Whale alert: 25.5B SHIB transferred in hours – What’s driving the surge?

- Whales remain active, with significant withdrawals from exchanges, but these movements have not reversed the bearish trend.

- Exchange netflows show a blend of accumulation and selling, with large holders redistributing their assets.

A few days ago, Shiba Inu’s [SHIB] whale activity was showing concerning trends. Wallets holding between $1 million and $10 million worth of SHIB reduced their balances by 31% in a single day.

This created significant selling pressure, pushing the price below $0.000014 and making it difficult for SHIB to find stability.

The lack of new whale entries weakened liquidity, keeping SHIB trapped within a descending triangle formation.

Whales return after a period of declining netflows

The latest data now reveals that despite recent sell-offs, whales are back in action.

Etherscan data has tracked a series of large SHIB transactions, with some exceeding 7 billion tokens in a single transfer. These movements involve major exchanges like Binance and OKX.

On-chain data unveils exchange outflows

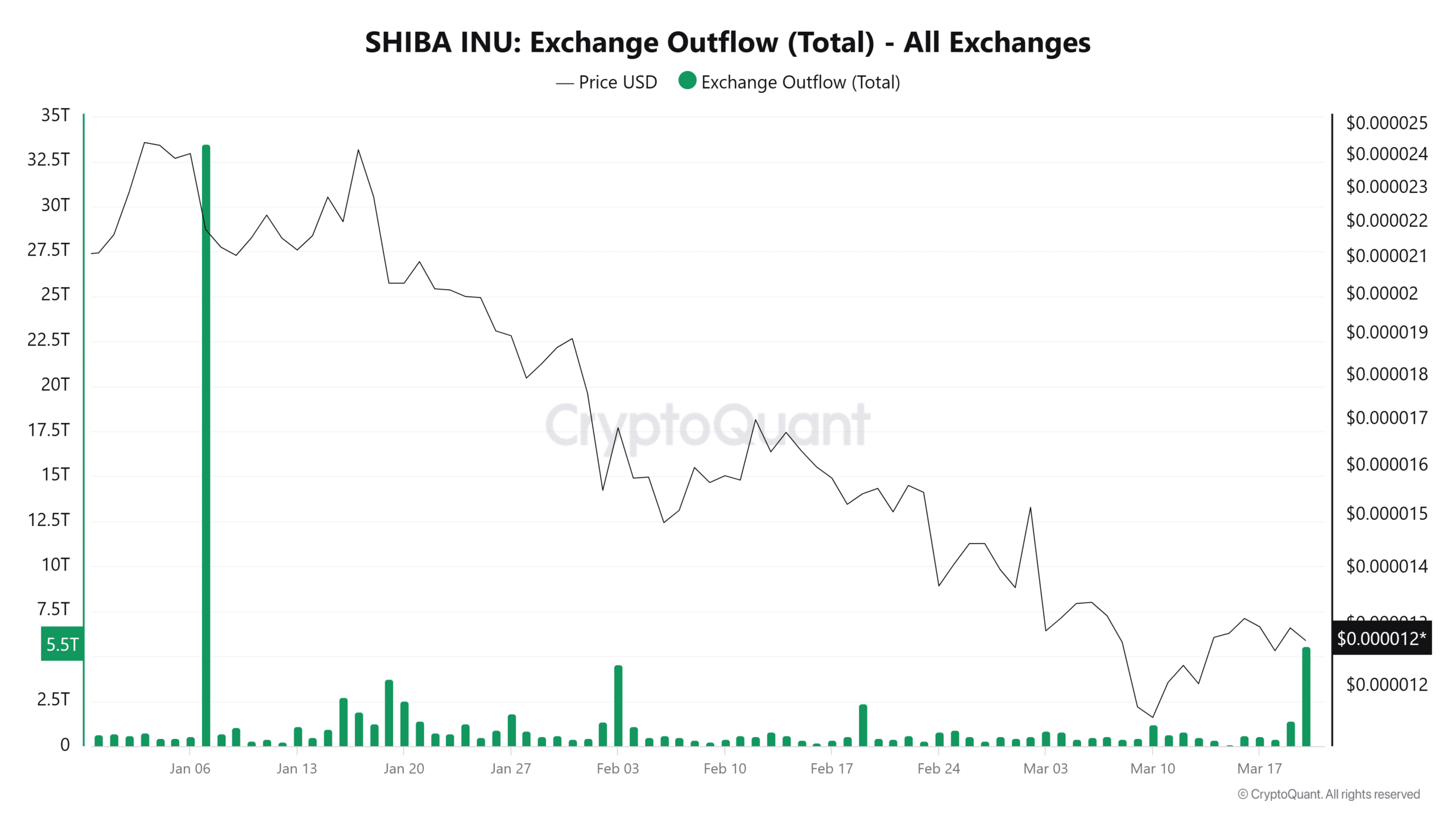

To get a clearer picture, we turn to CryptoQuant’s exchange outflow data.

On-chain data indicates large exchange outflows, including 33.48 trillion SHIB withdrawn on the 7th of January, the largest single-day removal.

Then, the 3rd of February saw another 4.53 trillion exit, while the 20th of March recorded 5.55 trillion in outflows.

Normally, removing tokens from exchanges reduces selling pressure and supports price stability. But in SHIB’s case, the price has dropped by approximately 43% since January.

This suggests that despite whales pulling tokens from exchanges, overall sell pressure remains dominant.

So, what’s really happening?

Are whales buying or just shifting funds?

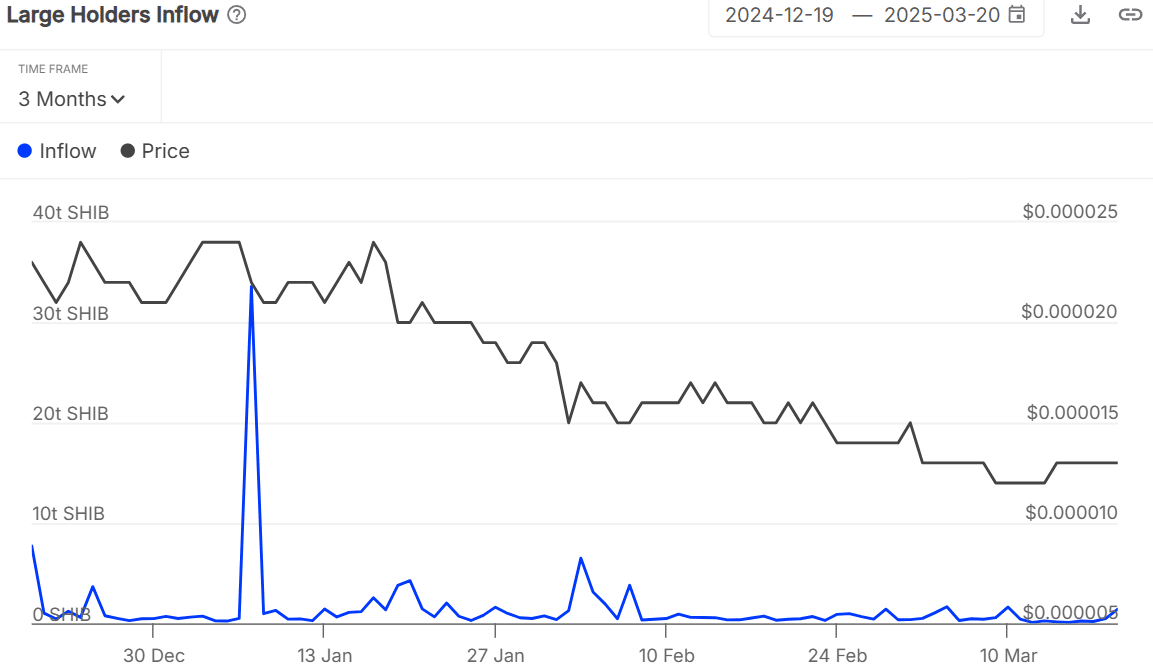

Whale activity in SHIB remains dynamic, with IntoTheBlock data showing large-scale inflows and outflows.

On the 28th of February, a net inflow of 1.16 trillion SHIB signaled accumulation, but by the 12th of March, a -561.99 billion SHIB net outflow suggested sell pressure.

A smaller 143.81 billion SHIB inflow on the 19th of March hinted at renewed holding interest.

This back-and-forth suggests whales aren’t just buying—they’re actively managing their positions, redistributing tokens based on market conditions rather than committing to long-term accumulation.

Whales appear to be actively managing positions rather than committing to long-term accumulation.

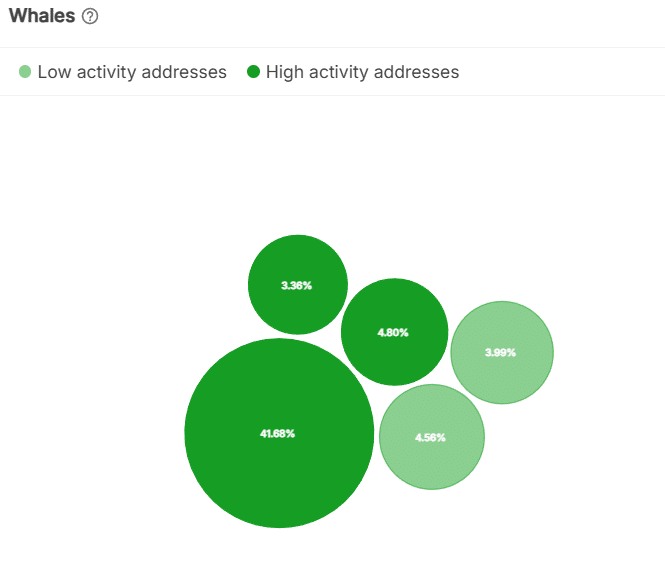

Just five addresses control 58.39% of SHIB’s supply, with one holding 41.68%. These high-activity wallets contribute to market volatility as SHIB’s overall holder base grows.

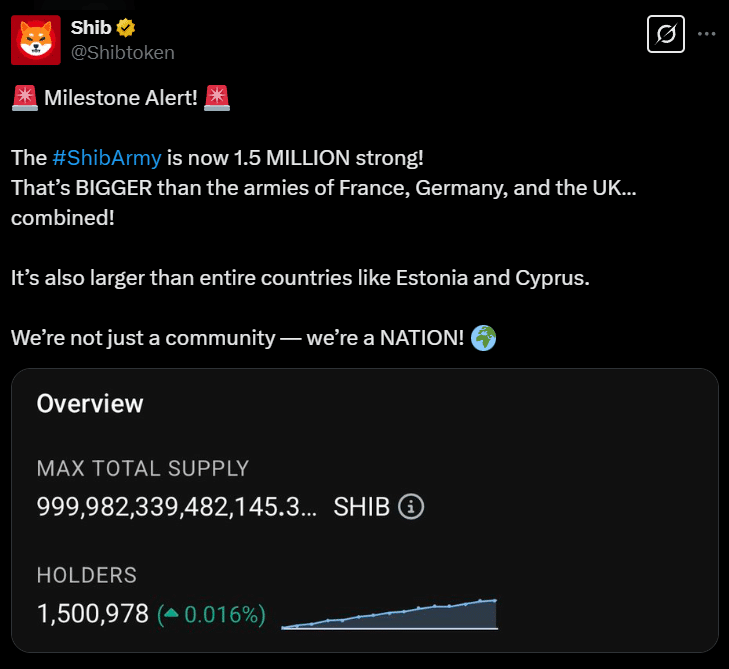

While whales continue shifting their positions, SHIB’s overall holder base has expanded.

Shib’s holder base grows, but is that enough?

The Shiba Inu official Twitter account confirmed SHIB holders now exceed 1.5 million. It signals growing adoption.

On-chain data shows addresses with a balance rose from 1.37 million in December to 1.39 million in March.

A brief drop in mid-February was quickly reversed, suggesting a temporary shift. Daily active addresses peaked at 13,440 on the same day but have since dropped to 3,560.

Despite this expansion, SHIB’s price remains largely unaffected, fluctuating between $0.000010 and $0.000020. This suggests new addresses aren’t injecting fresh liquidity or driving demand.

Whale activity has increased, but data indicates strategic redistribution rather than accumulation.

While large withdrawals from exchanges persist, SHIB’s 43% price decline suggests selling pressure is outweighing buy-side interest.

With whales controlling over half the supply, their next moves will dictate price action. A recovery is possible if accumulation strengthens, but renewed selling pressure could push SHIB below key support levels.