Weekly outflows surge by 42%; BTC, ETH lead the way

- Outflows increased to $88 million from $62 million the week before, representing an increase of nearly 42%.

- Ethereum marked its largest single week of outflows since the Merge last year.

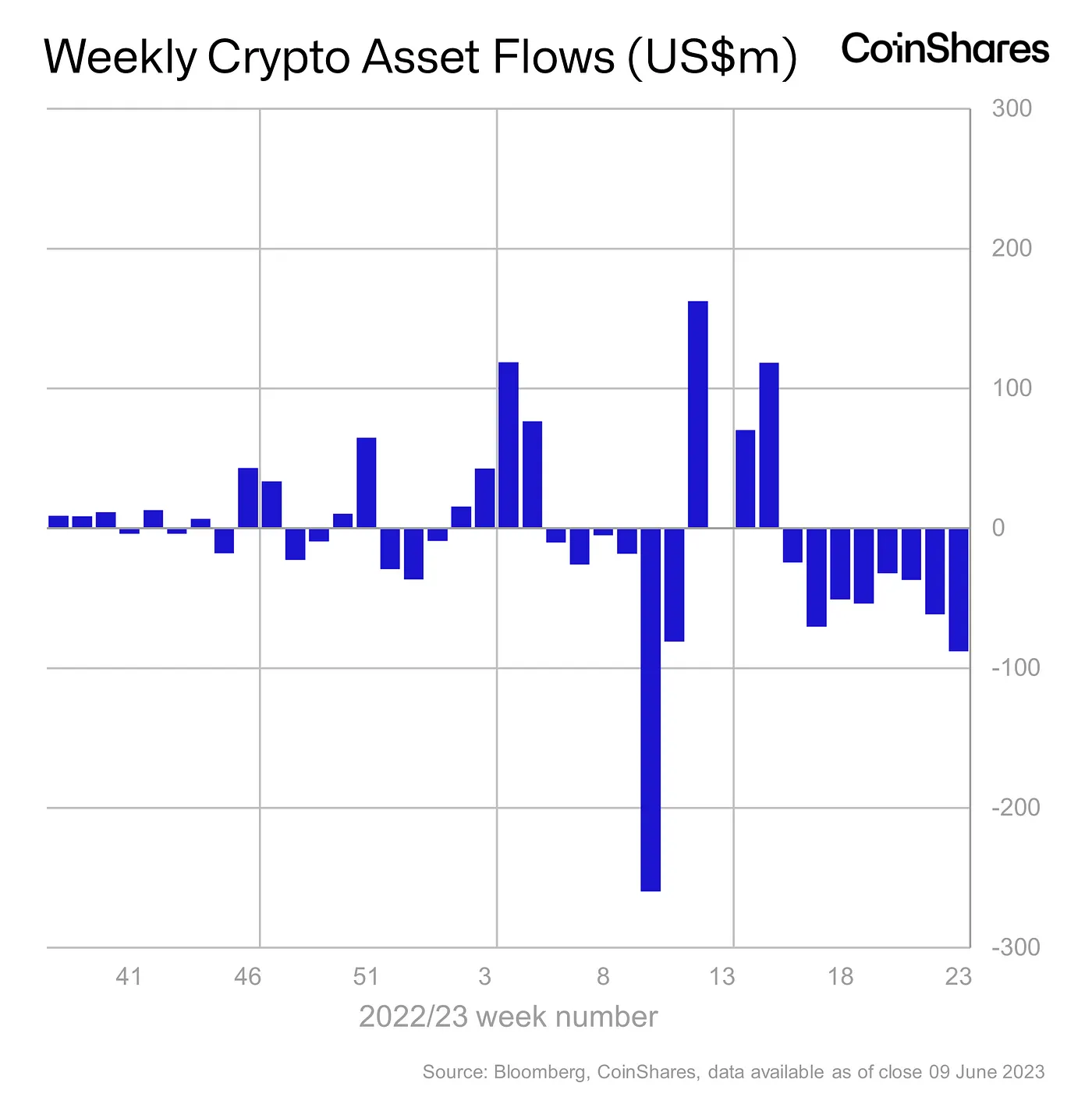

According to the latest report by crypto asset manager CoinShares, digital asset funds recorded a seventh straight week of net outflows, reflective of the uncertainty prevalent in the market. Outflows increased to $88 million from $62 million the week before, representing an increase of nearly 42%.

According to the research, the sell-offs by institutional investors were driven by macroeconomics with further possibilities of interest rate hikes by the U.S. Federal Reserve keeping them on their toes.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

BTC and ETH lead the carnage

The majority of outflows last week were from Bitcoin [BTC] at $52 million, bringing its eight-week outflow total to $254 million. On the other hand, the short Bitcoin fund, which bets on the decline of Bitcoin, recorded $1.1 million in net outflows. It was down significantly from the previous week’s figure of $6.3 million.

BTC’s selling pressure could also be attributed to Binance.US decision to suspend USD trading channels on its platform beginning 13 June. Thus, resulting in investors cashing out their holdings to withdraw dollars.

Similarly, the second-largest coin by market cap, Ethereum [ETH], logged outflows totaling $36 million last week. This marked its largest single week of outflows since the Merge in September last year.

The silver lining though, was the performance of other altcoins, as minor inflows were seen on Litecoin [LTC], Solana [SOL], and XRP. While the impending halving event for LTC may have attracted investors, the XRP community was pumped over a successful outcome in the legal dispute with the U.S. Securities and Exchange Commission (SEC).

SOL’s case was surprising as it was one of the many altcoins alleged to be securities in SEC’s lawsuit last week.

Is your portfolio green? Check the Bitcoin Profit Calculator

All eyes on the Fed meeting

The total market capitalization of the crypto space plunged 37% over the past week, with SEC’s lawsuit wiping out nearly $17 billion, according to CoinMarketCap.

However, the new week showed early signs of recovery. This was because BTC was trading at $26,138.43, a minor jump of 0.70% at press time.

The market’s next test will be the Fed’s meeting on 13 June and 14 June. Experts are divided over the outcome of the meeting with some predicting another interest rate hike by 25 basis points. However, others suggest that the central bank could skip it this month.