VET is struggling, can VeChain change things?

- VeChain attracts some social engagement as it attempts to boost network adoption.

- VET metrics underscore low activity that supports an extension of the current range.

VeChain’s native crypto VET showed some promise as one of the cryptocurrencies that may deliver a strong move after exiting the current range. This is because it delivered robust activity within the last few days.

Is your portfolio green? Check out the VeChain Profit Calculator

According to its latest announcement, VeChain plans to stimulate development within its network. It aims to achieve this through a newly launched WEB3 workshop that will feature a grant program. Blockchain networks usually host such workshops to attract more projects and facilitate organic growth.

? @Vechainofficial launches #Web3 technology workshop and Micro Grant Program

? The intent of the workshops is to educate developers about #Vechain’s advanced technical features and its extensive network of reputable enterprise partners

? VISIThttps://t.co/fvk1E2qU1S#SCN1 pic.twitter.com/eCGN6bVP5H

— ⚡️Smart Crypto News ⚡️ (@SmartCryptoNew1) May 25, 2023

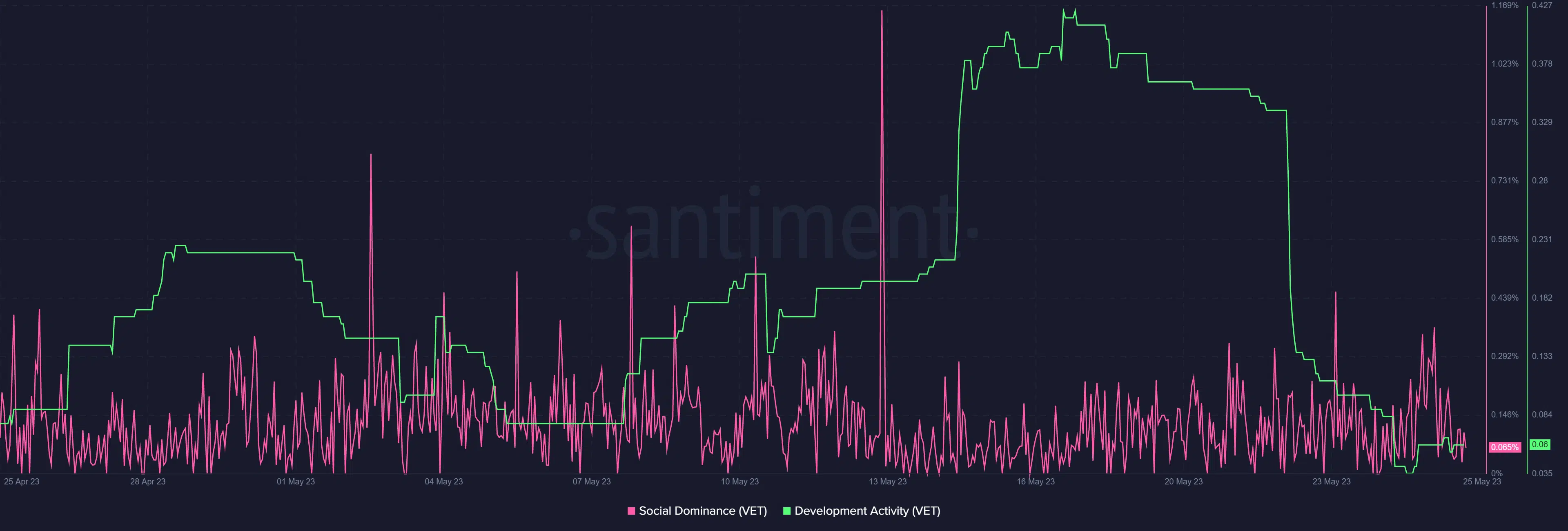

Interestingly, the announcement came at a time when VeChain had been experiencing a decline in development activity. The network’s development activity fell to the lowest monthly level on 24 May.

Despite the recent drop in development activity, VeChain managed to maintain a relatively stable level of social dominance in the last 30 days. Meanwhile, LunaCrush recently picked VeChain as the top network in terms of social and market activity. This suggested that the network had been experiencing noteworthy levels of recognition across the investment landscape.

VeChain is Coin of the Day on LunarCrush! #Vechain was automatically selected based on leading social and market activity over time.

Galaxy Score™ 42/100

AltRank™ 25/5244Real-time $vet metrics: https://t.co/IHkFNaQBZQ pic.twitter.com/a1gCUIx7wX

— LunarCrush (@LunarCrush) May 25, 2023

Will the social and market activity boost VET’s visibility and demand?

The increased activity demonstrated by these metrics is one of the best ways of determining the level of visibility that a cryptocurrency is exposed to. In this case, VET would benefit from a notable increase in investor attention especially at its current position. Such an outcome would likely facilitate a surge in demand.

VET traded at $0.019 at press time, which represented a 41% discount from its current 2023 high. The price action reflected a leveling out after the previous sell pressure but it also represented weak demand. This explained why it was yet to recover from the current level. This was also in line with prevailing market sentiment.

How many are 1,10,100 VETs worth today

VET’s metrics demonstrated a state of uncertainty regarding the next move despite the hopes of notable changes courtesy of the social metrics. An assessment of VET’s on-chain volume revealed that volumes have retained their weekly levels.

The market sentiment fell to a weekly low on 23 May but has since bounced back, albeit not strong enough to support major expectations.

Based on the above analysis, we can conclude that on-chain data, at press time, showed no signs of a growing change in favor of any particular direction. However, this does not necessarily discredit the chances of a breakout or breakdown from the current ranging performance.