Vitalik Buterin’s new vision: Is a ‘faster’ Ethereum on the horizon?

- Vitalik Buterin’s offer proposals that could speed up Ethereum transactions

- ETH’s price maintained its downtrend amidst overall negative sentiment.

Ethereum’s [ETH] founder, Vitalik Buterin, has proposed various ways of speeding up confirmation on the second-largest blockchain network.

Buterin noted that the time for confirmation in the Ethereum network dropped to 5-20 seconds after the Merge.

However, he believes the speed needs further improvement, especially because the current consensus mechanism is complex and can take up to 12.8 minutes for a ‘secure’ final confirmation.

As a result, Buterin proposed several approaches, including SSF (Single Slot Finality), Based, and rollup pre-confirmations. Through SSF, the network can confirm transactions even with fewer validators online. On SSF, Buterin added,

‘Single-slot finality allows the chain to keep going and recover if more than 1/3 of validators go offline.’

More ways to reduce Ethereum confirmation time

Buterin also suggested using Layers 2s (L2s) to speed up transaction confirmations. In this case, the rollups would use a few groups of validators to swiftly confirm transactions, which are later finalized on the main chain, the Ethereum layer (L1).

On the other hand, the based pre-confirmations approach is nearly similar to Solana’s [SOL] priority fees, allowing validators to charge a separate fee for faster confirmation of high-priority transactions.

In this regard, Buterin proposes a similar system but with a penalty for validators or proposers who fail to honor agreements with users.

‘If the proposer violates any promise that they make to any user, they can get slashed.’

However, Buterin acknowledged that the above design iterations and suggestions are far from perfect, but they offer a solid ground for further improvement to speed up confirmation speeds.

How about ETH’s price?

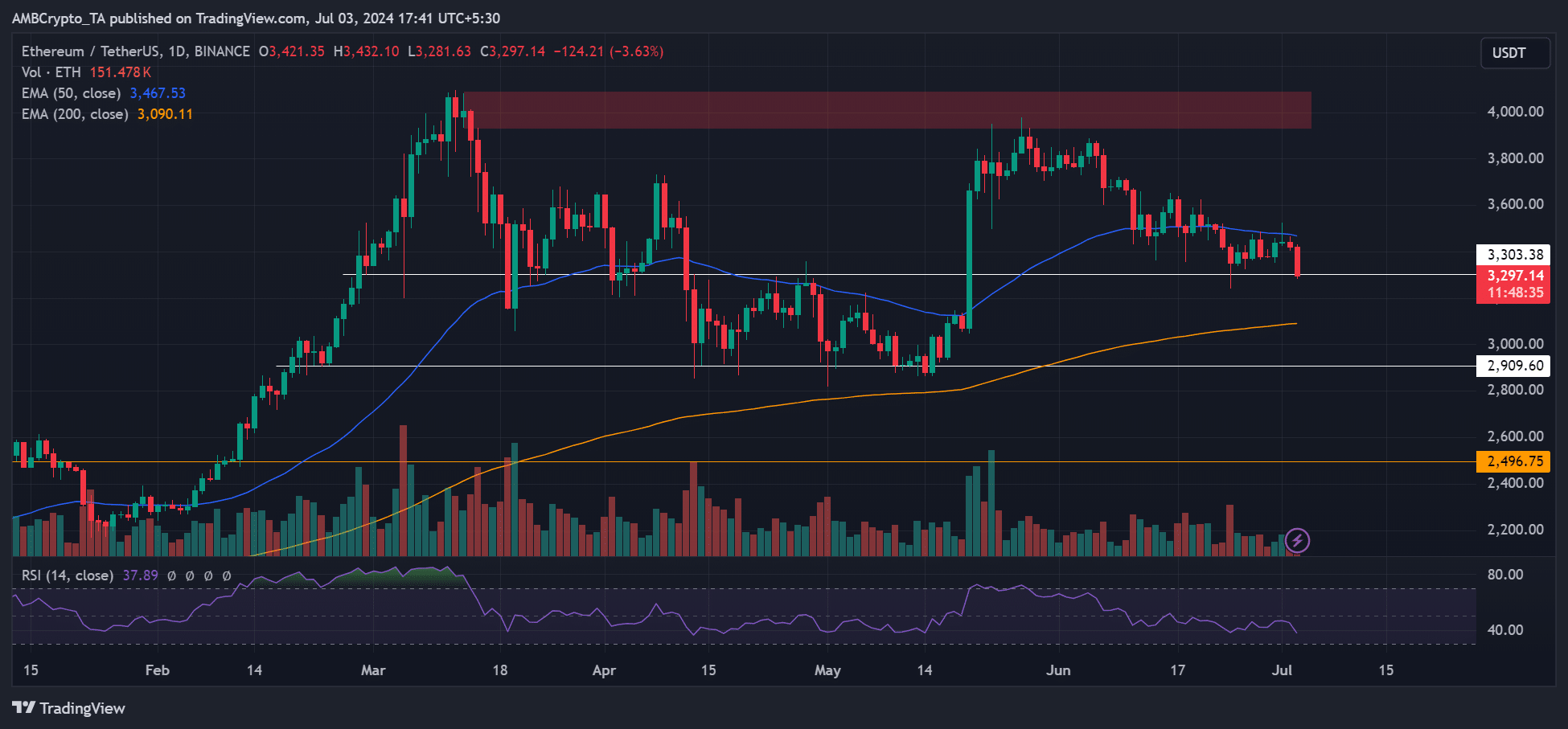

In the meantime, the ETH wasn’t ‘speeding’ up on the price chart. The altcoin struggled to clear the 50-day EMA (Exponential Moving Average), which has been a key resistance since late June.

Both higher and lower timeframe market structures were bearish. Additionally, the RSI (Relative Strength Index) indicated sellers had market leverage based on the below-average reading as of press time.

However, the retracement eased to a key support level at $3300. Although the delayed ETH ETF final approval and launch could further dent the sentiment, bulls could attempt to defend $3300.

If Bitcoin [BTC] posts more losses below $60K, ETH could break below $3300 support. In such a case, the next bearish target could be the 200-day EMA, which is nearly $3000.

However, the $4000 was a key supply zone and bullish target should the market sentiment favor ETH bulls.