Users move Ethereum out of exchanges in favor of…

- ETH’s staked supply was close to flipping ETH’s exchange supply.

- The convergence underlined that people were taking ETH out of the market to use it as yield-earning investments.

A researcher from blockchain analytics firm Nansen took to Twitter to draw attention to a fascinating trend developing in the Ethereum [ETH] ecosystem.

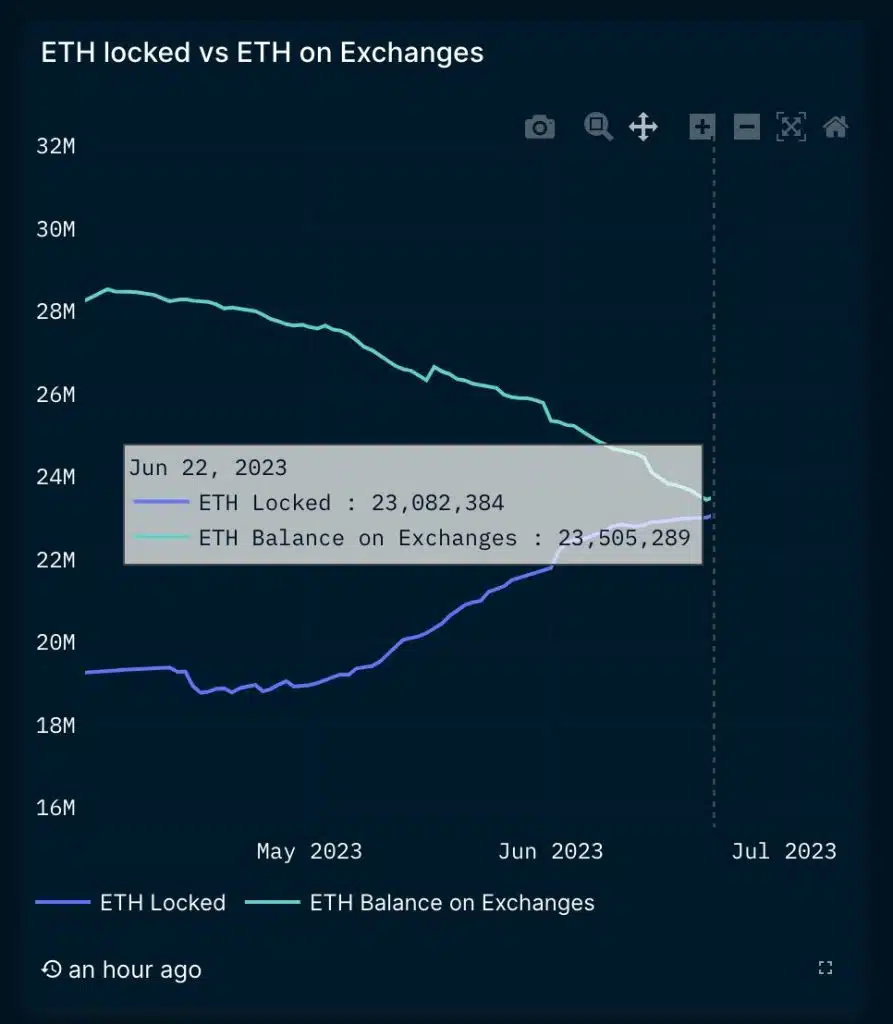

The snippet attached in the tweet dated 22 June revealed an interesting convergence of the amount of ETH staked on the network and ETH’s supply, which was available on exchanges for buying and selling.

Is your portfolio green? Check out the Ethereum Profit Calculator

Staking becomes lucrative

Users have shown significant interest in ETH staking since the Shapella Upgrade went live on the mainnet in April. As the ambiguity surrounding withdrawals was put to rest, people got more confidence in restaking their ETH.

This resulted in a sharp spike in the number of ETH staked with deposits consistently outpacing withdrawals over the last two months. At the time of publication, the total amount locked accounted for 16.7% of ETH’s total circulating supply, as per a Nansen dashboard.

On the other hand, the supply on exchanges, i.e. liquid supply, has steadily dropped in the same time period. As per the information provided in the aforementioned tweet, the exchange supply fell to 23.5 million from about 28 million at the start of April.

This equated to 19% of the ETH’s total circulating supply of 120.2 million, according to CoinMarketCap.

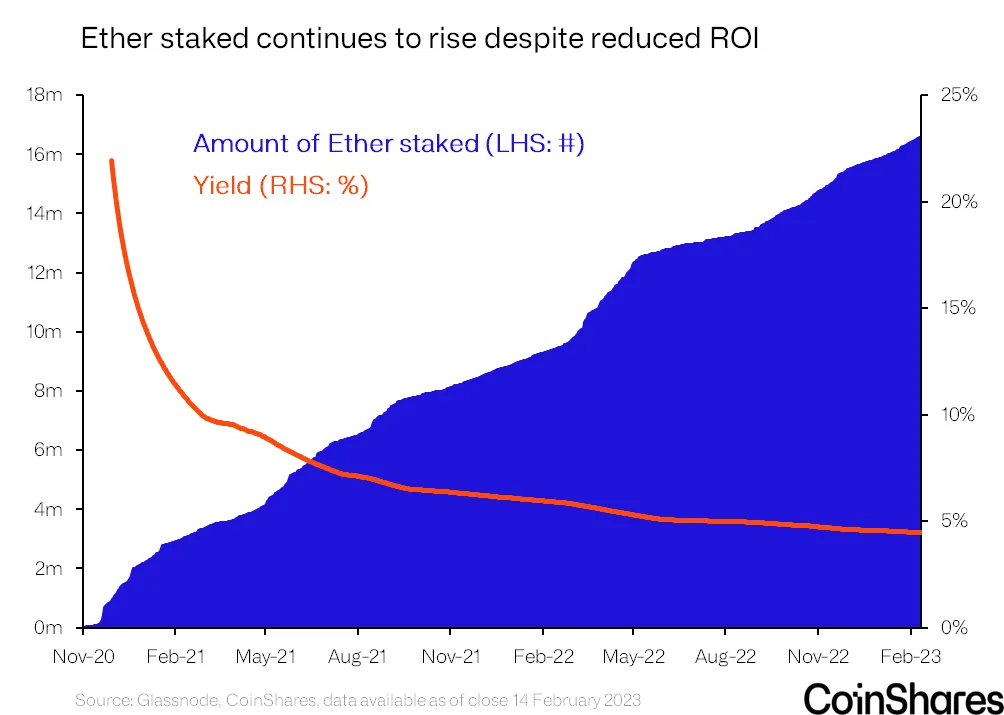

The convergence underlined that people were taking ETH out of the market and using it as an investment to earn yields. And even though staking rewards have progressively reduced over the past two years, people have preferred utilizing ETH as a savings option, as per a recent report by CoinShares.

ETH slips below $1900 after rally

ETH failed to hold its gains as it slipped below $1900 to trade at $1,885.59 at the time of writing, according to data from Santiment. It remained to be seen how sustainable the rally of 21 June would prove to be.

Read Ethereum’s [ETH] Price Prediction 2023-24

However, the spike boosted the overall profitability of the network. The 30-Day MVRV Ratio stormed into the positive territory after a gap of two weeks, suggesting that ETH holders, on average, would make profits if they were to sell their holdings.

And while the long-term holders reacted to the price rise as indicated by the hike in the Age Consumed metric on 21 June, the subsequent decline dampened their enthusiasm.