USDT vs. USDC: Will Circle’s plans help it give a boost over Tether?

- How close is USDC to competing more effectively against Tether’s USDT?

- USDC could be on the verge of more growth courtesy of a deal between Circle and Binance.

USD Coin [USDC] has undoubtedly lagged behind Tether [USDT] in terms of adoption in 2024, confirmation that the latter remained as the most popular stablecoin. But can Circle turn things around in favor of more USDC adoption?

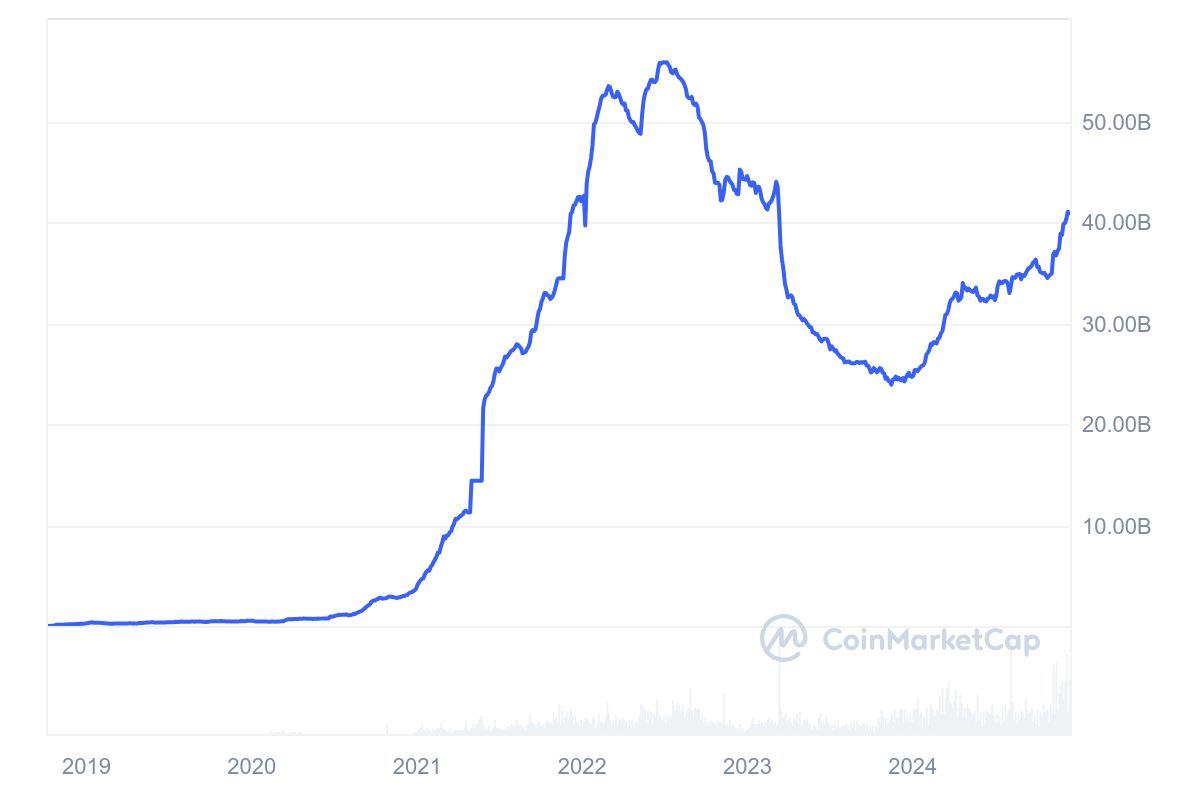

One of the most notable ways that Tether’s USDT maintained a strong lead over USDC was in terms of marketcap. USDT marketcap maintained robust growth in the last 12 months.

More of it was printed in the last four weeks, raising its marketcap to $136.87 million at the time of writing.

USDC has not enjoyed steady growth like its counterpart. Its first half of 2024 did bring forth robust positive growth.

Its market cap soared as high as $55.81 billion in July 2024, but this was followed by significant outflows, leading it to dip as low as $24.21 billion by November.

USDC has since entered recovery mode, soaring as high as $40.86 billion at the time of observation. In other words, Tether USDT’s latest market cap figure was about 3.3 times more than that of USDC.

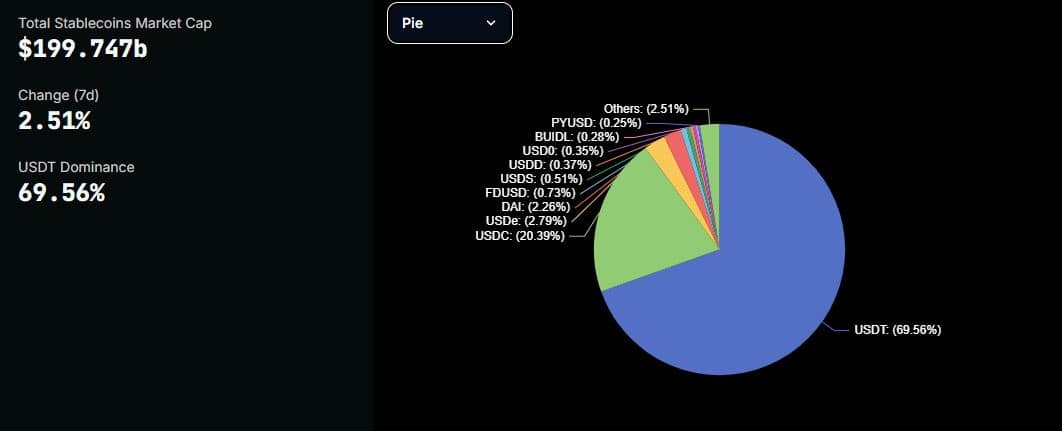

The disparity between the two stablecoin largely lies in the level of adoption. So far, the total stablecoin market cap was at $199.74 billion.

Notably, USDC controlled 20.39% of the total stablecoin market cap, while USDT controlled 69.56%.

As for the USDC stablecoin adoption, most of it (67.21%) is on the Ethereum [ETH] network. Solana [SOL] was second at 8.25%, and Base followed with 6.38%.

Circle plans to boost USDC dominance

Circle is reportedly aiming for a bigger piece of the dominance pie. It aims to achieve this courtesy of a strategic partnership with Binance.

Reports suggest that the Binance will integrate the stablecoin into all its services and products.

Binance is the top crypto exchange in terms of volume. This means the integration could offer a significant boost to the level of USDC demand and utility in the coming months.

Current expectations are that the move could boost market liquidity and enhance stablecoin dynamics. Binance is expected to benefit from the integration in terms of treasury operations.

In summary, Circle could put up a stronger effort in competing against USDT in the coming months. However, it has a long way to go before reaching the same heights that its top rival currently operates at.

In other words, the collaboration comes at an ideal time when the market needs more liquidity. However, it is a steep climb for USDC.