VanEck files first U.S. BNB ETF—Unlocking regulated crypto exposure

- VanEck filed for a BNB ETF in the U.S. and now awaits the SEC’s decision.

- BSC’s DeFi could see growth if the ETF gets approval from the commission.

VanEck applied to introduce the first U.S.-based BNB ETF that tracked the Binance Coin [BNB]. Delaware registration launched what stood as a historic instrument to offer investors access to a regulated cryptocurrency without requiring asset management or ownership.

This filing, as of press time, was awaiting U.S. Securities and Exchange Commission (SEC) approval, which would pave the way for mainstream acceptance of more altcoins by traditional financial institutions.

This ETF allows investors to gain exposure to BNB and its ecosystem, including Binance Smart Chain (BSC) and decentralized applications, while offering a simple and secure investment approach.

By eliminating the complexities of wallet management and private key protection, the fund appeals to both institutional and retail investors. VanEck, known for its Bitcoin and Ethereum ETFs, is well-positioned to meet the growing demand for such products.

The approval of a BNB ETF could enhance market stability by increasing liquidity and encouraging investors to inject capital into its ecosystem.

However, regulatory challenges tied to Binance’s past issues still present significant barriers to approval.

How a BNB ETF could shape its DeFi?

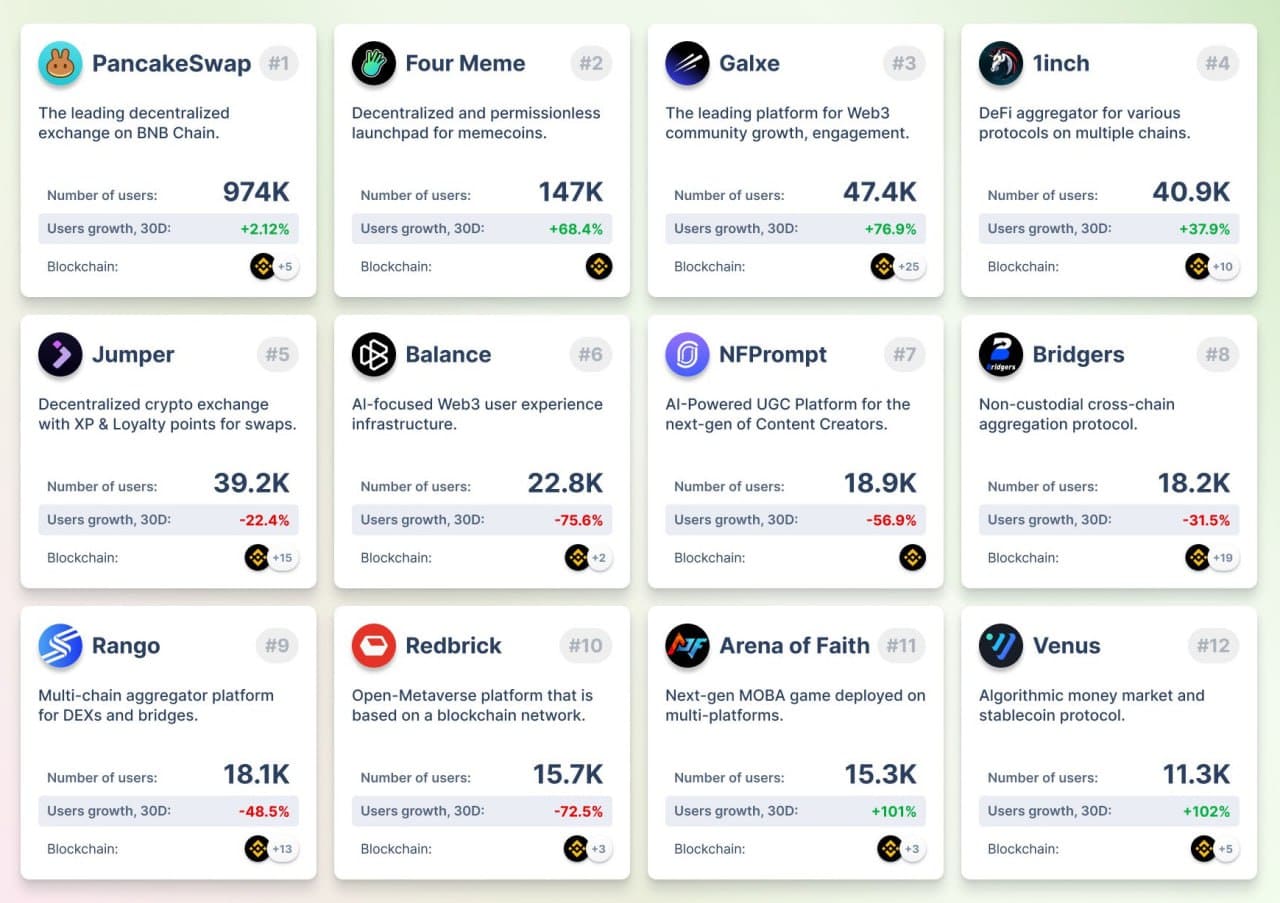

The proposed VanEck BNB ETF could further boost the growing DeFi ecosystem on BSC by exposing more users to BNB’s offerings. PancakeSwap remains the most popular dApp on BSC, with 974K active users, reflecting a 2.12% growth.

Four Meme follows with 147K users, showing a 68.4% increase, while Galxe and 1inch serve 47.4K and 40.9K users, respectively. Venus Protocol experienced the highest growth, with user numbers rising by 102%, showcasing the increasing popularity of BNB’s DeFi ecosystem.

If approved, the ETF could likely drive user growth and attract investment, much like Ethereum’s ETF launch, while significantly enhancing DeFi activity.

An ETF rejection would potentially slow down DeFi operations. However, if market sentiments turned negative, approval could not necessarily lead to growth.

CZ’s role on rising fundamentals on BSC

Notably, Binance’s founder, Changpeng Zhao (CZ), continues to play a pivotal role in shaping the core aspects of the BNB chain, despite its static prices.

CZ has actively used X (formerly Twitter) to endorse the ETF filing, which could positively impact the market by attracting institutional investors and increasing liquidity.

He has also focused on promoting initiatives such as memes on the chain, fostering community engagement, and boosting user participation.

Additionally, CZ recently donated 1,000 BNB tokens, valued at $600,000, to support earthquake relief efforts between Thailand and Myanmar, enhancing Binance’s reputation.

The combination of ETF advocacy, meme promotion, and philanthropic efforts strengthens both the utility of BNB and its public image, driving its future growth.