Vitalik Buterin hails Ethereum for this big upgrade, details here

- Vitalik Buterin has praised Ethereum for hitting key milestone in the execution layer client diversity.

- Ethereum plans to have multiple execution clients to work in parallel while verifying blocks.

Ethereum [ETH] has achieved a key milestone by limiting top execution clients run by validators from having a supermajority market share. Reacting to the update, Ethereum founder Vitalik Buterin termed it the ‘robustness’ of the ecosystem.

‘No execution client has more than 2/3 market share. Great news for the robustness of the Ethereum L1.’

The problem with ETH supermajority client risk

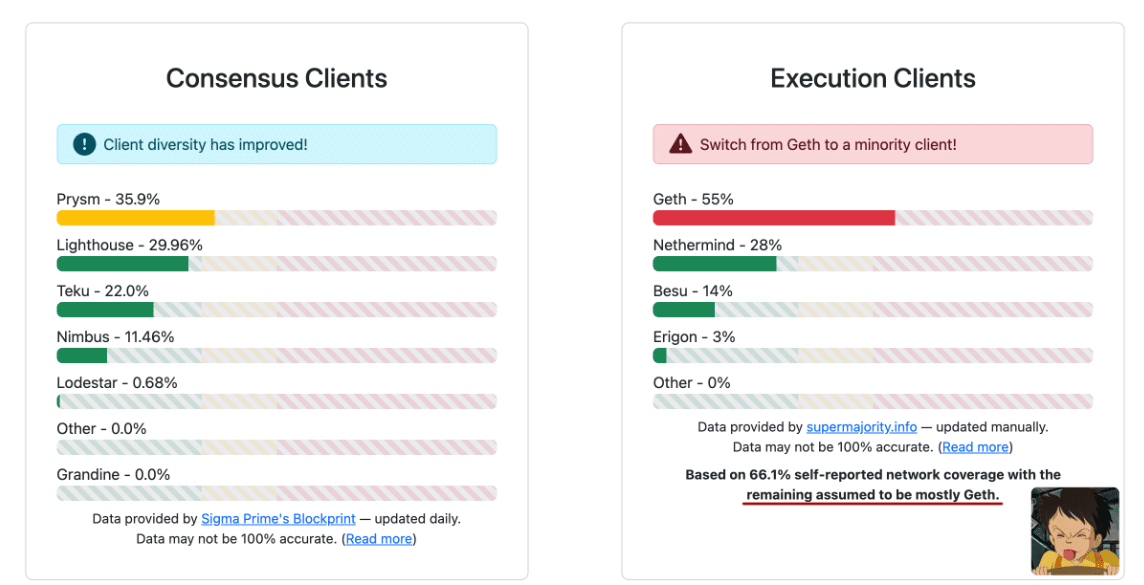

For context, validators running staking and pools use Ethereum execution client software. A dominant execution client, i.e., the one used by most validators, more than 2/3 of market share, is considered a supermajority client and carries a risk to the entire ecosystem.

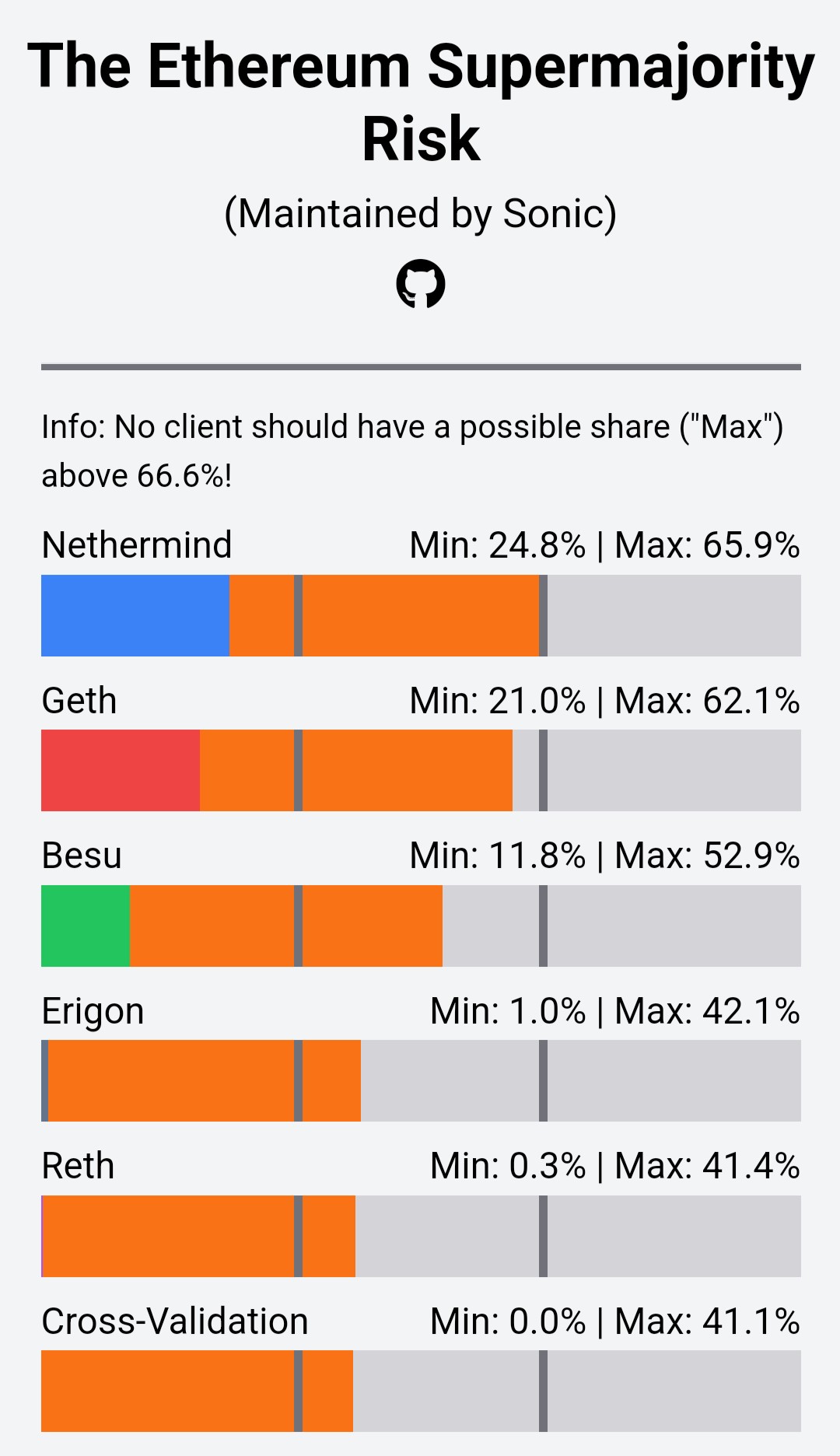

According to the Supermajority tracker, a supermajority client could cause a network split and even fund loss in case of bugs.

‘It has the capability to finalize the chain without the agreement of the other clients. A consensus bug within such a client would cause catastrophic results, such as a network split, loss of funds, and reputation damage.’

Additionally, the supermajority client could lead to consensus errors and mistakes from validators (block proposers and verifiers), which could attract severe penalties through slashing (destroying a portion of their stake/deposit).

In short, supermajority client risk translates to centralization risk which could affect the entire ecosystem. According to Ethereum’s Team Lead, Peter Szilágyi, the impact could be dire to even the chain’s adoption.

‘Even worse, if a majority of validators are in the wrong, the bad chain can get finalized, leading to gnarly governance issues of how to recover from the error with perverse incentives from the majority validators not to. Such an event would have the capacity to have a chilling effect on the entire Ethereum adoption.’

In the past, Geth (Go Ethereum) was the most dominant and popular execution layer client until recently.

To mitigate the risk, the ecosystem advocated for client diversity and urged users to opt for minority execution clients. Currently, Nethermind is the most dominant client, surpassing Geth. However, Nethermind was not a supermajority client at the time of writing.

Interestingly, a new proposal has been made to help validator nodes verify blocks with multiple clients in parallel to minimize the supermajority risk further.

In the meantime, the ETH price consolidated below $2800 after Friday’s impressive bounce. It remains to be seen whether investors’ risk-on approach will continue into next week.