Whale invests in Ethereum: Why PEPE, LINK, UNI are in focus

- Whales accumulated over $9 million worth of ERC-20 tokens.

- Pepe and LINK saw a more positive price trend than UNI.

Recently, Pepe [PEPE], Uniswap [UNI], and Chainlink [LINK] witnessed significant whale accumulations. While UNI stood out with its distinct price trend, PEPE and LINK displayed similar price movements.

Another commonality among these assets is that they are all ERC-20 tokens. The ongoing accumulation and price trends are considered a bullish signal, which could impact the Ethereum [ETH] network.

Whales accumulate Pepe, Chainlink, and Uniswap

According to data from Lookonchain, whales engaged in significant accumulation activities on the 4th of May, acquiring millions of dollars worth of various ERC-20 tokens.

One notable transaction involved a whale withdrawing 322.48 billion Pepe tokens from the Binance exchange, valued at approximately $2.78 million.

Another whale withdrew 500,000 UNI tokens worth about $3.75 million and 183,799 LINK tokens worth roughly $2.62 million from the Binance [BNB] exchange.

Pepe and Chainlink see uptrends

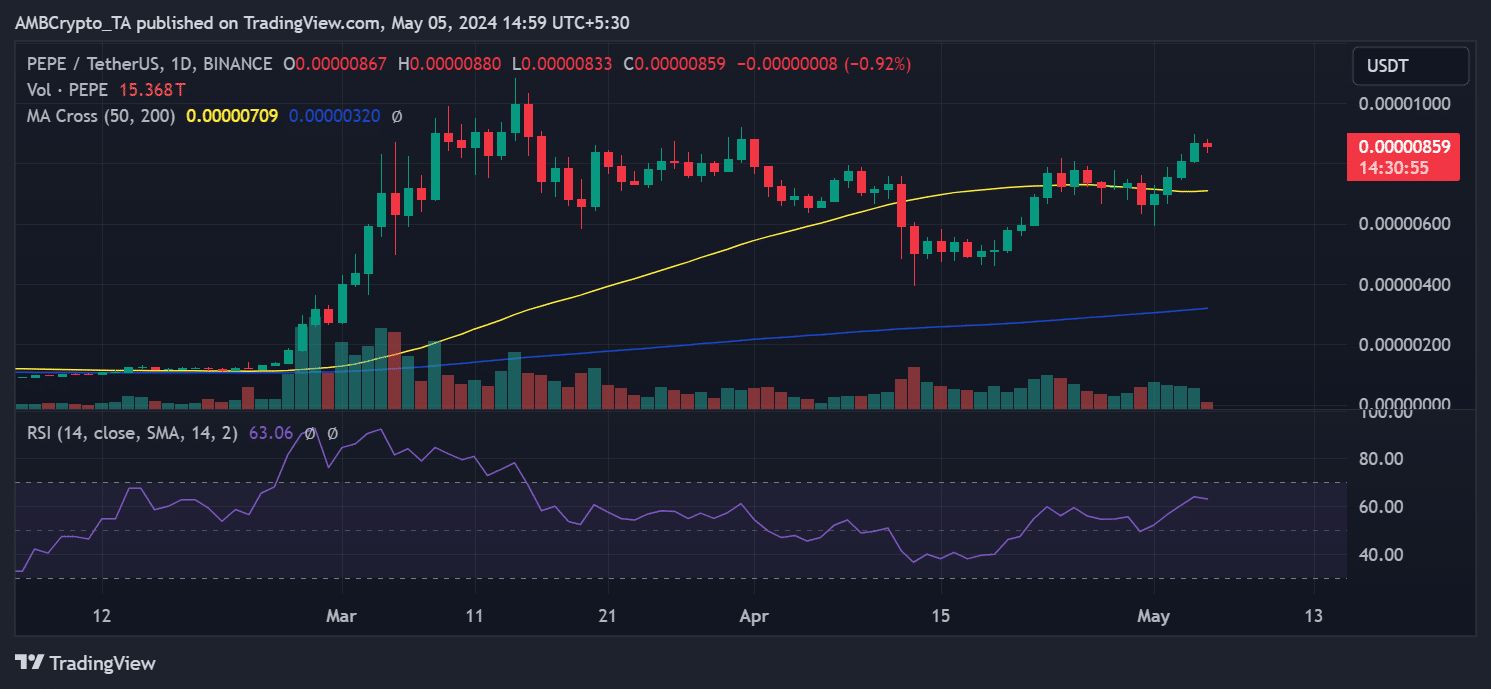

AMBCrypto’s analysis of Pepe’s price movement on a daily timeframe chart revealed consecutive uptrends from the 1st to the 4th of May. On the 4th of May, its value surged by 7.30%.

Notably, its price trend was now positioned above its short moving average (yellow line), which had transitioned to provide support, indicating a positive price trend.

However, Pepe was experiencing a decline of over 1% in its trading value at the time of writing.

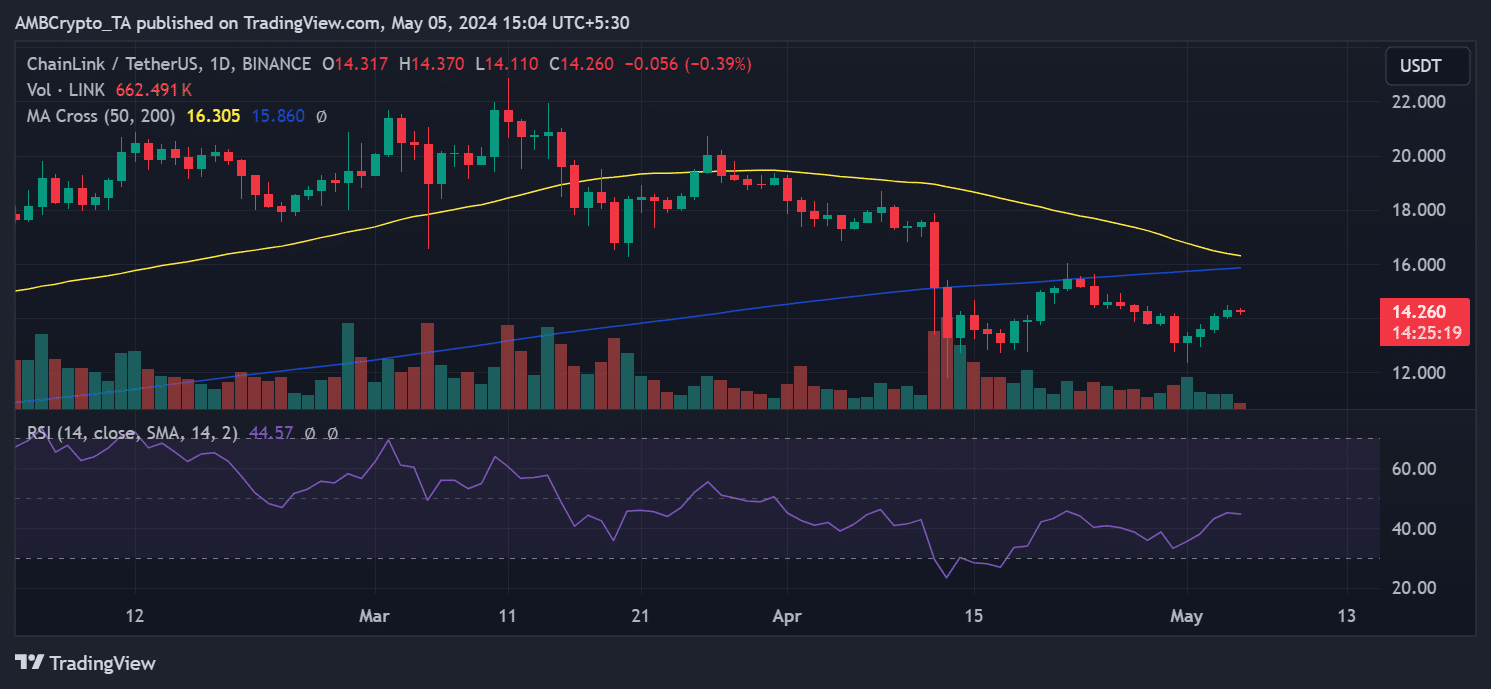

AMBCrypto found that Chainlink also exhibited consecutive uptrends from the 1st of May.

Its price surged from around $13 to over $14, closing at approximately $14.3 on the 4th of May, marking a price increase of over 1%.

Despite the positive movement, Chainlink’s overall trend remained less positive than Pepe’s, with its price trading below its short and long averages (yellow and blue lines).

As of this writing, it was trading at around $14.2, reflecting a decline of less than 1%.

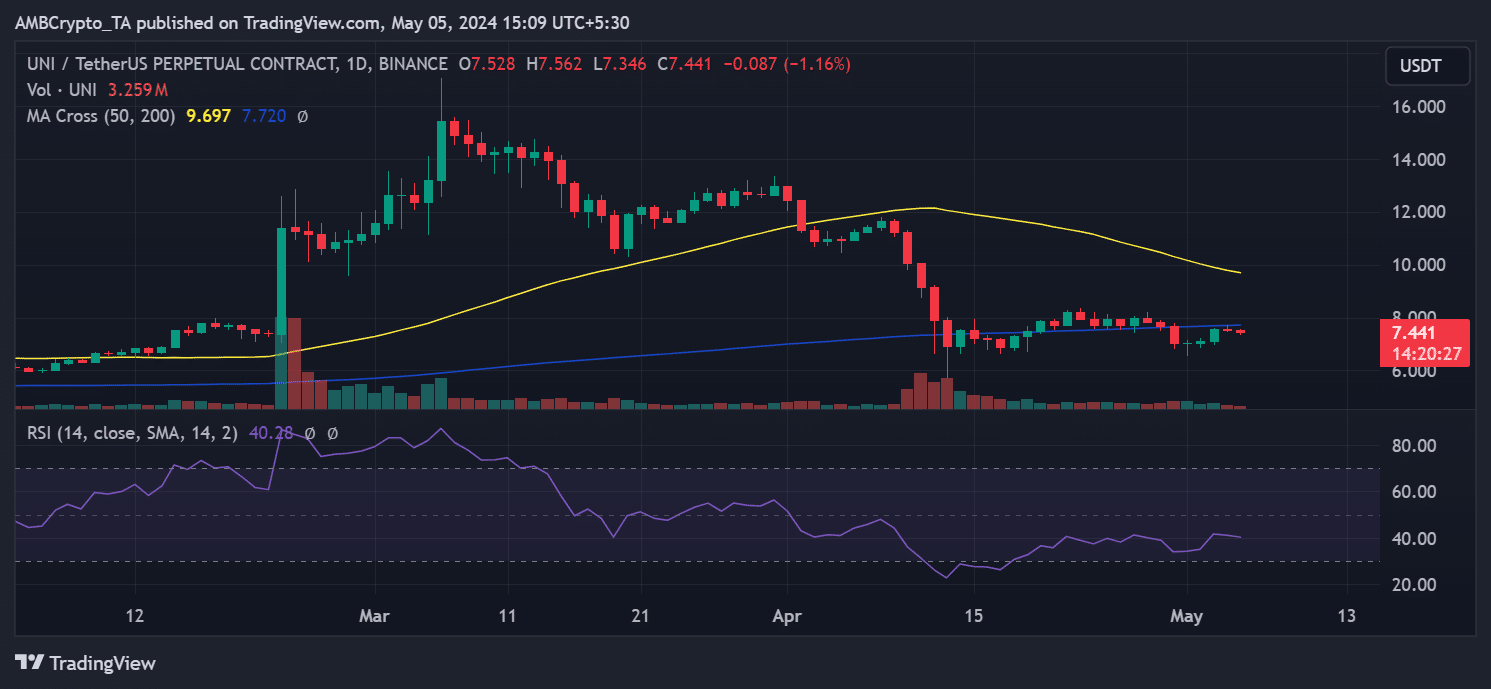

Among the Ethereum standard tokens accumulated by whales, Uniswap displayed the poorest price performance.

While it saw price increases from the 1st of May, only on the 4th of May did the increase exceed 1%, rising by 6.66% to trade at around $7.5.

However, despite the increase, its blue and yellow lines acted as resistance levels. It was trading at approximately $7.4, indicating a decline of over 1% in value.

Additionally, its Relative Strength Index (RSI) hovered close to 40, suggesting a bear trend.

Will Ethereum face the effects?

The accumulation of Pepe, Chainlink, and Uniswap is a positive signal for these Ethereum-based assets. It suggests an anticipation of further price appreciation, which is inherently bullish.

Is your portfolio green? Check out the LINK Profit Calculator

In the event of an eventual price surge for these tokens, the sales from these accumulating whales could trigger further accumulation by other traders.

This resultant increase in trading volume could significantly impact the overall trade volume of the Ethereum network. Moreover, an uptick in volume would likely affect the fees on the network.