Unraveling the mystery behind Coinbase’s L2 meme invasion

- Several memes emerged on the chain, driving a surge in network activity.

- Rumors went around that the Base chain could be temporarily restricted.

When BuildonBase, Coinbase’s Layer Two (L2) network, opened its door to developers, little did it envision that a long list of deployed tokens, liquidity, and degenerates would infiltrate the ecosystem.

How much are 1,10,100 ETHs worth today?

But between 29 June and the time of writing, Base welcomed a dramatic rise in memes with a number of them growing exponentially in thousands and millions.

Created by Coinbase, Base is an Ethereum [ETH] L2 chain operating on the Optimism [OP] Stack to allow scalability and security of decentralized Applications (dApps).

Users pull the strings on the bridge

While Coinbase officially launched Base on 23 February, access was limited to the public. However, the recent opening of the chain to developers suggests that the mainnet launch was close by.

In fact, speculation went around that the public mainnet would be live in the first week of August. Meanwhile, it seemed that market participants were unconcerned about waiting patiently for the announcement.

Due to this resolve, participants found a way around bridging to the chain using DEXes like LeetSwap, RocketSwap, and a decentralized wallet like MetaMask.

As a result, meme tokens like BALD emerged and grew as much as 3,000,000% in less than 10 hours. And according to Lookonchain, both retail and whales took advantage of the situation to make potential gains.

Wallet"0xC57E" bridged 65 $ETH to the Base network yesterday, and now he holds 507 $ETH, earning 442 $ETH ($826K) in 1 day.

0xC57E spent 65 $ETH to buy $BALD and sold for 482 $ETH, making 417 $ETH.

Then spent 10 $ETH to buy $OPTISM and sold for 34 $ETH, making 24 $ETH. pic.twitter.com/iuMy5yj9Kw

— Lookonchain (@lookonchain) July 31, 2023

Other tokens that spiked like BALD include OPTIMS, RCKT, and BRIAN, among others. Amid the frenzy, rumors circulated that the rise of the tokens could be linked to Coinbase’s CEO Brian Armstrong.

And considering how certain accounts turned a few hundred into millions, speculation also spread that there was insider trading.

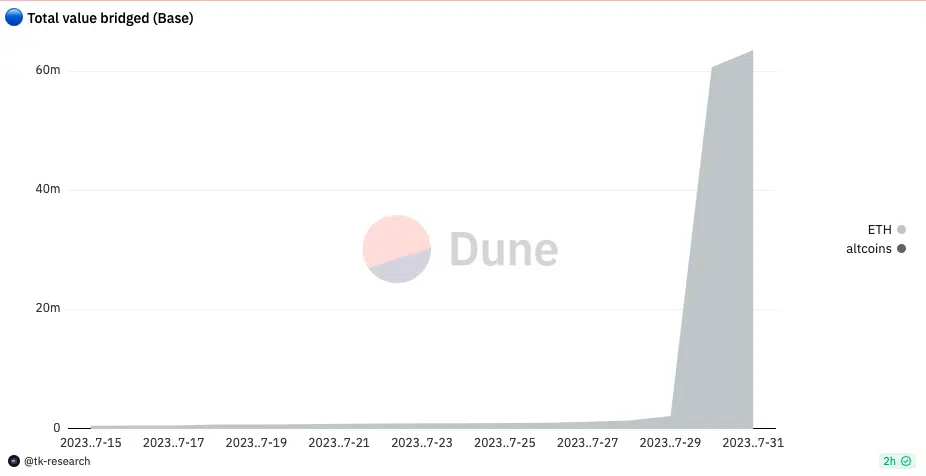

Following the surge in trading activity on Base, Dune Analytics showed that 39,094 ETH, worth over $64 million, had been used on the network. This indicates an increase in ETH burned and a possible hike in transaction fees registered.

Time for closure?

However, unconfirmed reports suggested that Coinbase had resolved to temporarily freeze the Base protocol. According to a pseudonymous web3.0 analyst Napgener, inside information revealed that the exchange took the action because of the aforementioned unusual activity.

https://t.co/XkMo2lf3nx pic.twitter.com/fLirnG95OD

— Napgener (@napgener) July 30, 2023

At press time, almost all the memes involved in incredible hikes have had their value subdued. But in another development related to Coinbase, the U.S. SEC has asked the exchange to delist and stop the trading of all other cryptocurrencies apart from Bitcoin [BTC].

Recall that recently, the SEC sued Coinbase due to alleged past offerings of unregistered securities. And according to Financial Times, CEO Armstrong said that it was one of the conditions prior to the served lawsuit. Armstrong said,

“They came back to us, and they said . . . we believe every asset other than bitcoin is a security. And, we said, well how are you coming to that conclusion, because that’s not our interpretation of the law. And they said, we’re not going to explain it to you, you need to delist every asset other than Bitcoin.”

Realistic or not, here’s OP’s market cap in ETH terms

However, Armstrong also said that the exchange did not budge, and asked that the parties sort the matter in court.

At press time, almost all the memes involved in incredible hikes have had their value subdued. And in the meantime, Base had not confirmed when the Mainnet would go live.