Waves surge briefly to $2.9 before pullback, what’s next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

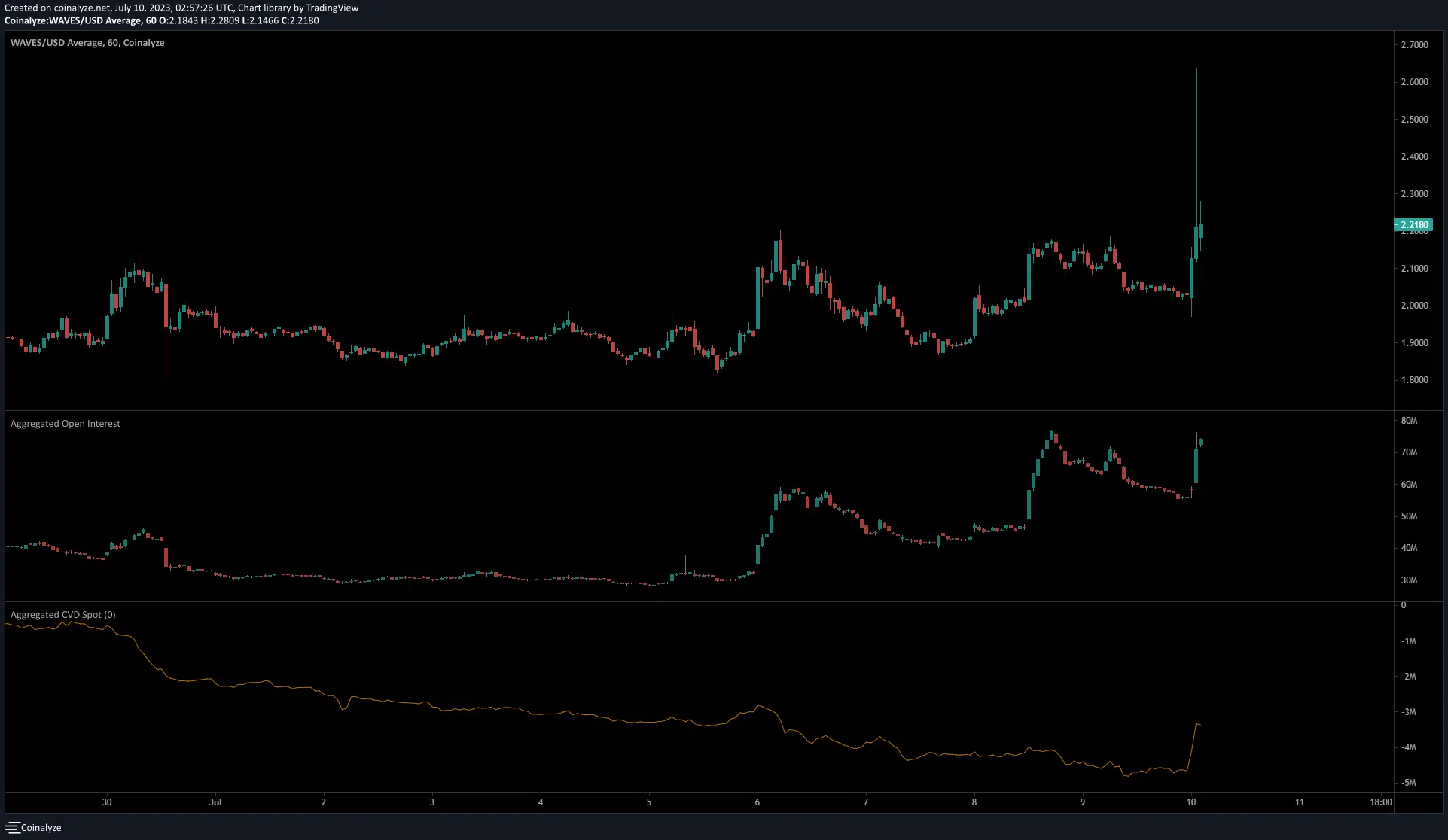

- The recent rise and fall of WAVES measured 36.84% and happened within an hour.

- The trend of WAVES had been shifting bullish over the past week

In a recent report, the likelihood of Waves [WAVES] prices reaching their June highs was highlighted. In the early hours of 10 July, WAVES shot upward from $2.12 to $2.89 before retracing almost all the gains.

Read Waves’ [WAVES] Price Prediction 2023-24

It all happened within an hour. Does this highlight a whale swallowing liquidity on the sell side by driving a rally to the highs and beating the lower timeframe resistance at $2.25, before selling into the FOMO that arose in those minutes? Or was it something else?

Was the recent short-lived move just a test pump?

The why of a price move can be debated all day but for a trader the “why” hardly matters. What matters is whether the information can be used to generate profits. The 4-hour timeframe chart of WAVES showed that not a lot has changed over the past week despite the recent pump.

The prices tested the 61.8% Fibonacci retracement level in late June before moving higher. On 9 July, the bulls were stymied by the sellers at the higher timeframe resistance at the $2.15 level, which was the high from 24 May. But the price action had already displayed its bullish intent with a candlewick above this mark.

The OBV continued to trend higher over the past few days. The RSI stayed above neutral 50 to highlight sustained bullish momentum. This hinted at the bulls gearing up for another push higher. The $2.89, $3 and $3.26 levels could serve as resistance in the coming days or weeks.

Meanwhile, a drop below the $1.97 mark would show the beginning of bearishness. If WAVES continued downward to fall below $1.83, the sellers can be considered to be dominant.

How much are 1, 10, or 100 WAVES worth today?

Short liquidations fed the WAVES impulse move higher

Source: Coinalyze

The data from Coinalyze showed that the Open Interest surged by close to $17 million in recent hours. The spot CVD also spiked higher. Its positive slope suggested an influx of buyers in the market.

Together, the two indicators signaled bullish intent and rising demand in the market. Hence, it was likely that WAVES could continue to climb higher. While buyers can look to build longs, they should be cautious of a price move below $2.