USDT: Will these activities affect sentiment negatively?

- A surge in potentially tainted USDT tokens due to illicit activities occurred over the last few years.

- Tron network’s sentiment and TRX’s price faced uncertainties as a result.

Tether [USDT], a dominant stablecoin in the cryptocurrency market, faced growing concerns due to illicit activities that have been funneled into its addresses. This influx of questionable activity may have repercussions for both USDT and the Tron [TRX] network.

Realistic or not, here’s TRX’s market cap in BTC’s terms

Over the counter, under the table

Over the last 24 months, an alarming amount of TRC20 USDT has found its way into over-the-counter (OTC) addresses. Many of these transactions were associated with various scams and illicit actions.

OTC trading serves as a crucial channel for cryptocurrency users to facilitate the exchange of their assets. Beyond traditional centralized platforms, compliant cryptocurrency service providers, and significant money laundering hubs, some crypto payment platforms also provide OTC trading services.

However, the degree of KYC implementation varies among these platforms. This results in varying levels of risk associated with their addresses.

A comprehensive fund analysis conducted by Bitrace focused on Tron addresses exhibiting characteristics indicative of OTC business. It excluded addresses connected to centralized exchanges, compliant cryptocurrency services, and large-scale money laundering operations.

The analysis exposed a significant inflow of more than 34.39 billion USDT tokens into these addresses within the past two years.

Worryingly, more than half of these inflows fell into the medium- and high-risk fund category. Specifically, 14.7% of the USDT was associated with online gambling, 20.1% with gray and black-market industries, and 19.4% with money laundering.

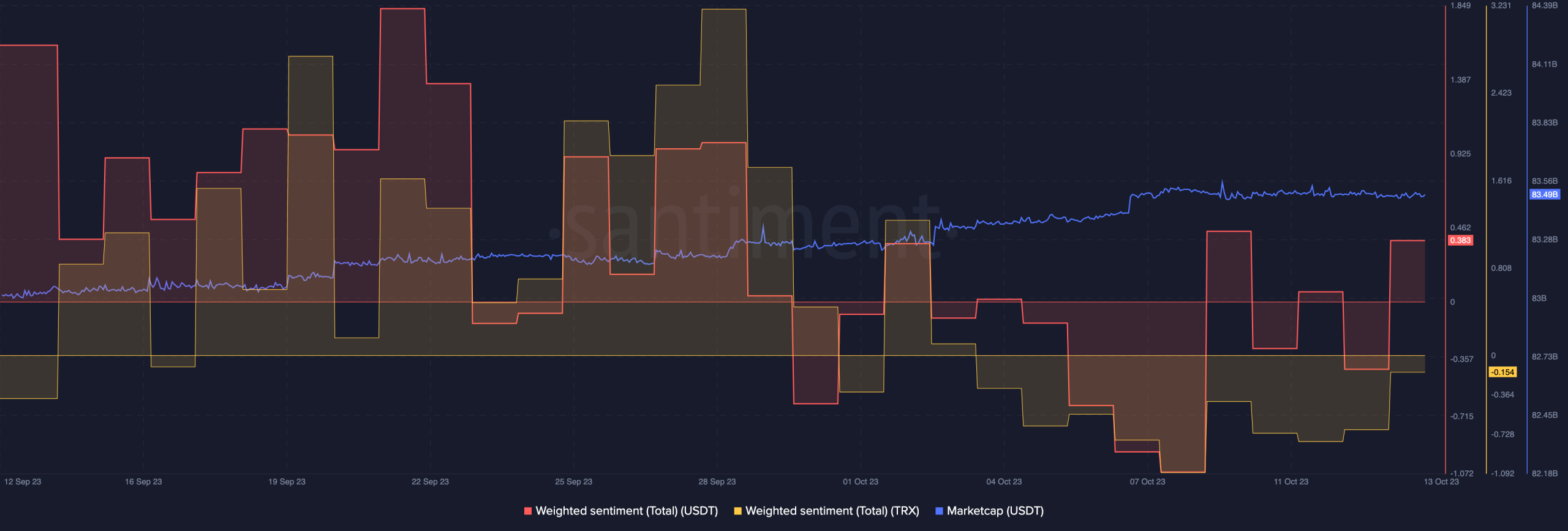

Looking at the sentiment

The implications of this surge in potentially tainted USDT tokens are multifaceted and could significantly affect the sentiment surrounding both USDT and the Tron network.

While the weighted sentiment for Tron has experienced a decline, USDT’s weighted sentiment remained relatively high.

Regarding market capitalization, USDT continues to lead the stablecoin market and has so far appeared resilient to these concerning developments.

Nevertheless, there is an underlying apprehension that the association with criminal activities could eventually deter the stablecoin’s future growth.

Is your portfolio green? Check out the TRX Profit Calculator

Meanwhile, turning attention to TRX, the token’s price witnessed a decline over the past month, which can be attributed to these ongoing issues. The volume of TRX being traded has also seen a significant reduction in recent times.

What’s particularly noteworthy is the dramatic spike in price volatility for TRX, suggesting a potentially tumultuous future for the cryptocurrency.