Whale frenzy: 1 billion XRP accumulated in 48 hours means THIS for price!

- XRP saw massive whale accumulation, fueling discussions about its market trajectory and network dynamics

- On-chain metrics revealed significant trends in network growth, holder activity, and price performance

In a remarkable trend, XRP whales have added over 1 billion tokens to their holdings within the last 48 hours. Needless to say, this significant accumulation has raised questions about its potential implications for XRP’s network health, price momentum, and broader market positioning.

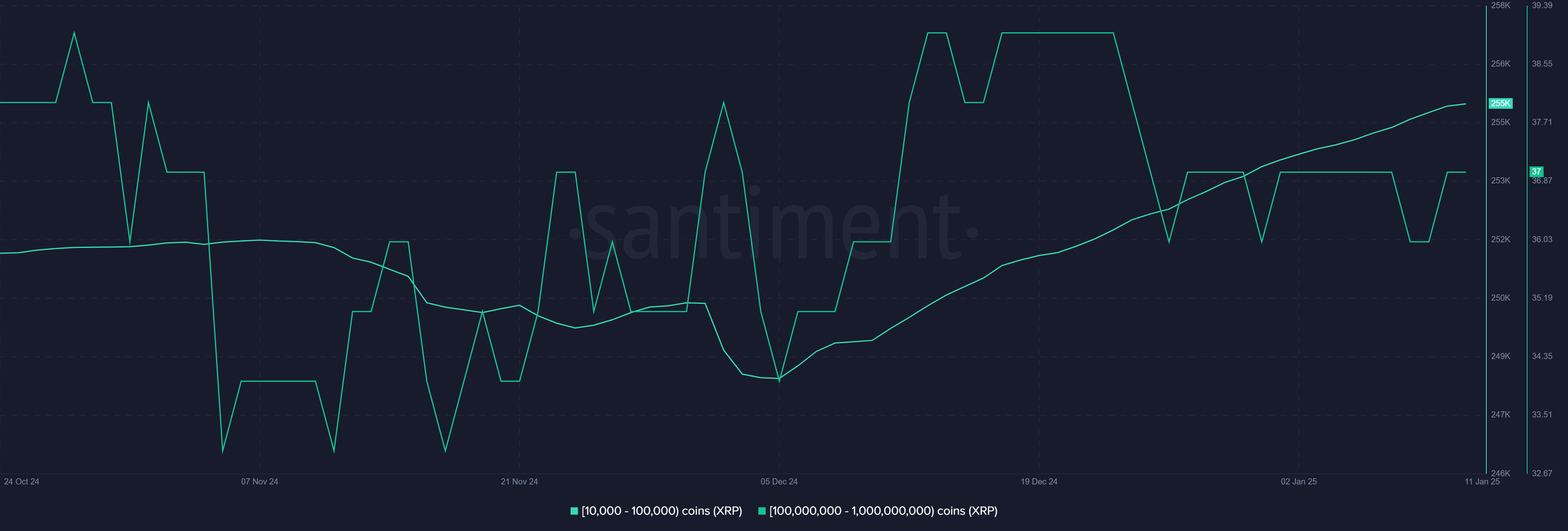

XRP whale accumulation – A closer look

The accumulation of 1 billion XRP by whale addresses highlights renewed confidence in the digital asset. According to the chart tracking wallet distribution, large holders with balances exceeding 10 million XRP saw a sharp uptick in their holdings.

Speculatively, this move could signal anticipation of a price hike in the coming weeks or a strategic response to the recent market consolidation.

The accumulation trend not only influences market liquidity, but also boosts sentiment among smaller investors. Whales have historically acted as market movers, and their activity often aligns with pivotal market shifts.

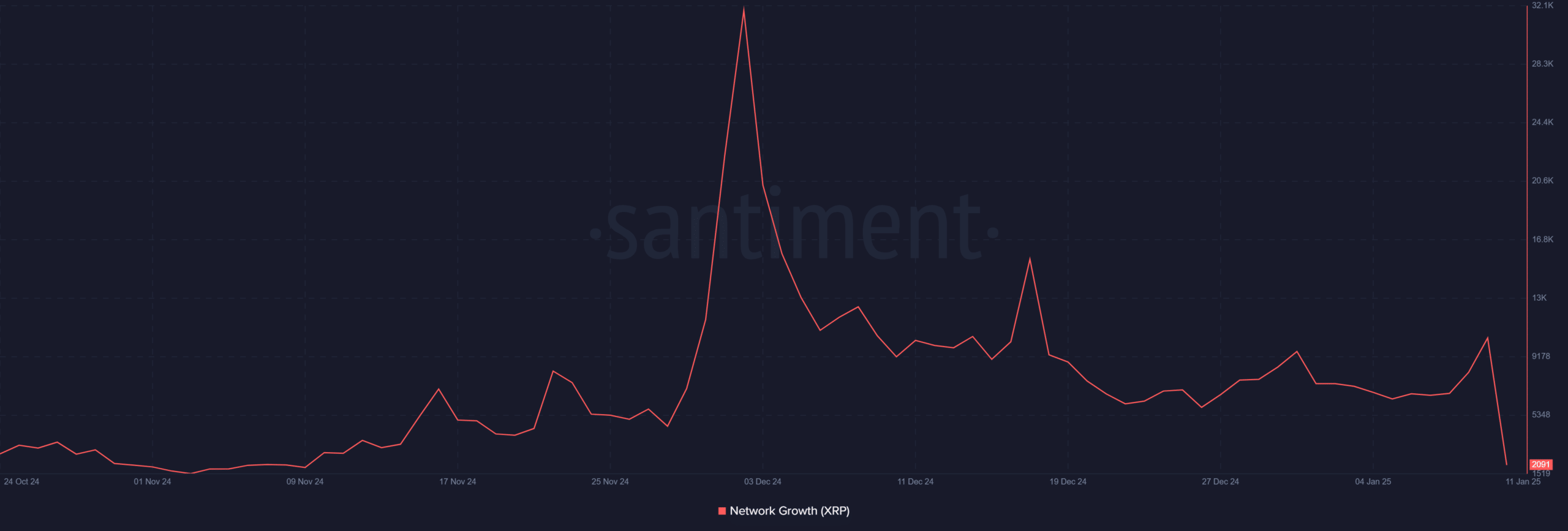

Network growth – Signs of strength?

Here, it’s worth pointing out that the network growth chart revealed an intriguing narrative. While new wallet creation spiked dramatically in December 2024, indicating heightened interest in the XRP ledger, a subsequent decline suggested that the market may be cooling off.

However, the presence of consistent daily new addresses, even post-spike, indicated that XRP continues to attract new participants. In fact, analysis revealed that the number spiked to over 10,000 on 10 January, before declining at press time.

This pattern hinted at a mix of speculative and long-term interest.

While whale activity might have driven short-term growth, sustained address creation can be seen as a sign of broader adoption, possibly stemming from increased utility of the XRP ledger in cross-border payments.

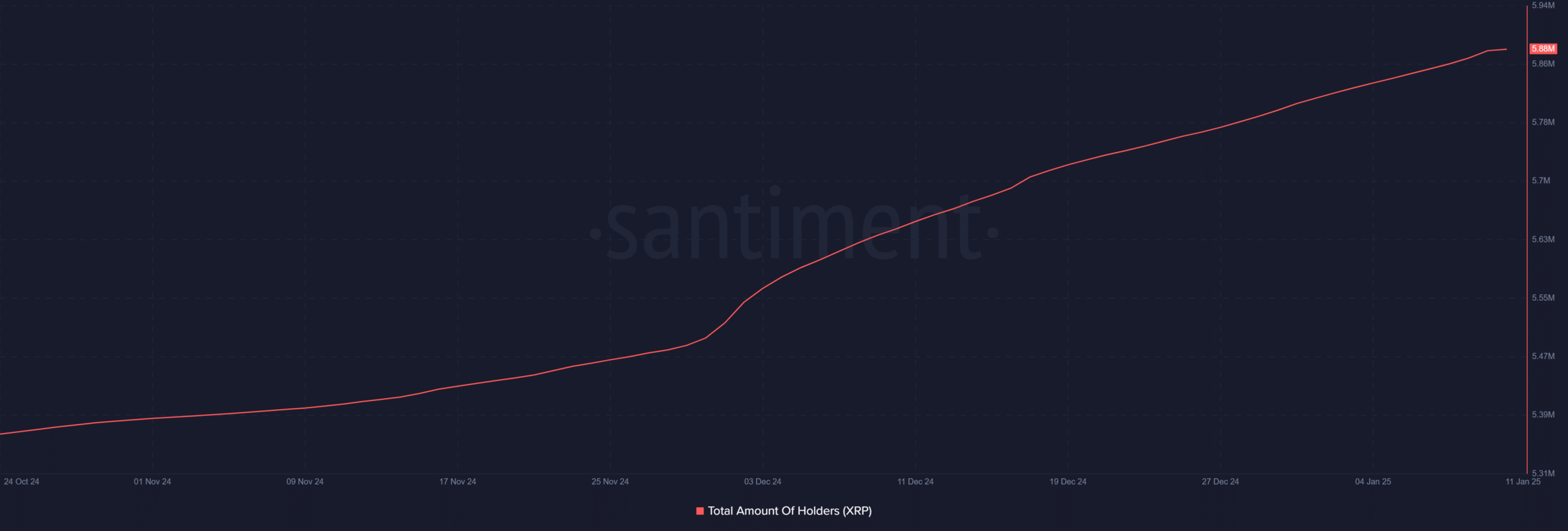

Total holders – The bigger picture

The total number of XRP holders has demonstrated steady growth, too with the chart showcasing a near-linear rise over the past few months. As of January 2025, the total holder count exceeded 5.88 million, reflecting an expanding base of investors.

Interestingly, this hike seemed to align closely with whale accumulation periods, suggesting a trickle-down effect where large whale purchases influence retail participation.

This dynamic could enhance market stability by distributing XRP more evenly across different holder categories.

Price analysis – Can XRP sustain its momentum?

Finally, the price chart offered some insights into XRP’s current trajectory. After hitting a peak of $2.50, it entered a consolidation phase, trading at approximately $2.33 at press time. The accumulation/distribution (A/D) line reflected sustained buying pressure, further bolstering the narrative of whale support.

Indicators such as the 50-day moving average suggested that XRP is holding above critical support levels, while the Relative Strength Index (RSI) hovering near neutral territory indicated balanced momentum.

For XRP to maintain its upward trajectory, breaking resistance at $2.50 will be crucial.

Market implications and future outlook

Whale-driven accumulation and subsequent network growth underscored XRP’s growth in the last few weeks. However, the interplay between whale behavior, retail adoption, and other external factors, such as regulatory decisions, will shape its medium- to long-term prospects.

– Realistic or not, here’s XRP market cap in BTC’s terms

In conclusion, the network’s growth and total holder trends suggested resilience, while the price action highlighted key levels to watch. If whales continue their accumulation and the network attracts new users, XRP may sustain its bullish momentum, barring any macroeconomic shocks.