USDC volume surges to $23B in 2024: What are the reasons behind the rise?

- USDC trading volume surged to $23 billion in 2024.

- Increased regulatory hurdles increased demand for regulated stablecoins.

The crypto market has experienced increased regulation and scrutiny, with altcoins such as Ripple [XRP], Uniswap [UNI], and Monero [XMR] facing legal hurdles.

Conversely, the increased regulation also heightened the global demand for compliant stablecoins such as USD Coin [USDC].

In 2024, USDC’s trading volume surged to $23B from $9B in 2023. The exponential growth arises amid higher demand for legally accepted stablecoins among major traders, making regulated stablecoins a perfect alternative.

Thus, recent developments have seen USDC’s market share rise to a record high. According to Kaiko’s report, USDC’s market share was nearing FDUSD 14%.

What’s driving USDC’s surge

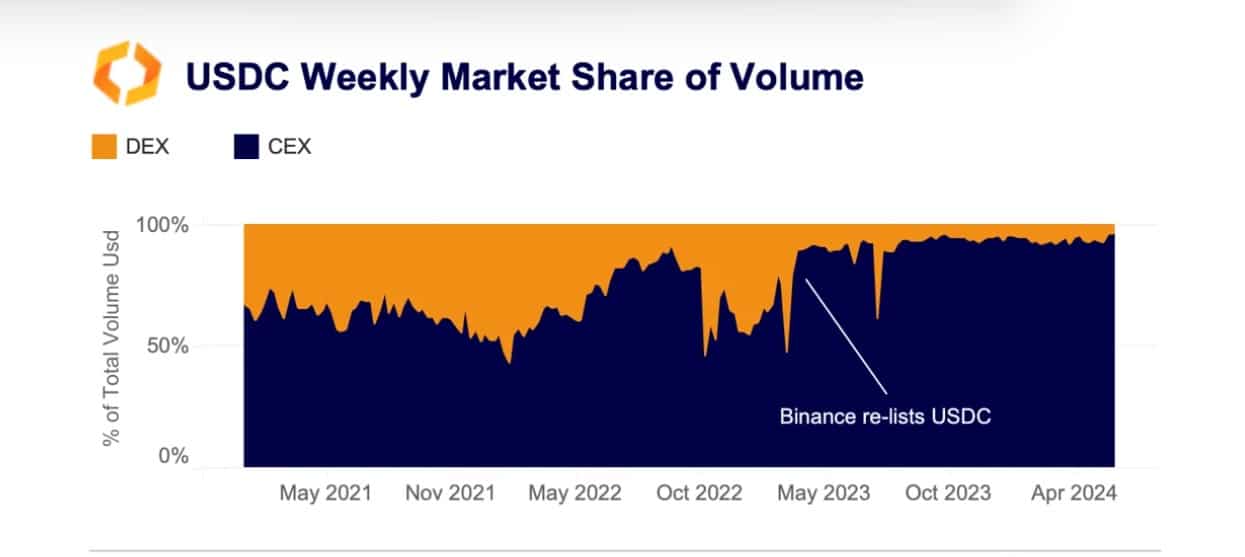

Various market factors have been driving USDC’s trading volume and market share. According to Kaiko, the rise of CEXes are a central factor driving USDC volume.

Based on the report, USDC’s market share of CEXes experienced a higher surge from March 2023, rising from 60% to 90%.

Equally, perpetual futures settlements have played a critical role in surging trading volume. Kaiko reported that Bitcoin [BTC] perpetuals in USDC rose to 3.6% from 0.3%, while Ethereum [ETH] perpetuals rose to 6.8%.

The increased use of perpetual settlements shows changing sentiment among investors over-regulated stablecoins.

MiCA: The game changer

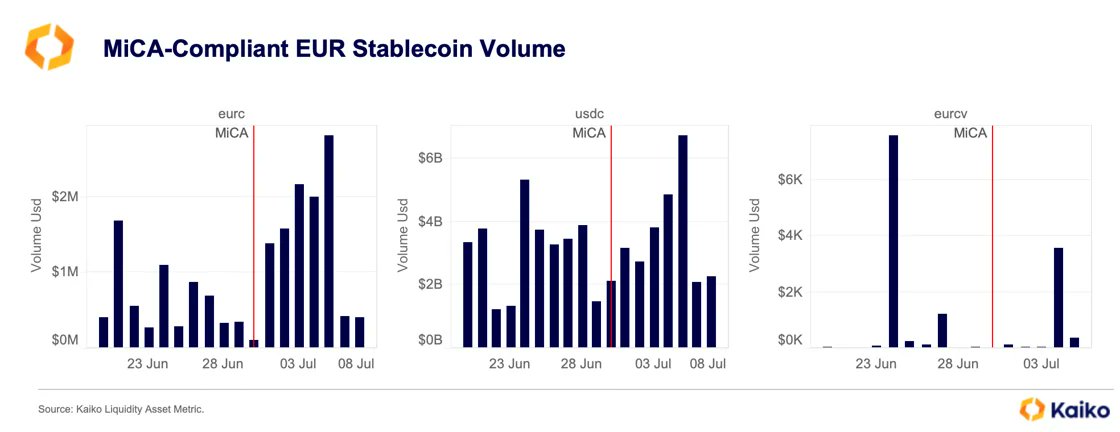

On the 30th of June, Circle reported its full compliance with MiCA (European Markets in Crypto-assets Regulation). This was a critical point in Europe’s stablecoin market, acting as a framework for others.

After Circle, other firms followed suit, including SocGen’s Forge, which mostly issues EURO convertibles.

From the compliance of these firms emerged a roadmap that involved requirements for other issuers, such as whitepaper publication, governance, reserve management, and prudential standards.

After Circle announced its compliance with MiCA requirements, EURC and USDC experienced the highest trading volume on daily charts.

Equally, SocGen saw a rise in trading volume. Therefore, the surge in trading volume showed that MiCA compliance played a critical role in increasing USDC’s demand.

Essentially, the existing legal framework allows institutional investors and other big players to follow while sticking to their requirements for derivatives markets.

The entrance of institutional investors will play a critical role in further driving USDC demand and trading volume.

Thus, USDC and other regulated stablecoins will experience a surge in trading volume as user preferences continue to shift.

Although unregulated stablecoins are still dominant, the future of regulated stablecoins seems bright as major exchange platforms such as Binance [BNB], OKX, Kraken, and Bitstamp continue to restrict and delist them.