News

Vitalik Buterin backs Polymarket’s role in U.S. elections amid regulatory heat

How will the CFTC’s crackdown on Polymarket and Vitalik Buterin’s defense influence the future of prediction markets?

- Polymarket gains prominence in predicting U.S. elections despite regulatory scrutiny.

- Vitalik Buterin and Cameron Winklevoss defend Polymarket’s value and integrity against critics.

This year, Polymarket has emerged as a significant player in predicting the next crypto president in the U.S., particularly in a landscape where the previous administration under President Joe Biden was perceived as anti-crypto.

Polymarket election prediction

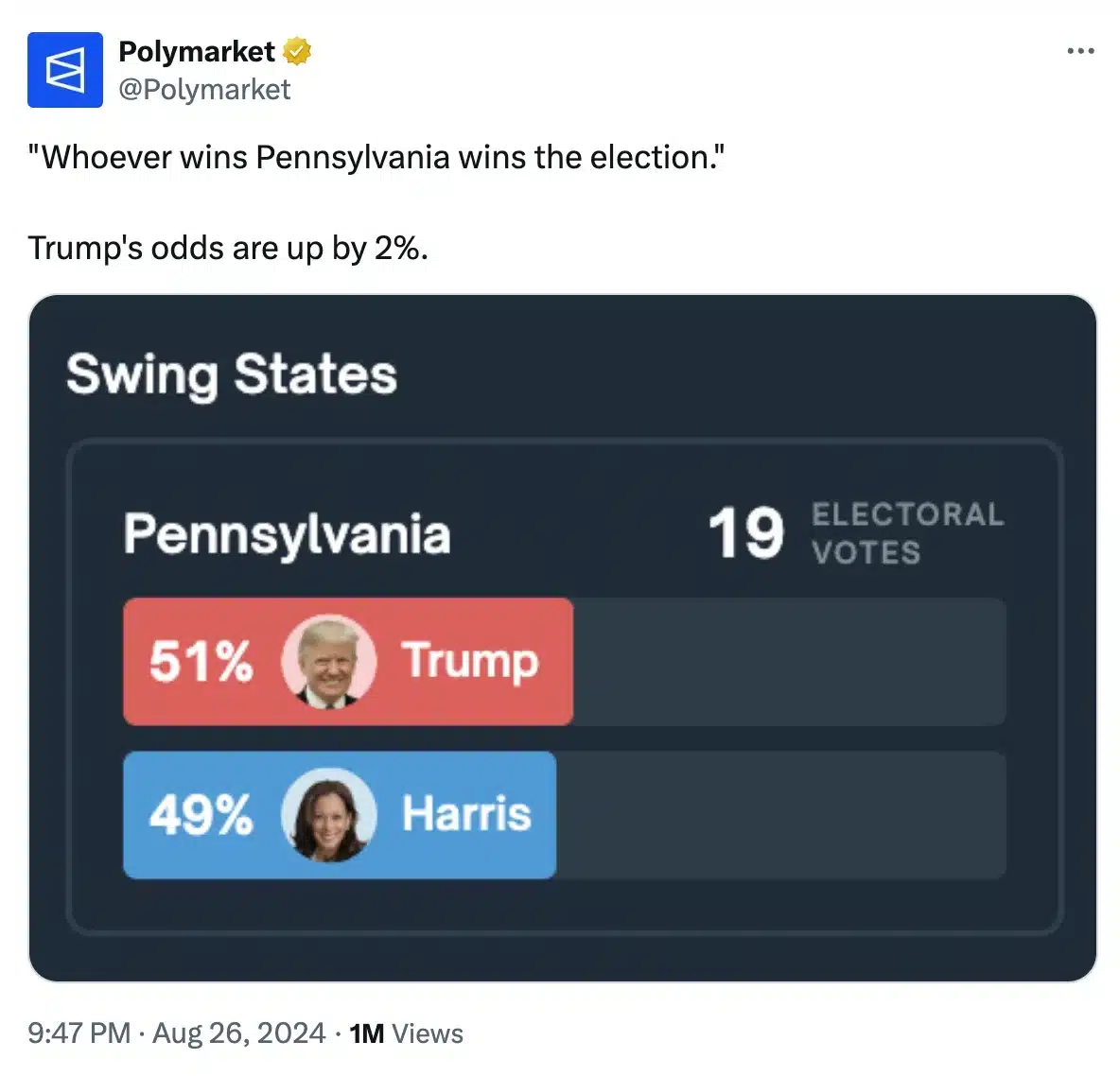

In fact, recent data from Polymarket emphasized the election and talked about the importance of Pennsylvania in the upcoming election, considering its substantial number of electoral votes, making it a key determinant of the overall election outcome.

In its X post, it noted that the candidate who wins Pennsylvania is likely to secure the presidency.

Despite these efforts, the platform continues to face criticism from those who dismiss it as just a gaming site, prompting calls for stricter regulations.

Vitalik Buterin backs Polymarket

Nonetheless, Ethereum co-founder Vitalik Buterin has voiced his support for Polymarket.

He acknowledged the platform’s contribution to providing valuable data for informed decision-making, and said,

“Putting Polymarket into the category of “gambling” is a massive misunderstanding of what prediction markets are or why people (incl economists and policy intellectuals) are excited about them.”

Further explaining his stance he noted,

“Prediction markets are interesting because they’re a social epistemic tool.”

Here the “social epistemic tool” aspect refers to how prediction markets help society understand what events are considered important and how likely they are to occur, based on the collective input.

Buterin believes that unlike traditional media or social media, which has bias and editorial agendas, prediction markets provide a more objective view of the likelihood of certain outcomes.

He also talked about “conditional prediction markets” and says,

“Conditional prediction markets have applications in governance, which we’re starting to see already.”

All in all, he emphasized that prediction markets offer a less biased, data-driven perspective on future events, with potential applications in improving governance.

However, as noted earlier, these prediction markets have been under scrutiny for potential limitations.

CFTC against Polymarket

For those unaware, in May, the U.S. Commodities and Futures Trading Commission (CFTC) proposed new regulations aimed at restricting prediction markets like Polymarket.

The CFTC contends that these markets could undermine the public interest, especially when linked to election-related betting.

This viewpoint is shared by U.S. Senator Elizabeth Warren, who has been a vocal advocate for banning prediction markets connected to U.S. elections, citing concerns over their potential to disrupt the democratic process.

However, despite these regulatory challenges, Polymarket continues to receive significant support from the community, especially during this election cycle.

Buterin not alone

As expected, Buterin’s endorsement of the platform has been echoed by many who oppose the CFTC’s stance.

Cameron Winklevoss, co-founder of Gemini, commended decentralized prediction markets for their “genuine public utility,” and said,

“Unlike polls, pundits, or expert opinions, they require participants to put their money where their mouth is — to have skin in the game. This proof of stake requirement gives them an integrity that other information sources cannot claim.”