USDC, USDT and DAI: What’s the next move for these stablecoins?

- Stablecoins lost their market cap dominance over the last few months.

- USDT dominated in terms of market cap, while USDC continued to see high volume.

Stablecoins were dominant in the crypto market till last year, taking up their fair share of space in the sector. However, since the beginning of 2023, the stablecoin sector was declining.

According to data provided by Delphi Digital on 20 April, stablecoins’ market cap dominance fell from 20% to 10% in the last few months.

Stablecoins have traditionally been used as a safe haven in times of market volatility, but the decline in their dominance suggested that investors are becoming more comfortable taking risks in the cryptocurrency market.

Stablecoins are more than 10% of the Total Crypto Marketcap. pic.twitter.com/32qqkr02ns

— Delphi Digital (@Delphi_Digital) April 20, 2023

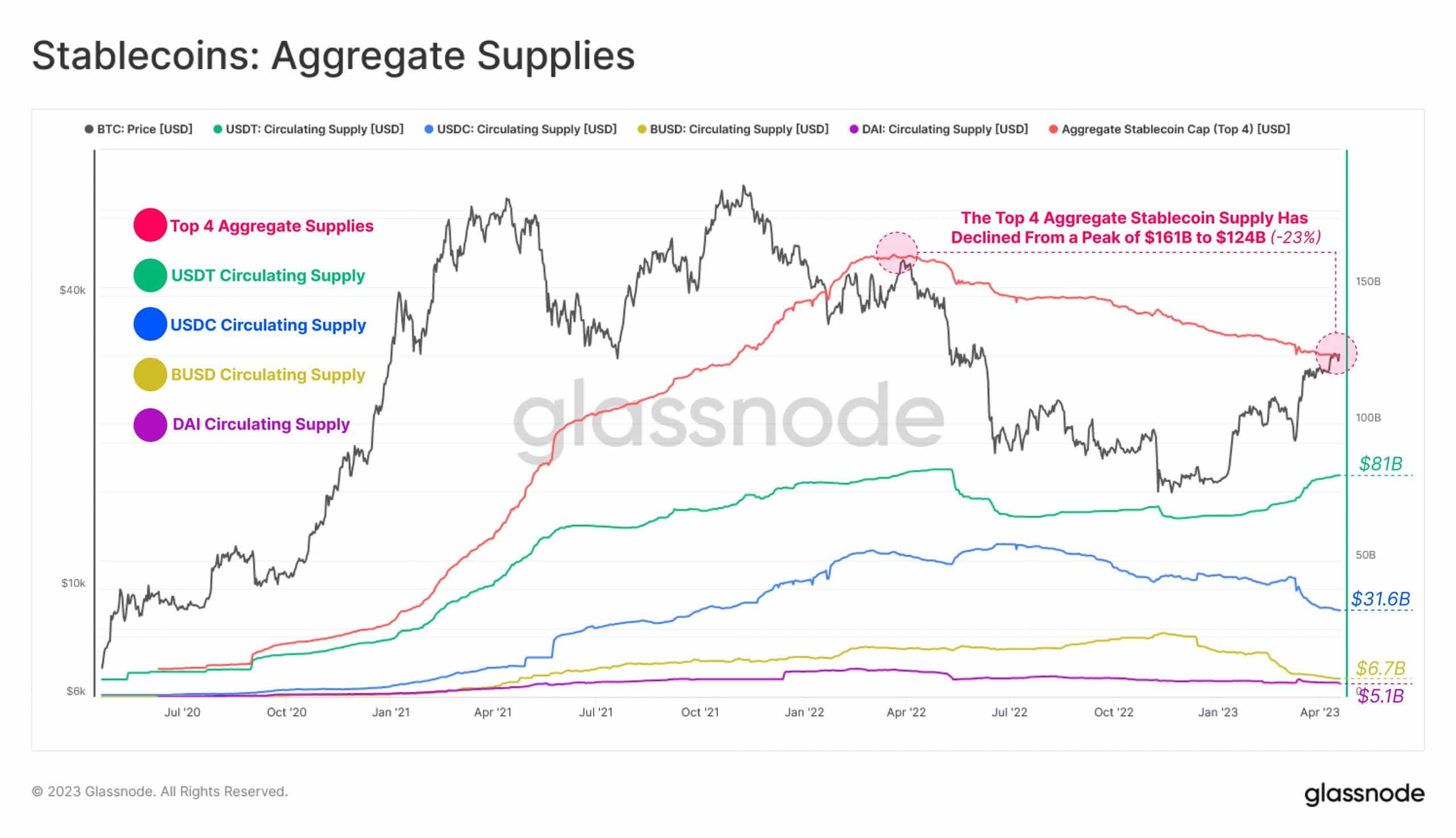

Another indicator of falling interest in stablecoins would be the decline in stablecoin aggregate supplies. According to Glassnode’s data, the aggregate supply of the top four stablecoins has dropped significantly from its peak of $161 billion to $124 billion, a decline of 23%.

This drop was reflected in the net flows of each stablecoin, with USD Coin [USD] seeing the largest decline of $20 billion, followed by Binance USD[BUSD] with $11.1 billion, Tether [USDT] with $1.3 billion, and Maker [DAI] with $4.4 billion.

Additionally, the number of users sending stablecoins across addresses also fell. Over the last few days, the number of stablecoin senders declined from 515,319 to 363,948 according to Dune Analytics’ data.

Stablecoins: A race to the bottom?

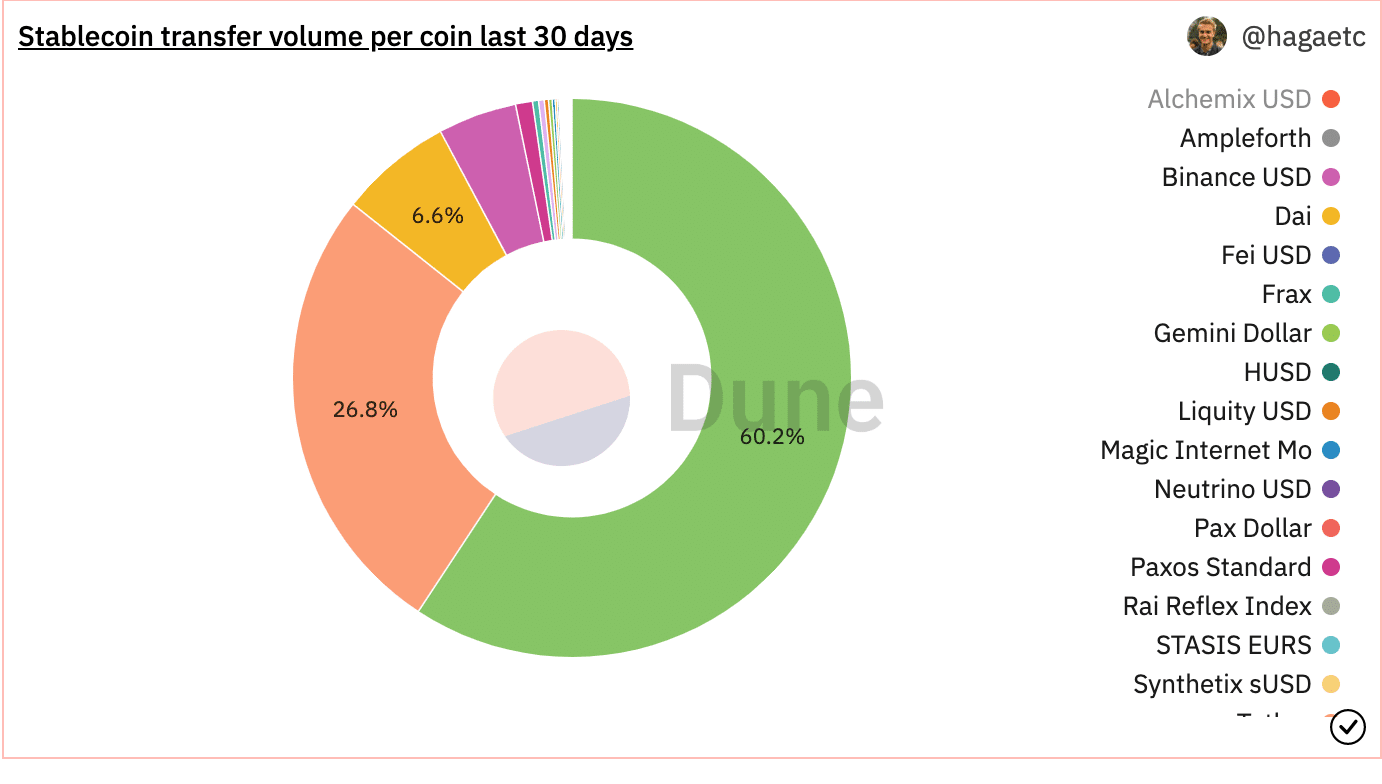

The volume of stablecoins being transferred also took a dip because of the above-mentioned reason. At press time, USDC contributed 60.2% of all stablecoin volume. Whereas USDT and DAI captured 26.8% and 6.6% of the market, respectively.

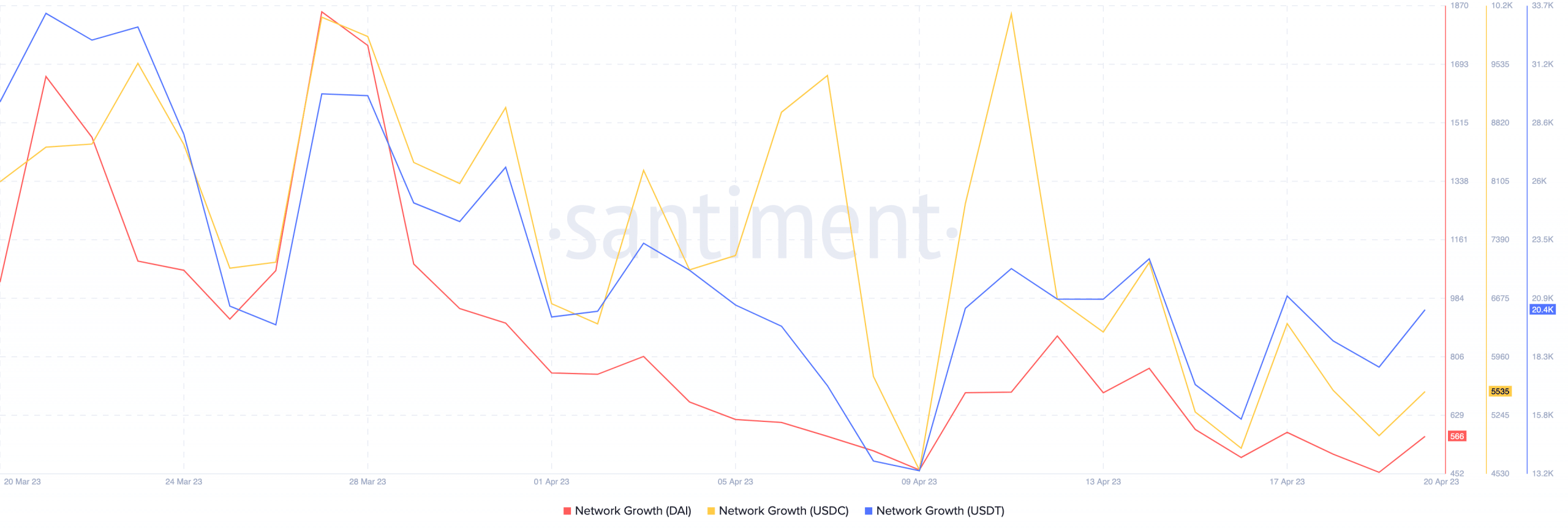

The network growth of these stablecoins also declined materially during this period. This suggested that new addresses did not show any interest in USDT, USDC, and DAI.

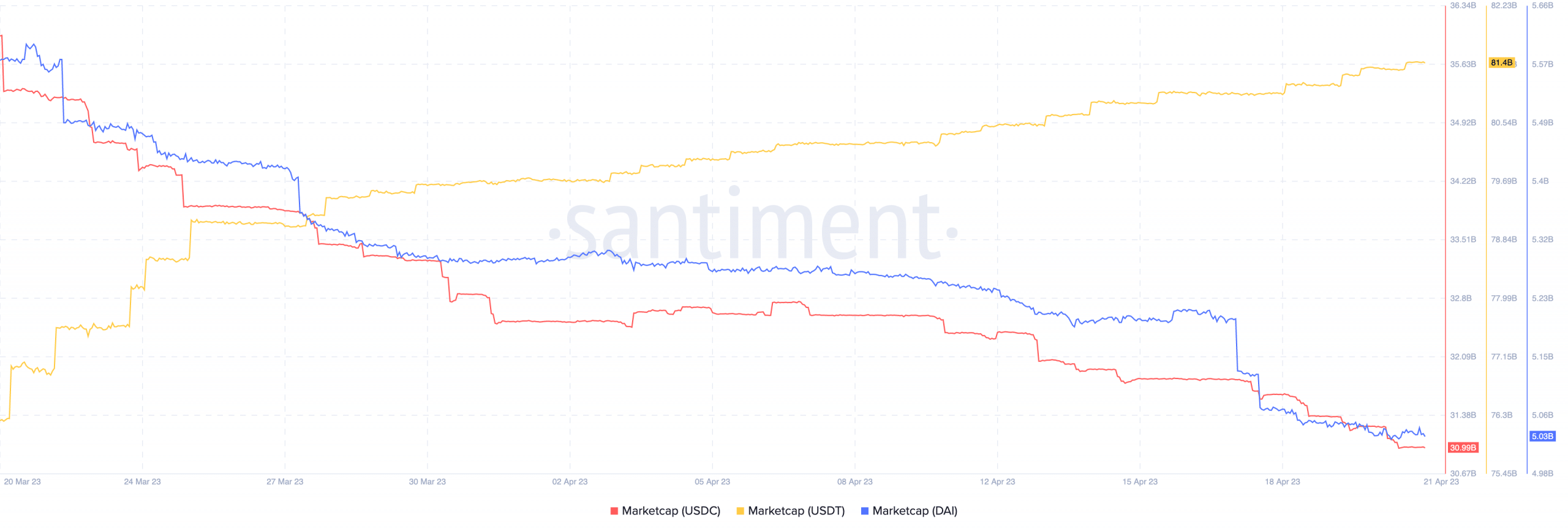

USDT’s market cap exhibited a persistent upward trend despite the declining network growth. In contrast, DAI and USDC’s market cap declined during the same period.

In order to ascertain the future trajectory of stablecoins, it is imperative to be aware of the ongoing legal proceedings pertaining to this domain.

Lately, the Chief Strategy Officer and Head of Global Policy at Circle addressed a bipartisan gathering of Congressional Members on 20 April. During the session, he stressed the pressing requirement to enact legislation concerning stablecoins.