Altcoin

Uniswap’s recovery stalls near range lows – Are shorting gains likely?

Uniswap’s [UNI] strong recovery could be far from sight unless BTC reverses recent losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- UNI reclaimed the $5 level at press time.

- More long positions wrecked on a 4-hour timeframe at press time.

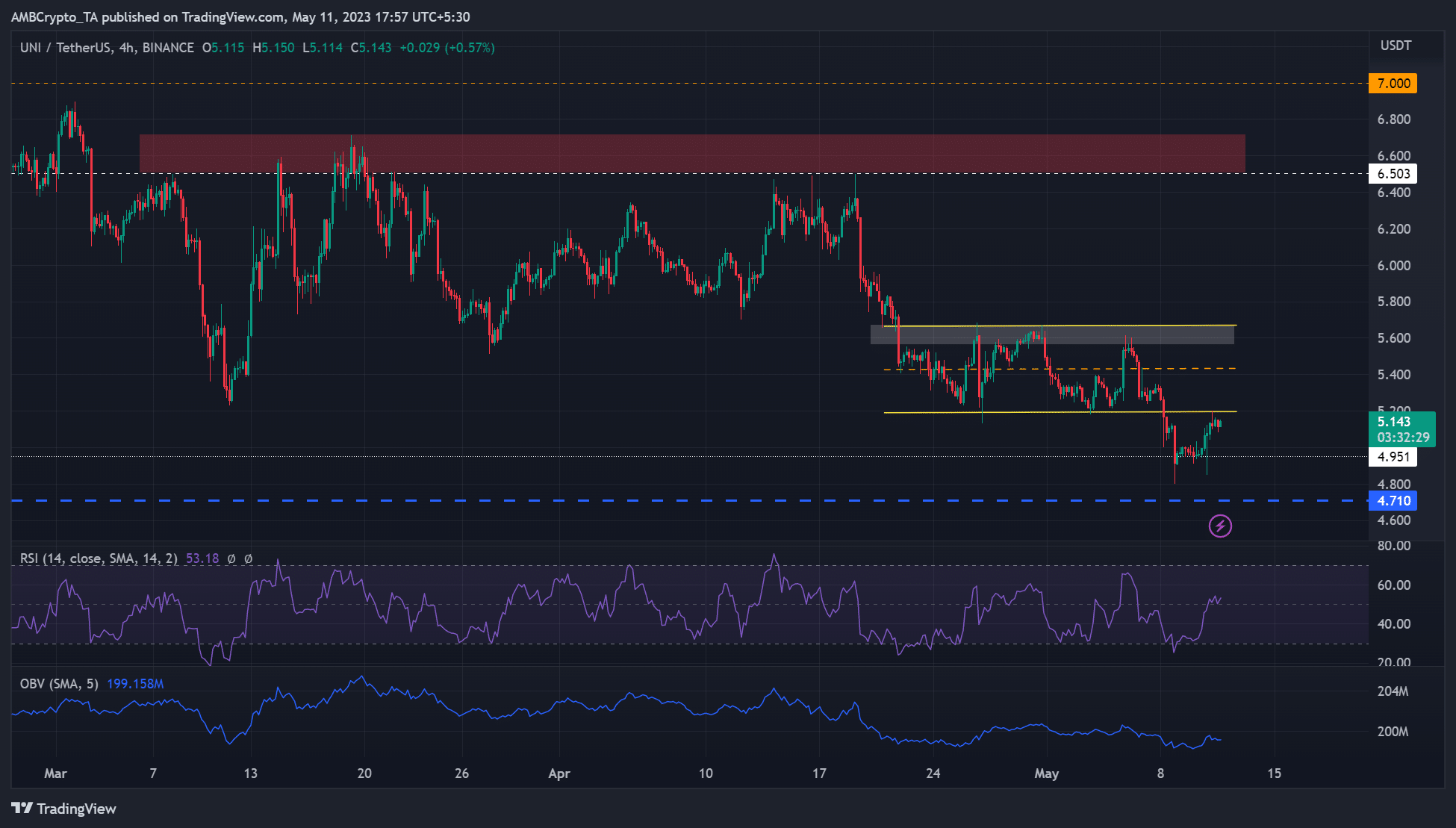

The crypto market was ecstatic on 10 May after U.S. inflation eased below 5%. Notably, Uniswap [UNI] fronted a recovery on the same day and traded at $5.143 at press time, way above its lowest of $4.800 on 9 May.

Is your portfolio green? Check

UNI Profit CalculatorHowever, the mild uptrend has hit UNI’s previous range lows of $5.2 and could see a sharp drop if the obstacle persists. Meanwhile, Bitcoin [BTC] traded below $27.5k, meaning short-term bearish pressure could escalate in the next few hours/days.

Bulls can bid at these levels if the $5.2 obstacle persists

In the past two weeks, UNI consolidated between $5.2 – $5.7. It inflicted a bearish breakout on 8 May but reversed the losses on 10 May. However, the price rejection at the range low of $5.2 could set UNI to retrace to lower support levels again.

Short sellers could drive down UNI toward the December low of $4.95 or the November low of $4.71. Notably, the range low $5.2 are January 2023 low level, meaning UNI has cleared all gains made in Q1 2023.

However, a close above $5.2 could give near-term bulls a shot at reversing losses made in the past weeks. However, they will only gain leverage if UNI closes above the consolidation range of $5.2 – $5.7.

At the time of writing, the RSI (relative strength index) was above the 50-mark, reinforcing that demand improved on 10 May.

Similarly, the OBV rose slightly on 10 May but exhibited a downtick at press time – the rise and slight drop in volume that could undermine further surge.

Sellers had the upper hand

How much are 1,10,100 UNIs

worth today?According to Coinglass’s exchange long/short ratio, UNI shorts dominated at 51.32% in the 4-hour timeframe. It underscores a short-term bearish outlook that could make the range low of $5.2 a formidable obstacle.

In addition, more long positions ($4.37k) were wrecked in the past 4-hours, while no short positions suffered any liquidations. It corroborates a likely downtrend for UNI, which could drag it to lower support levels.