Ripple

Waiting for XRP to reach $1? You NEED to know this

As XRP continues to plummet, there’s only one way you can see profits at this point.

- XRP noted a decline in key on-chain metrics.

- The time for panic and despair is now, but there’s one route to profits.

Ripple [XRP] has been mostly red since the 12th of April on the daily price charts. It fell by 32% from Friday’s high to Saturday’s low.

In doing so, it reached the lows of an 8-month range. Simultaneously, it fell below the lows of a month-long range as well.

A recent AMBCrypto report highlighted a decline in network growth for Ripple. This meant that user adoption had fallen, and so had the demand for XRP.

The selling wave of the past week

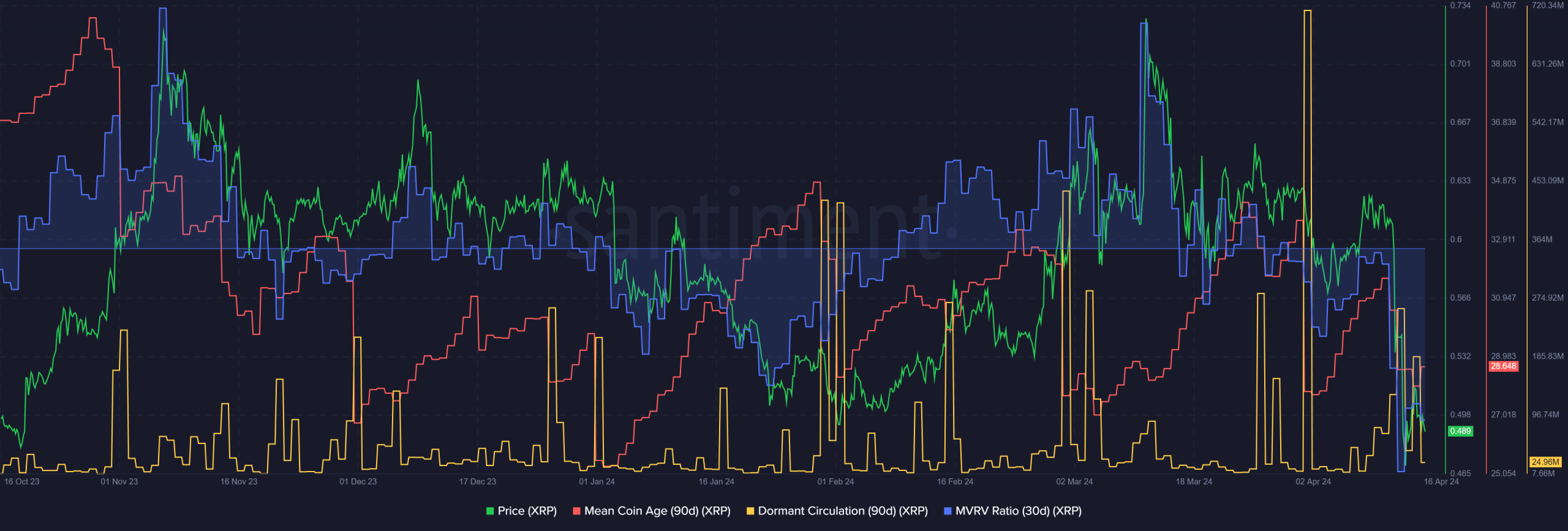

Source: Santiment

Since the 23rd of March, the mean coin age metric has been trending downward. This pointed toward increased XRP token movement between addresses, likely for selling.

On the 12th of April, both the mean coin age and the MVRV ratio dropped sharply. This came alongside a steep drop in price. It showcased holders relinquishing their XRP in fear.

Additionally, the dormant coin age also saw a large spike on that day.

Together, they all pointed toward stiff selling pressure. Additionally, even though the MVRV signaled an undervalued asset, XRP could be hard for long-term investors to justify buying.

The psychology of ranges

An anonymous crypto analyst on X (formerly Twitter) noted that a steep drop like the past few days has two preferred outcomes. One is a V-reversal and prices are recovering swiftly. Another is a continued downtrend.

Both would be clear indications of bullish or bearish pressure. However, if prices formed a range and consolidated, it would be harder for newcomers to hold on to their assets.

The yellow range is a month old, while the purple one is eight-and-a-half months old. In February and up to mid-March, while Bitcoin [BTC]

rallied from $41.8k to $73.7k (a 76% move), XRP moved 51% higher.Yet, it was still unable to break the range highs. The subsequent reversal must be hard on long-term holders.

At press time, the proximity to the $0.46 range lows presented an attractive buying opportunity for a swing trader.

Yet, the question remains-will XRP be able to outperform other large-cap cryptos in the coming months? The evidence of the past nine months of price action indicated this was unlikely.

However, the 2020-21 run saw XRP trapped beneath a similar resistance at $0.65.

In April 2021, in 15 days, XRP gained 243% to reach a high of $1.96 (but not an ATH). April 2021 also marked the first time Bitcoin climbed above $60k.

Read Ripple’s [XRP] Price Prediction 2024-25

Perhaps during this cycle, XRP investors might have to hold against all odds and see their bag consistently underperform until a final, glorious fortnight of gains.

While this is speculation, it’s still something for investors to consider.