USDC surpasses Tether USDT – A sign of stablecoins’ future?

- USDC surpasses USDT, indicating a shift in stablecoin market dynamics.

- Leaders stress aligning stablecoins with democratic values and transparent regulations.

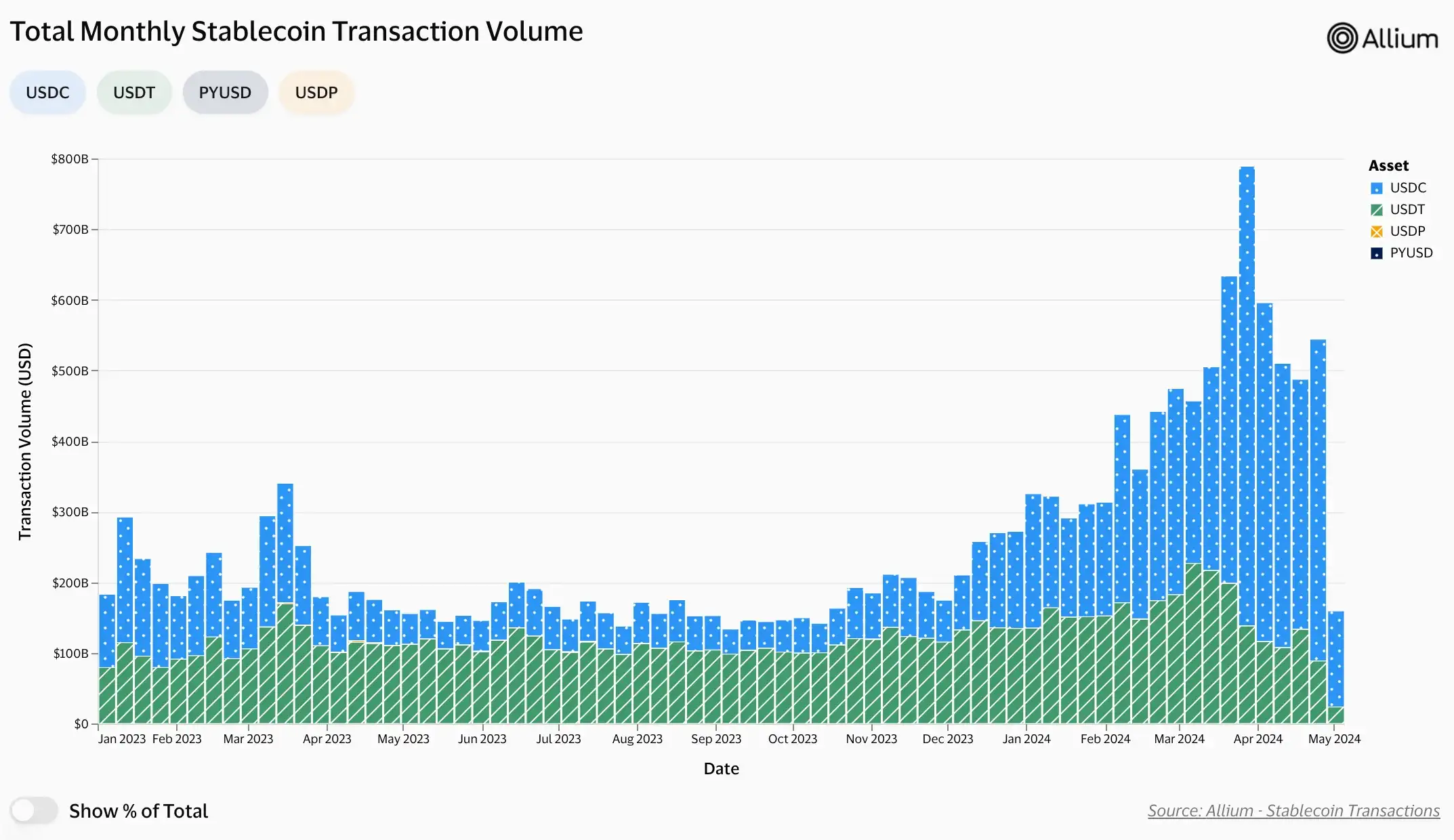

In a surprising development, Circle’s USD Coin [USDC] has surpassed Tether [USDT] in stablecoin transactions, marking a significant shift in the cryptocurrency market.

According to Visa’s on-chain analytics, USDC recorded 166.6 million transactions in April 2024, outpacing USDT’s 163.6 million transactions.

Amidst these developments, a crucial question emerges: How can the industry ensure that stablecoins uphold democratic values and comply with regulations?

USDC Circle founder’s insights

In response to the above question, Jeremy Allaire, the Founder of USDC Circle, in a recent conversation with the Bankless podcast said,

“We do need to have regulation around the world on stablecoins. There should be expectations about the issuers and how they manage risk and their obligations from a compliance perspective.”

This unexpected turn of events underscores regulatory action against Tether due to its alleged ties to illicit activities. It also underlines the growing prominence of USDC as a preferred stablecoin for transactions.

In early February, Caroline Hill, a senior executive at Circle, advocated for dollar-pegged stablecoins to align with US values.

Hill addressed this issue during her testimony before the House Subcommittee on Digital Assets, Financial Technology, and Inclusion. She said,

“I personally believe that no company should be allowed to reference the US dollar without having those democratic values inside the company, inside their US dollar-backed stablecoin.”

She added,

“And so if Treasury thinks that it needs additional authorities to go over that, then I think that this committee should consider that.”

This highlights the tensions between the crypto industry’s desire for open competition and regulatory compliance to avoid risks.

Importance of stablecoins

Additionally, talking about transparent laws and regulations accessible to all and how it’s essential for encouraging competition and innovation in the stablecoin market, Allaire added,

“I think when you see stablecoin laws come into effect you’re going to see a ton of companies including major financial institutions, major payments companies, technology companies. I think the competition will increase immensely.”

Drawing parallels with the communications and internet industries in the late 90s. He added,

“Right now people are afraid to get into this market because they don’t know where the rules are and so, I do think that part of the goal of establishing a regulatory regime is to enable free and fair competition.”

All in all, this concludes that stablecoins play a vital role in facilitating swift transactions within the cryptocurrency market.

With a total market capitalization exceeding $161 billion, they represent a significant portion, around 6.63%, of the overall crypto market.