Unpacking the Altcoin Season Index: What a score of 16 means for you

- The Altcoin Season Index had a reading of 16, meaning that the Bitcoin season was ongoing.

- TON was the top altcoin in the last 90 days, followed by KAS and PEPE.

Latest setback aside, Bitcoin [BTC] has been the center of attraction of late. This attention, however, bode ill for altcoins, as several top coins were sidelined.

What the Altcoin Season Index tells us

For the uninitiated, the Altcoin Season Index is designed to measure the profitability of altcoins compared to Bitcoin.

A high score on the index typically indicates a period during which altcoins are expected to outperform Bitcoin — an altcoin season.

On the contrary, if the score is closer to 0, then it’s a Bitcoin season. At press time, the Altcoin Season index had a reading of 16, hinting that Bitcoin was still dominant in the market.

Therefore, investors might need to wait longer to see all altcoins pump.

Nonetheless, AMBCrypto checked other data sets to find out how the market performed in the last 90 days. As per our analysis, Toncoin [TON] was the top performer as its price surged 229%, followed by Solana [SOL] and Pepe [PEPE].

On the other hand, Fetch.ai [FET], Optimism [OP], and Sui [SUI] were the worst performers, as their values dipped by 38%, 36%, and 35%, respectively.

Will top altcoins ETH and SOL bounce back?

While the wait for an altcoin season would be longer, we then planned to check how top altcoins have been performing.

According to CoinMarketCap’s data, the price of Ethereum [ETH], the king of altcoins, dipped 1.2% in the last 24 hours. SOL’s state was worse as its price witnessed a 5% drop.

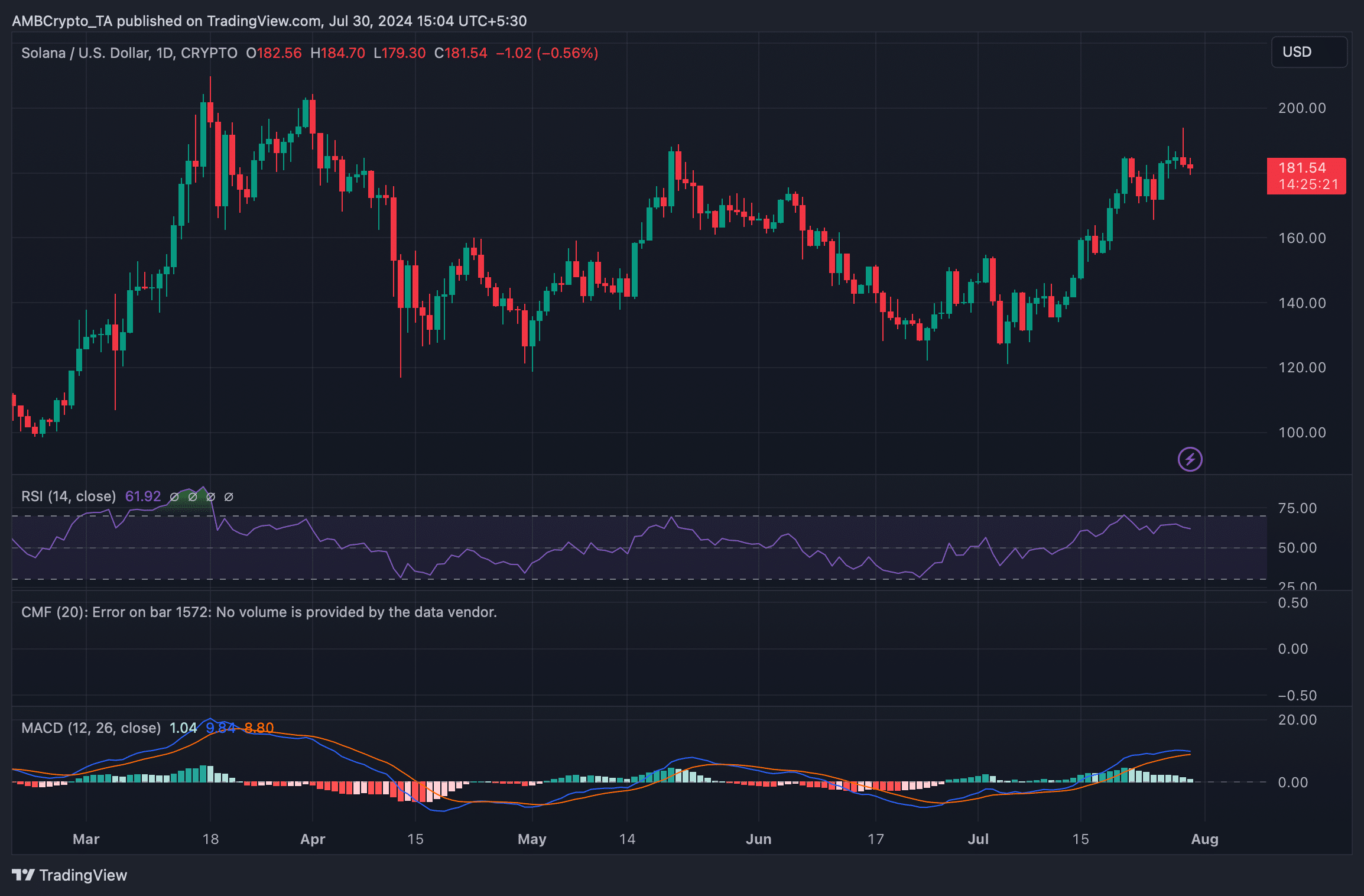

At the time of writing, ETH was trading at $3,341 and SOL had a value of $181.

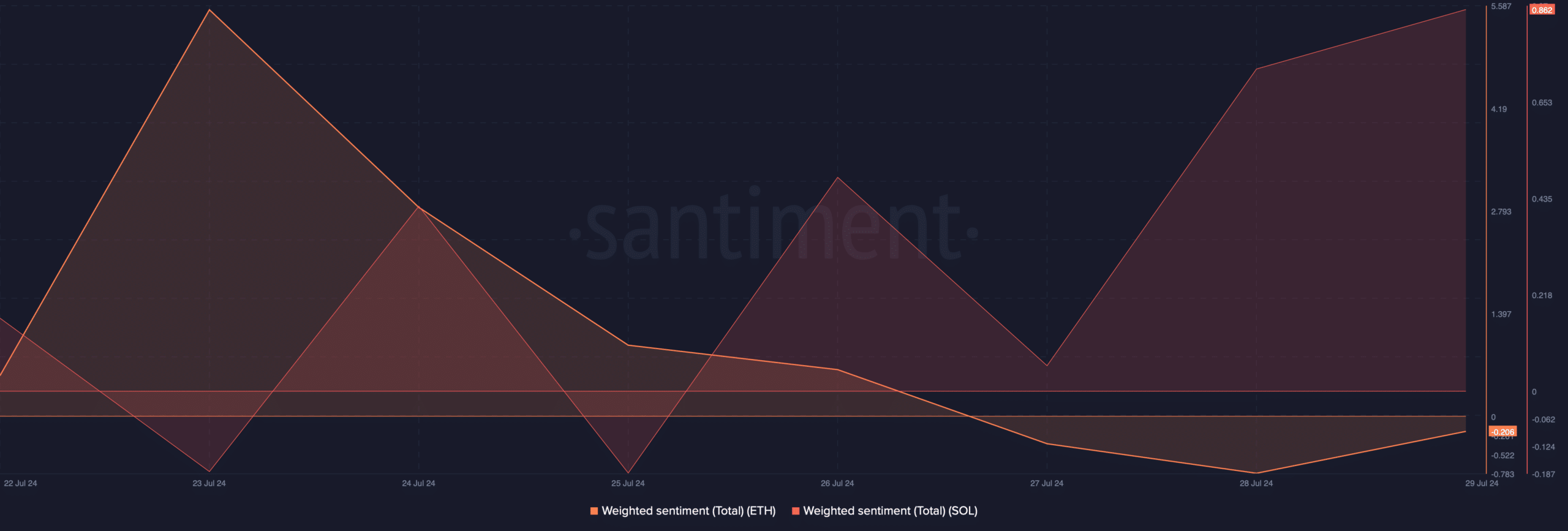

It was interesting to note that despite SOL’s massive plunge, its Weighted Sentiment increased, meaning that bullish sentiment around it was rising. However, ETH’s Weighted Sentiment remained in the negative zone.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Since market sentiment around SOL was bullish, AMBCrypto planned to take a look at its daily chart. As per our analysis, the MACD displayed the possibility of a bearish crossover.

Its Relative Strength Index (RSI) also registered a slight downtick, suggesting that price decline might continue.