Vitalik Buterin’s $530K Ethereum transfer: Impact on ETH?

- ETH looked bearish as it experienced a price drop of over 4% in the last 24 hours.

- Nearly $163 million worth of short positions will be liquidated if ETH falls below $2,596.

In the last 24 hours, the overall cryptocurrency market has experienced a notable decline, including Bitcoin [BTC] and Ethereum [ETH].

Amid the market downturn, on the 15th of August, on-chain analytic firm Spot On Chain made a post on X (formerly Twitter) that the Ethereum’s co-founder Vitalik Buterin has moved a notable amount of ETH to Kraken.

Notably, Vitalik deposited a substantial 200 ETH worth $530,000 to the Kraken cryptocurrency exchange. Also, this is the first time in 2024 that Vitalik has deposited to any centralized exchange (CEX).

Crypto giants like Vitalik have a significant influence on the overall market, and such deposits can impact the industry.

However, the Ether amount was relatively low, and it is also not specified whether it was for donation, staking, or selling.

Otherwise, Vitalik has recently moved over 3,200 ETH worth $8.32 million to two new multisig wallets, which are potentially for donation.

Ethereum’s price performance

At press time, ETH was trading near $2,620 and had experienced a price drop of over 4% in the last 24 hours. Despite this, its Open Interest dropped by 4%, indicating lower interest from investors and traders.

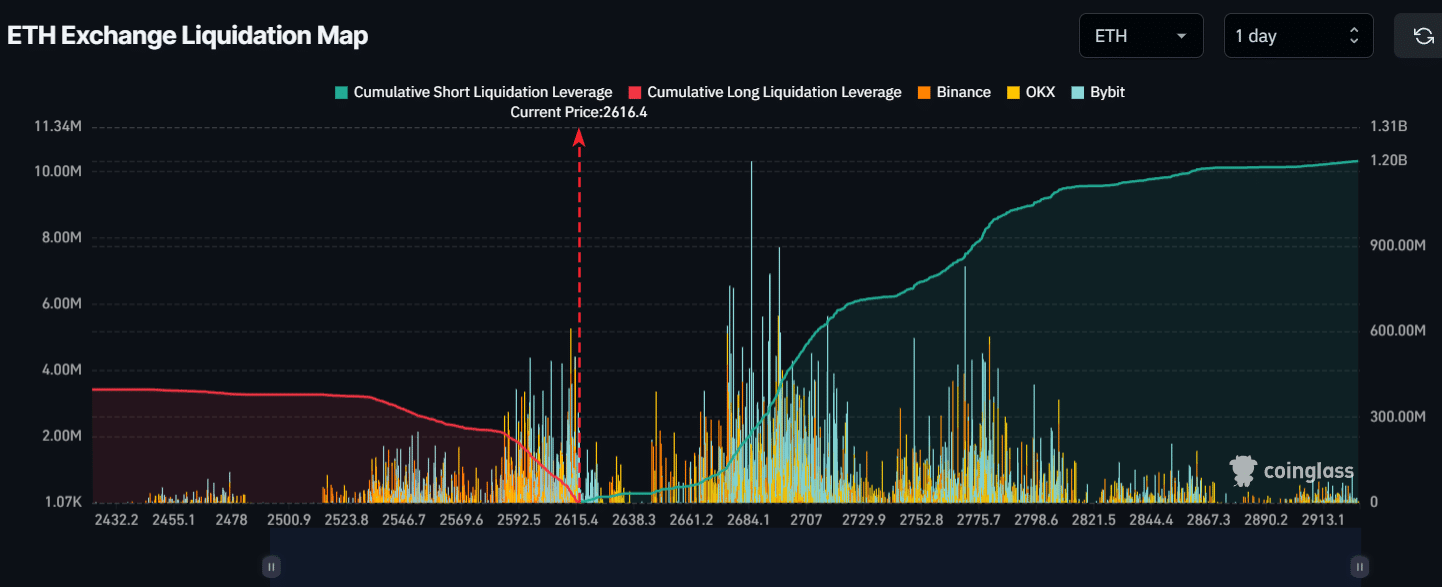

As of press time, the ETH’s major liquidation levels were at nearly $2,596 on the lower side and $2,686 on the higher side, according to the on-chain analytic firm Coinglass.

If the sentiment remains the same and ETH falls to the $2,596 level, nearly $163 million worth of short positions will be liquidated.

Conversely, if the sentiment changes and the price rises to the $2,686 level, nearly $240 million worth of long positions will be liquidated.

Looking at the current situation, it looks like ETH is bearish. Whereas, on the 14th of August, veteran trader Peter Brandt shared a bearish outlook for ETH, using technical analysis on both higher and intraday levels.

Is your portfolio green? Check out the ETH Profit Calculator

In a post on X, Peter hinted at a bearish trade with a $1,651 target and $2,961 as a stop-loss.

This post has gained significant attention from the crypto community during this ongoing bearish market sentiment.