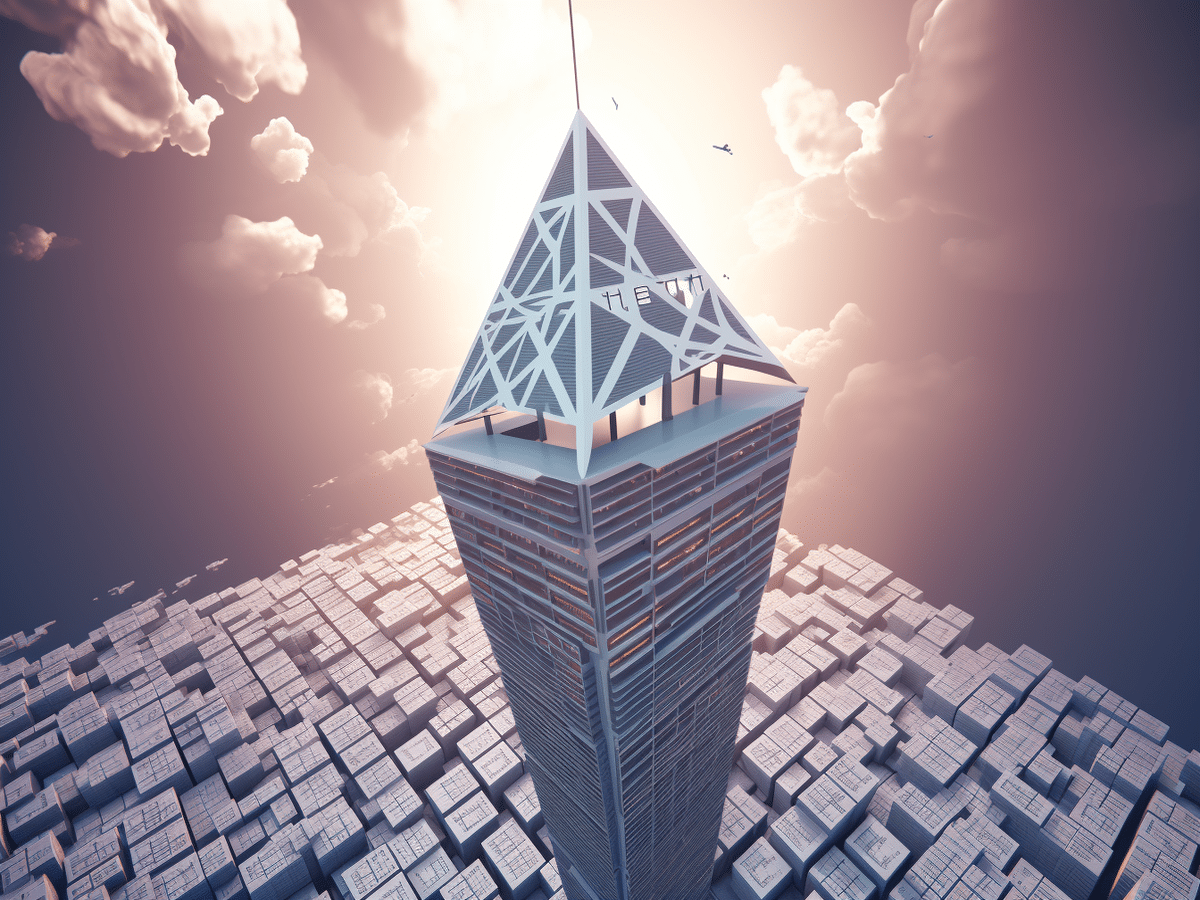

Unveiling the Ethereum elite: Top addresses, market cap and price trends

- Ethereum top two addresses currently hold over $10 billion worth of ETH.

- ETH’s recent price trend has slumped from its uptrend at the beginning of the year.

A recent Arkham Intelligence report has identified the addresses holding the most Ethereum globally. Given this fresh information, how do these holdings compare to the market capitalization of ETH?

How much are 1,10,100 ETHs worth today

Top Ethereum addresses identified

On 9 September, Arkham Intelligence published a post that revealed the top Ethereum addresses associated with exchanges, active large-scale investors, and even permanently unusable addresses. According to the report, Binance and Grayscale were the top two entities with the largest ETH holdings. Arkham reported that Binance possessed approximately $5.7 billion worth of ETH, securely stored in two cold wallets.

In contrast, Grayscale’s ETH holdings were distributed across over 650 different addresses, totaling around $5 billion in value. Each address held at most $30 million worth of ETH. The data also indicated that exchanges held most of ETH among the top holders.

Current Ethereum market capitalization

As per CoinMarketCap, Ethereum currently has a circulating supply of over 120 million tokens, with a total supply that matches. As of this writing, the market capitalization of Ethereum exceeded $195 billion.

Notably, it becomes apparent from the ETH market cap that the combined value of the two leading addresses was significantly smaller in comparison. This observation suggested that any transactions or movements originating from these top addresses would unlikely substantially impact the overall price trend of Ethereum.

ETH price trend

The price of Ethereum has exhibited various trends throughout the year, with the most recent development being a descent to its lowest level since its upward movement in January. As of this writing, ETH was experiencing a loss on a daily time frame, trading at approximately $1,600, representing a decline of less than 1%.

Notably, within the current trend, Ethereum struggled to surpass the $1,700 price threshold, and conversely, it managed to stay above the $1,600 mark despite its recent drop.

Is your portfolio green? Check out the ETH Profit Calculator

Additionally, a notable observation is that the chart indicates a downward trajectory over the past three days.

In light of this decline, Ethereum’s Relative Strength Index (RSI) line has dipped below 40. This particular RSI reading implies that the prevailing bearish trend in the asset has been gaining strength.