USDC and BUSD breathe a sigh of relief, thanks to Biden administration

- U.S. government comes to the rescue of failed banks. However, BUSD and USDC continue to suffer.

- The crypto community, in general, criticized the government’s bailout.

Over the last few days, the collapse of Signature and the Silicon Valley Bank has impacted the financial and crypto markets quite significantly.

A much-awaited response by the U.S. government was issued on 12 March, which aimed at tackling the challenges being faced by the banks and their depositors.

The White House breaks its silence

The government’s response was communicated through a joint statement from the Treasury, Federal Reserve, and FDIC (Federal Deposit Insurance Corporation).

It confirmed that the Silicon Valley Bank issue will be successfully resolved with the approval of the U.S. Treasury Secretary, Janet Yellen.

The statement also assured depositors of the bank that they would be fully safeguarded and would be able to access their funds after 13 March.

An equivalent risk exception was declared for Signature Bank, with a confirmation that all depositors of the bank would be fully reimbursed.

Additionally, it was mentioned that there would be no financial burden on taxpayers for resolving these banks.

The President of the United States also took to Twitter to share his perspective, emphasizing the government’s intention to bolster oversight and regulation of major financial institutions.

Additionally, he made it clear that the authorities are determined to hold those who are responsible for such occurrences accountable.

At my direction, @SecYellen and my National Economic Council Director worked with banking regulators to address problems at Silicon Valley Bank and Signature Bank.

I’m pleased they reached a solution that protects workers, small businesses, taxpayers, and our financial system. https://t.co/CxcdvLVP6l

— President Biden (@POTUS) March 13, 2023

Paxos and Circle respond

Following the government’s announcement of resolving issues at both banks, the Paxos team confirmed that their stablecoin reserves were completely collateralized. And, it could be redeemed by customers at a 1:1 ratio with the U.S. dollar.

The team further clarified that 90% of Paxos’ reserves were held in U.S. treasury bills and overnight repos and that there was no real threat to their stablecoins.

The team at Circle followed suit, as cofounder Jeremy Allen took to Twitter to ensure holders that their assets were absolutely secured.

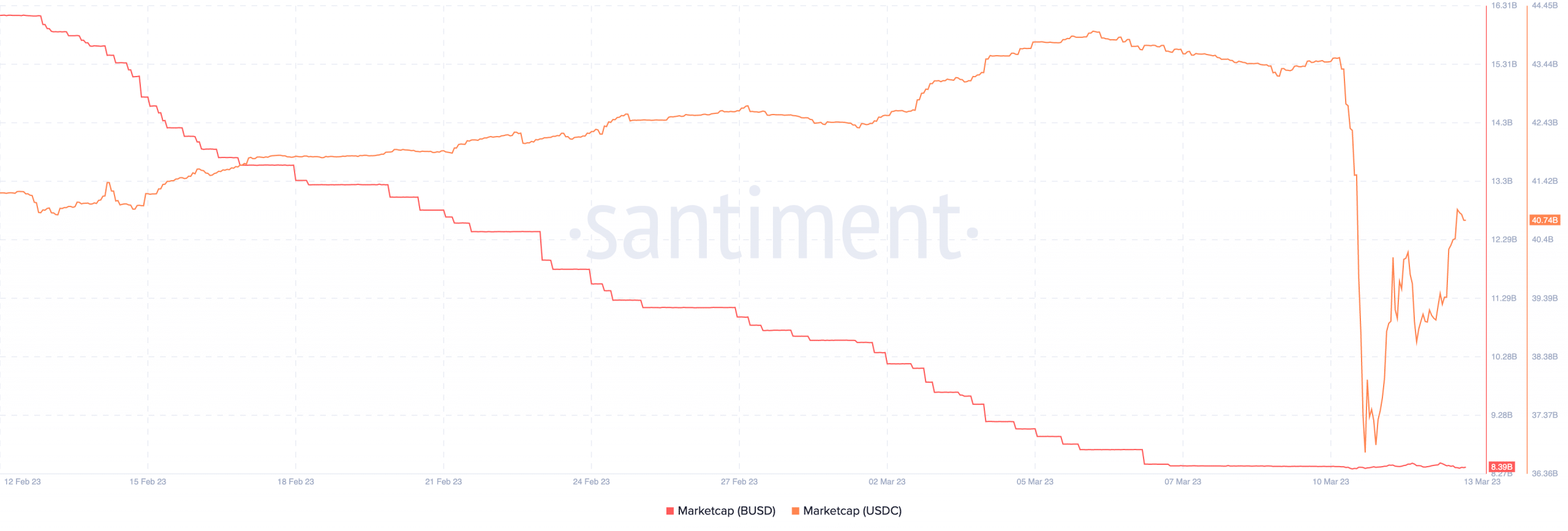

On the other hand, despite Paxos’ efforts to dampen the FUD surrounding its stablecoin BUSD, its market cap continued to decline.

The same, however, couldn’t be said about USDC’s market cap, which witnessed some improvements in its marketcap owing to the faith shown in the stablecoin by whales and fund managers alike.

Deja Vu

While government bailouts may provide short-term security for investors, members of the cryptocurrency community argue that such bailouts can actually encourage risky behavior.

Many influential figures have drawn parallels between the current situation and the 2008 banking crisis.

CZ and other prominent leaders expressed concerns that government bailouts may lead banks to prioritize their own interests over the safety and well-being of their depositors.