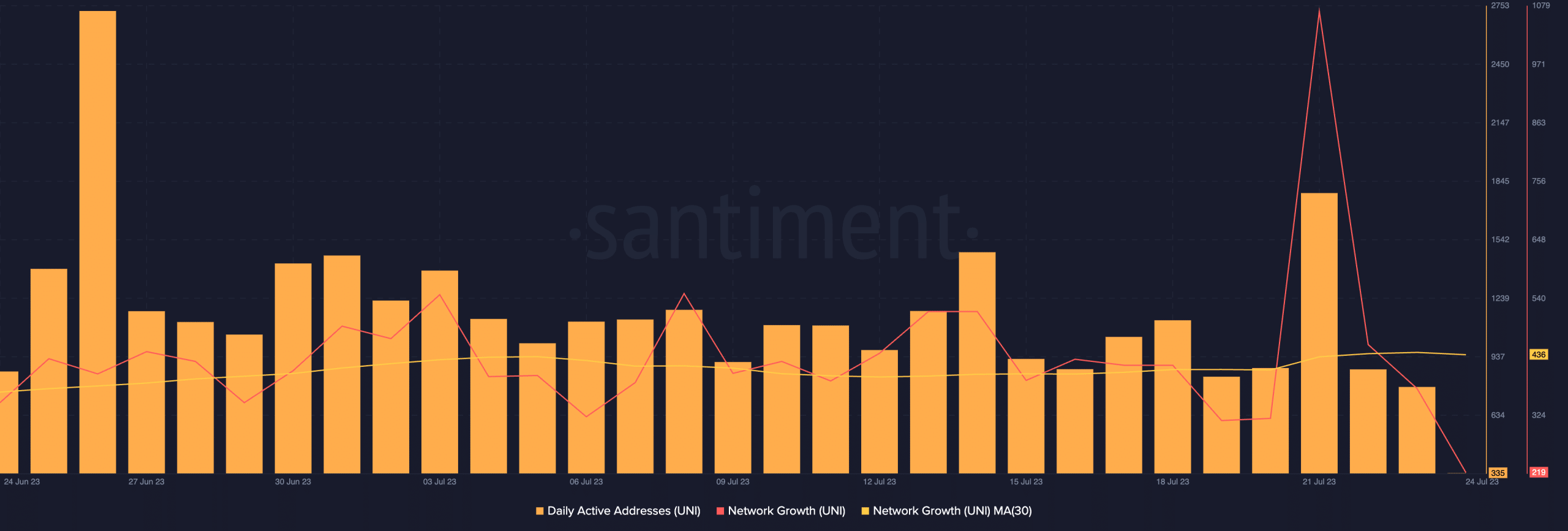

On-chain network activity for Uniswap’s governance token UNI has dropped to its lowest level in the last month, data from Santiment showed.

Is your portfolio green? Check the Uniswap Profit Calculator

According to information from the data provider, the count of daily active addresses that trade UNI has trended downwards after marking a high of 2726 addresses on 26 June. On 23 July, only 781 unique addresses completed transactions that involved the UNI token. This represented a 71% fall in active address count for the DeFi-based token.

All thanks to the new entrants

Interestingly, while old addresses stayed their hands with regard to trading UNI, the token logged a considerable surge in new demand in the last month. On a 30-day moving average, the count of new addresses that traded the alt increased by 25%.

As a result of this, UNI’s price rallied by 25%. According to data from CoinMarketCap, the token exchanged hands at $6.02 at press time. A month ago, the price per UNI token was under $5.

On the asset’s D1 chart, buyers regained control of the Uniswap market due to the increase in new demand in the last month. According to its Directional Movement Indicator, the positive directional index (green) initiated a crossover above the negative directional index (red) on 24 June and has since maintained this position. At press time, the buyers’ strength at 27.64 rested solidly above the sellers’ strength at 8.44.

Also, UNI’s Relative Strength Index (RSI) and Money Flow Index (MFI) indicators signaled a steady growth in UNI accumulation during the period under review. At press time, the RSI was far from its center line at 61, while the MFI rested in the overbought territory at 80.64.

Further, UNI’s Aroon Up Line (orange) was pegged at 78.57% at the time of writing. When an asset’s Aroon Up line is close to 100, it indicates that the uptrend is strong and that the most recent high was reached relatively recently. This is generally considered a bullish sign.

How much are 1, 10, or 100 UNI worth today?

However, a look at the alt’s Chaikin Money Flow (CMF) sent cautionary signals. While UNI’s price has experienced growth in the last month, its CMF began to trend downwards on 14 July. This indicated that buying interest had begun to weaken. And there might be less conviction among traders or investors about the sustainability of the price rise.

Likewise, despite the price growth, investors’ weighted sentiment remained negative, mainly because the ratio of UNI’s daily on-chain transactions that returned losses exceeded those that have been profitable in the last month.