USDT vs USDC: Why USDC’s stumble is USDT’s triumph

- The debate of USDT vs USDC continues unabated as both stablecoins fight for dominance.

- However, most investors prefer one stablecoin over the other.

With a combined market capitalization of over $110 billion, Tether [USDT] and Circle [USDC] are two of the most popular stablecoins in the cryptocurrency ecosystem.

Stablecoins are crypto assets specifically designed to maintain a stable value. They are typically pegged to a fiat currency like the US dollar, or other cryptocurrencies. USDT and USDC are leading examples of fiat-collateralized stablecoins, pegged to the US dollar at a 1:1 ratio. This means that each USDT or USDC token is always worth $1.

Over the years, particularly following the collapse of Terra Luna and the failure of its UST algorithmic stablecoin, there have been growing concerns over the value offering of this asset class and whether they are actually “stable.”

USDT vs USDC: What do the investors favor

Founded in July 2014, USDT was one of the earliest stablecoins, created by Brock Pierce, Craig Sellars, and Reeve Collins. USDT was developed to address two main challenges that existed in the cryptocurrency space: volatility and the ability to convert between fiat currencies and cryptocurrencies.

While the asset is primarily issued on the Ethereum [ETH] and Bitcoin [BTC] blockchains, its representation on both networks differs. On Ethereum, USDT tokens are implemented as ERC-20 tokens, while on Bitcoin, Tether utilizes the Omni layer to represent USDT tokens.

Since its launch in 2014, Tether has been a subject of a never-ending controversy, primarily due to the company’s failure to properly furnish audited financial statements verifying the sufficient reserves supporting its USDT stablecoin.

Tether first promised transparency on 9 March 2015 when it announced its partnership with the now-liquidated Factom to “innovate its transparency and audit strategy.”

We've partnered with @factomproject to innovate our transparency and audit strategy http://t.co/69wc93sG8j #bitcoin

— Tether (@Tether_to) March 9, 2015

Though the official link to the partnership announcement is no longer functional, details of the same can be found on the internet archives. The archives revealed that the Factom blockchain would create an “unforgeable audit trail of Tether wallet database.” However, there is no evidence of any collaborative involvement to this end between either entities.

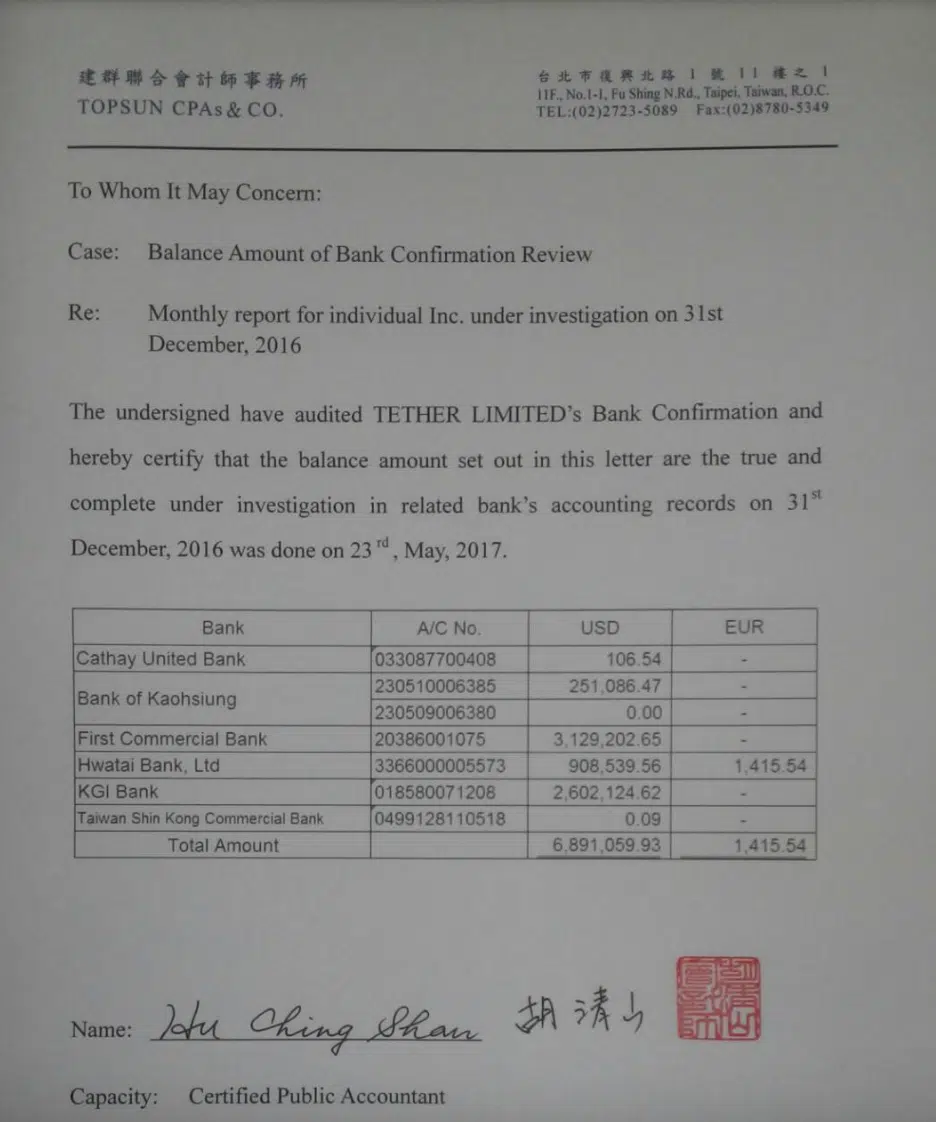

Another promise came in 2016 following Bitfinex’s hack (Tether’s sister company). Tether sought the services of Taiwanese auditor Topsun. However, many believe that the engagement with Topsun did not resemble a proper audit, but rather an attestation based on bank account statements provided by Tether management.

Tether’s long history of promise and failure

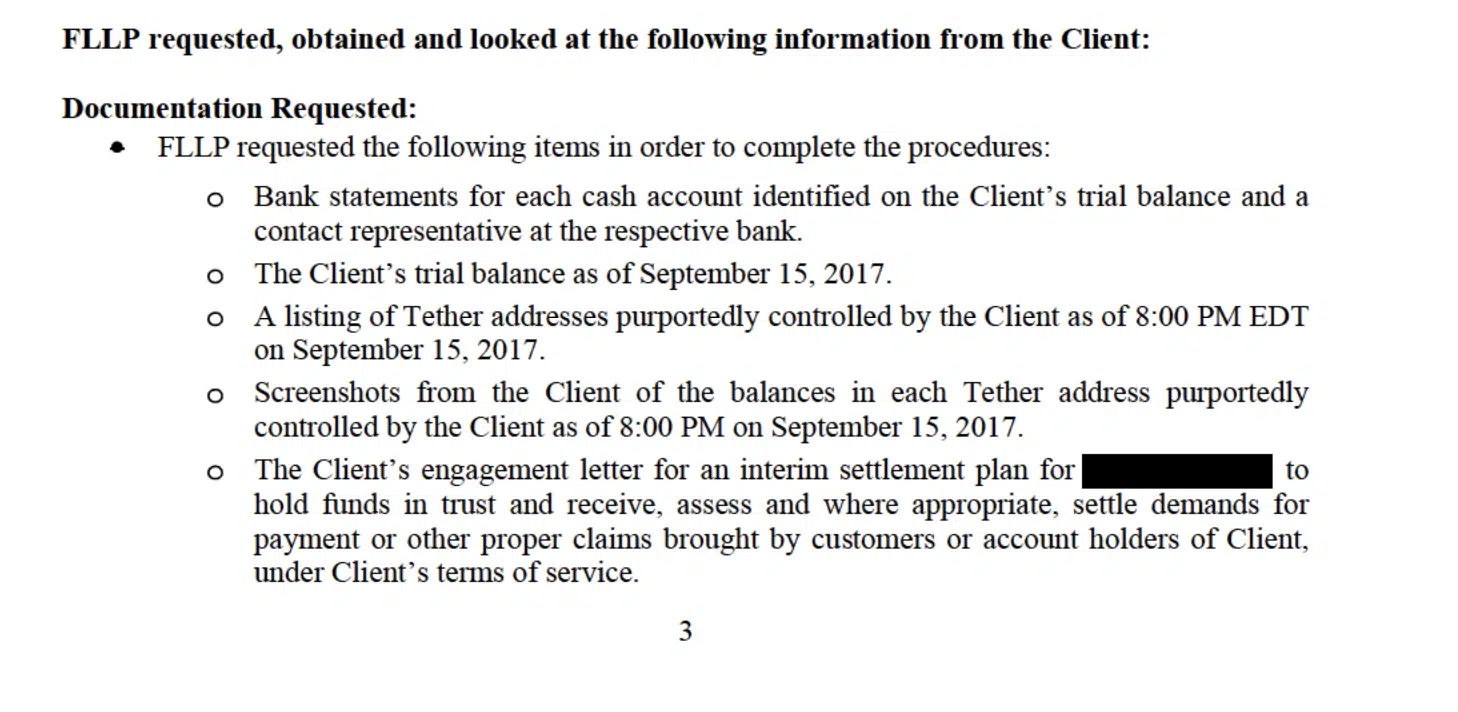

In 2017, following its own $30 million hack, Tether announced that it had engaged the services of Friedman LLP to “perform historical balance sheet audit procedures.” Instead of a most-coveted audit report, what came out of that engagement was a memorandum from Friedman LLP to Tether wherein the former released its findings on the latter’s financials based solely on Tether’s documents.

A year later, Tether ended its relationship with Friedman. According to Tether’s spokesperson,

“Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame.”

In the same year, Tether engaged the services of the law firm of Freeh, Sporkin, and Sullivan. However, Bloomberg reported that the law firm did not conduct an official audit as it merely:

“Had access to Tether’s accounts at two banks for weeks and released data on how much money the company held on a single day, June 1.”

By the end of 2018, Tether had moved on from Freeh, Sporkin, and Sullivan and started working with its current banking partner, Deltec Bank & Trust. The company published a “portfolio confirmation,” about Tether’s bank cash portfolio. Interestingly, at the time, Tether had claimed that it was fully backed by US dollars and not holding any portfolio.

Since 2021, following a settlement with the New York Attorney General, Tether was obligated to provide quarterly attestations as proof of fully backed reserves. While Tether has continuously published its proof of reserves since then, doubts still linger in the market.

USDC’s fall from grace

USDC suffered a blow to its marketshare in March following the unexpected collapse of Silicon Valley Bank (SVB). On 11 March, Circle confirmed its inability to remove $3.3 billion of the $40 billion of USDC reserves locked up at SVB. This immediately caused the stablecoin to lose its $1 peg and traded for as low as $0.96 on 12 March. It finally regained its peg on 16 March.

Amid all this, many swapped their USDC for USDT, which led to a significant decline in USDC’s aggregate supply.

The aggregated valuation of the top four Stablecoins ? has continued to decline from its peak of $161B to a current value of $124B, an overall decline of 23%.

Netflow since aggregated peak:

? USDT: -$1.3B

? USDC: -$20B

? BUSD: -$11.1B

? DAI: -$4.4B pic.twitter.com/HZxKCyTaqR— glassnode (@glassnode) April 19, 2023

USDT’s market capitalization embarked on an uptrend as it offered the safety net required by many at the time.

Top Stablecoin Marketcaps Over the Past 4 Months:$USDT: +$14B$USDC: -$10B$BUSD: -$14.6B pic.twitter.com/DNsD2g69pr

— Delphi Digital (@Delphi_Digital) March 27, 2023

At $29.56 billion at press time, USDC’s market capitalization has since dipped by 28%, according to data from CoinMarketCap.

USDT vs USDC: Who’s the winner?

Despite the growing concerns surrounding USDT’s backing, the failings of USDC and other stablecoins have made it the most preferred stablecoin. This is not, however, to say that the asset itself is fail-proof.