USDC woes far from over as market cap draws down- Is USDT leading

- USDC’s loss becomes USDT’s gains after market events in March.

- The tides are calm for now but there might still be more stablecoin risk ahead.

Roughly two weeks have passed since USDC lost its USD peg due to SBV turmoil. A sizable reshuffling has occurred since then as many crypto users shifted their attention from USDC to other stablecoins.

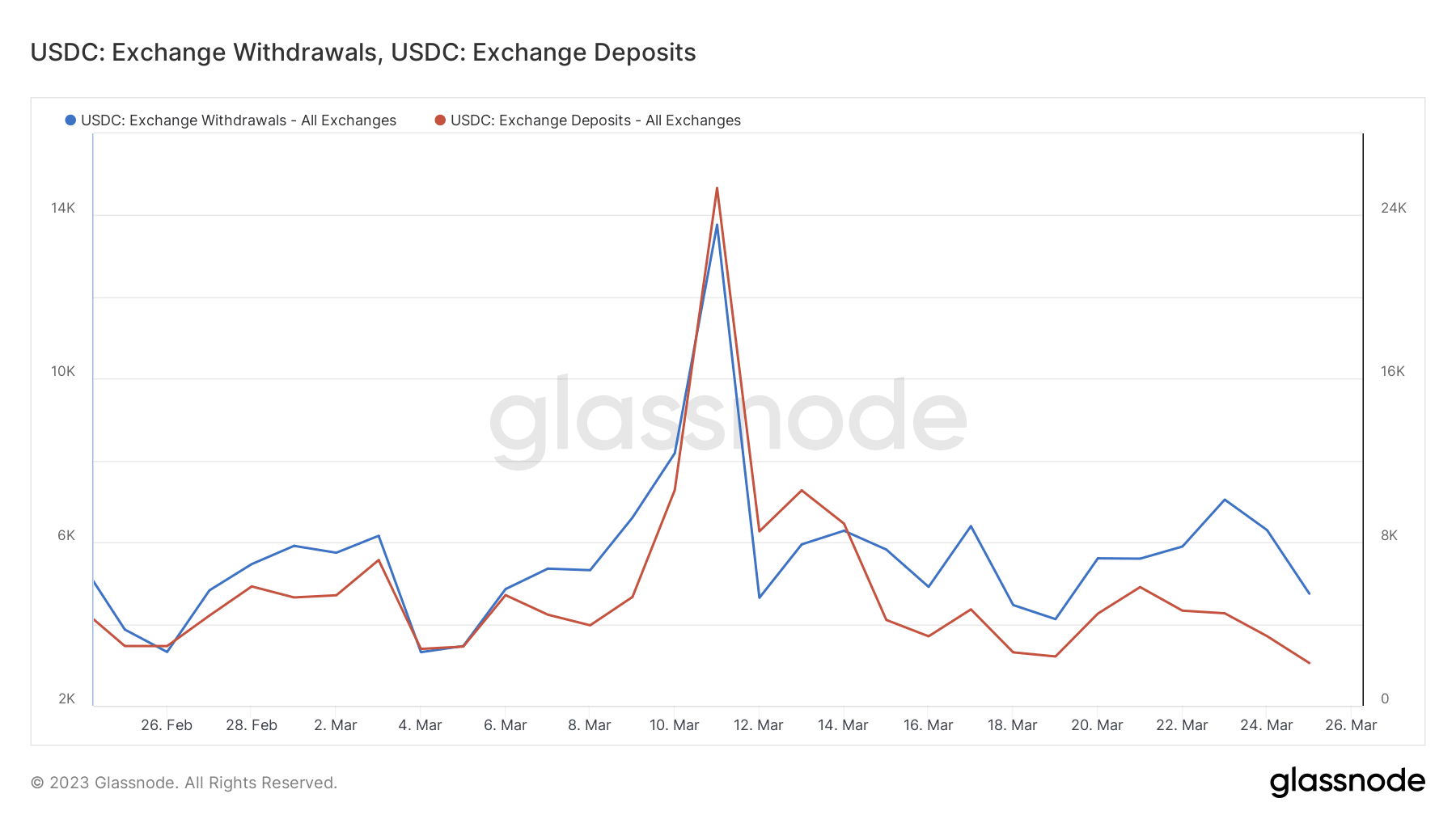

The impact on Circle’s USDC is particularly evident in its exchange deposits and withdrawals. The latest glassnode data reveals that exchange deposits are currently less than half the amount of exchange withdrawals.

The lower exchange deposits reflect the disrupted confidence in the cryptocurrency, as a result of user migration to alternative stablecoins.

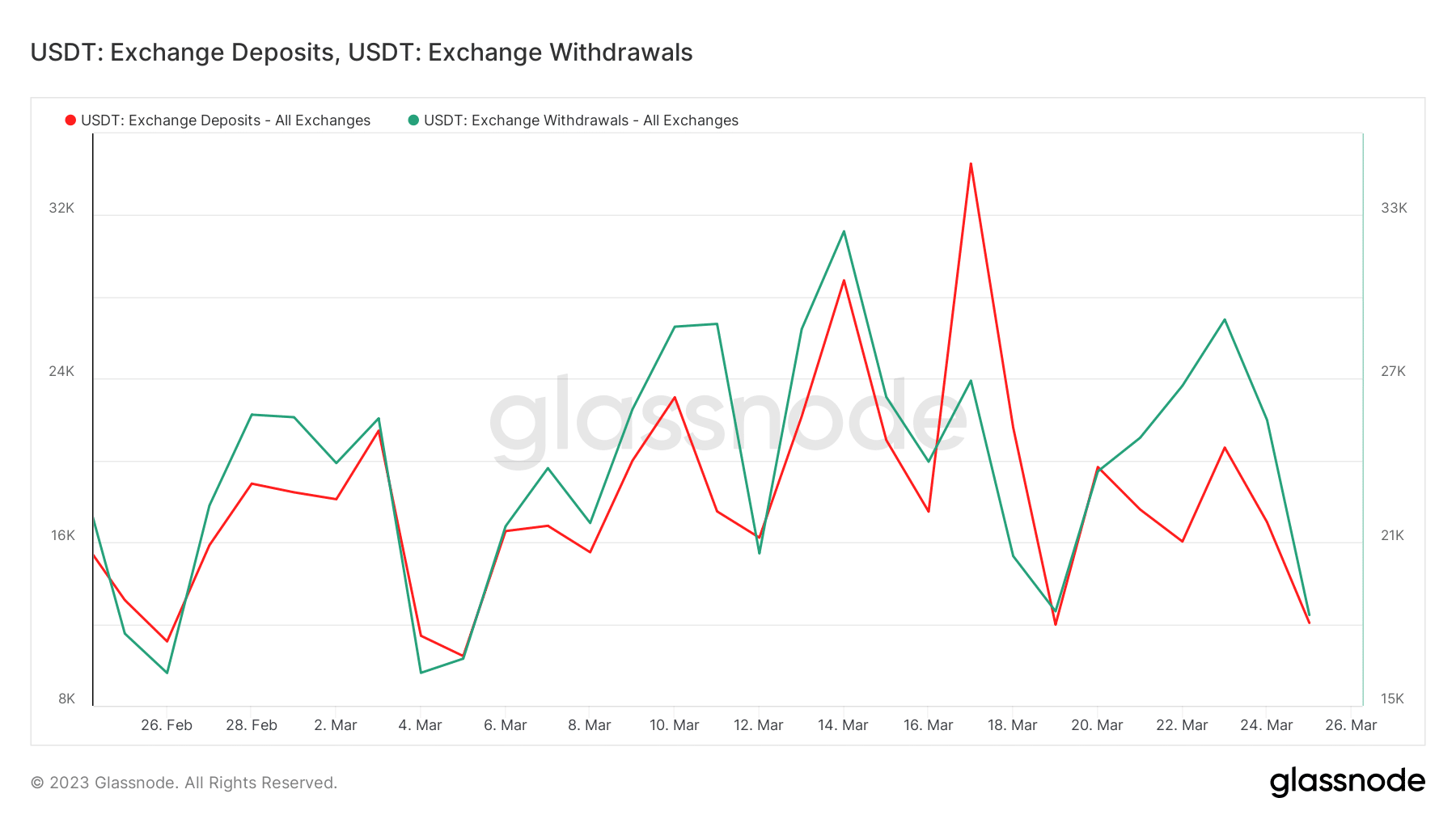

On the other hand, USDT flows have been more pronounced. A look at USDT flows in the last two weeks reveals that USDT exchange deposits peaked on 17 March, a few days after USDC lost its peg. This shows the robust flow of liquidity from USDC to USDT.

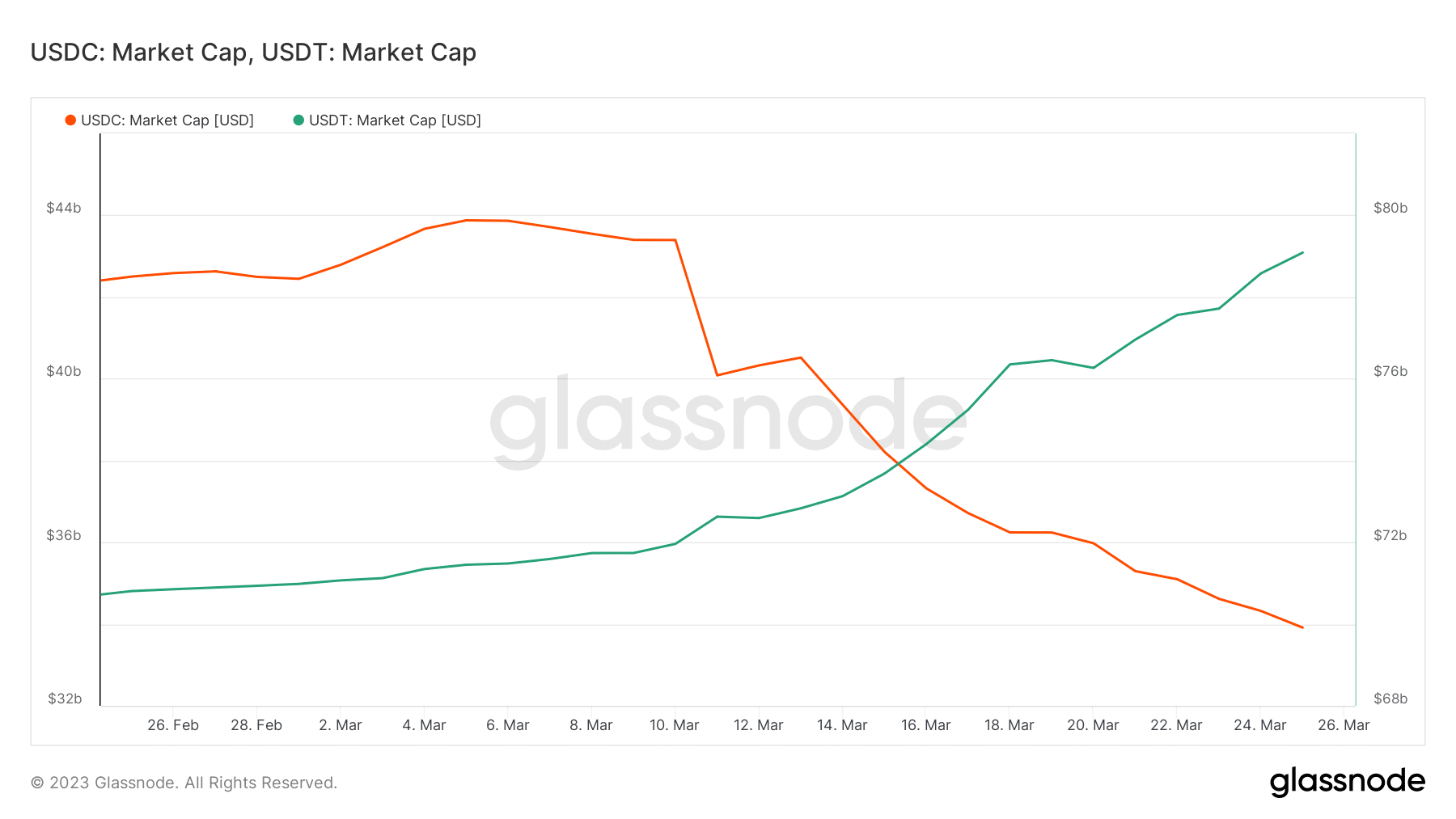

USDT also experienced a slowdown in exchange outflows and inflows as the flow of liquidity entered Bitcoin and altcoins. The difference between USDT and USDC demand was further evident in the market cap directions of both stablecoins.

For perspective, USDC’s market cap fell by $9.96 billion from its March peak to its current low. Meanwhile, USDT’s market cap grew by almost $9 billion from its 4-week low to its current high.

USDC is not the only stablecoin that has been negatively affected by the market events in March. A glassnode tweet from 26 March showed that the number of BUSD transfers is currently at an eight-month low. Meanwhile, its liquidity on Uniswap fell to a four-month low.

? $BUSD Liquidity on Uniswap just reached a 4-month low of $28,725.78

Previous 4-month low of $28,869.32 was observed on 20 March 2023

View metric:https://t.co/aTcUpCu12y pic.twitter.com/zTdj2XW3ev

— glassnode alerts (@glassnodealerts) March 26, 2023

Is the stablecoin risk over?

If there is one major takeaway from the crypto market in the last few months, it is to expect the unexpected. This means there might be some risks further down the road that may impact stablecoins.

Some of those risks may come from governments aggressively pushing against cryptocurrencies, as has been the case recently.

USDT is now the most popular stablecoin by a large margin thanks to the SVB issue. However, this also means it might be the next big target for future attacks. Meanwhile, USDC recovered its peg but some damage has already been done.