Whale sells PEPE at a loss: Where does the memecoin go from here?

- A whale recently sold over 2 trillion PEPE at a loss of around $700,000.

- More tokens are, however, leaving exchanges compared to the volume coming in.

Pepe [PEPE] appears to be running out of steam, as evidenced by a notable shift in a particular whale’s behavior. Fresh data revealed that a prominent whale in the Pepe community had parted ways with its holdings, incurring losses along the way. The question then is: to what extent has this recent whale maneuver influenced the overall trajectory of the asset?

How much are 1,10,100 PEPEs worth today?

Whale disposes of Pepe holdings

On 7 August, a major transaction orchestrated by a whale captured the spotlight. Insights from Lookonchain unveiled the whale’s decision to offload its Pepe holdings. Yet, it wasn’t the sale that stirred curiosity but rather the unfortunate loss incurred during the process.

A whale dumped all 2.26T $PEPE($2.53M) at an average price of $0.000001121 just now, with a loss of $707K.

The whale spent 1,102 $ETH($2.01M) to buy $BALD before, but only got 189 $ETH($346K) back, with a loss of 912 $ETH($1.67M).https://t.co/HF8aZplGXS pic.twitter.com/xtFApeQr9m

— Lookonchain (@lookonchain) August 7, 2023

The data revealed a sizeable volume of approximately 2.26 trillion PEPE tokens exchanged for approximately $2.53 million.

Astonishingly, despite the substantial sum garnered from the sale, the whale grappled with a deficit exceeding $700,000, as the data illustrated. The rationale behind this maneuver remained unclear, although it’s worth noting that this particular whale had also engaged in another sale resulting in a loss.

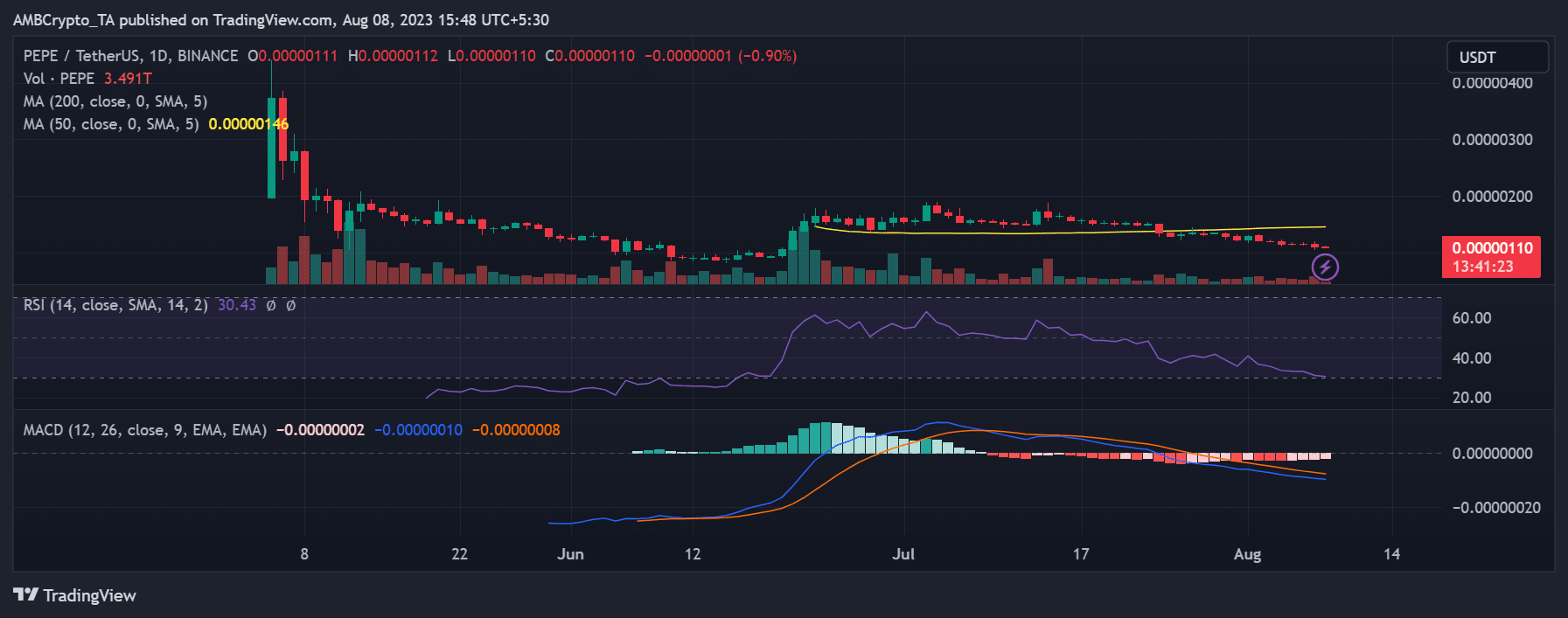

Pepe on a daily timeframe

The performance of the Pepe price trend, as depicted on its daily timeframe chart, has been less than impressive. Following a modest 4% surge on 1 August, the trend has steadily descended.

Additionally, once the price dipped beneath the neutral line on the Relative Strength Index (RSI), it encountered difficulty re-emerging above it. As of this writing, the RSI rested at 30, suggesting that any forthcoming price decline would propel it into the oversold zone.

The confirmation of bearish sentiment for PEPE was reinforced by the Moving Average Convergence Divergence, which maintained a trend below zero.

The lackluster nature of the price trend might motivate the whale to liquidate its holdings. Nevertheless, other holders opted to adopt a more patient and long-term perspective.

Is your portfolio green? Check out the PEPE Profit Calculator

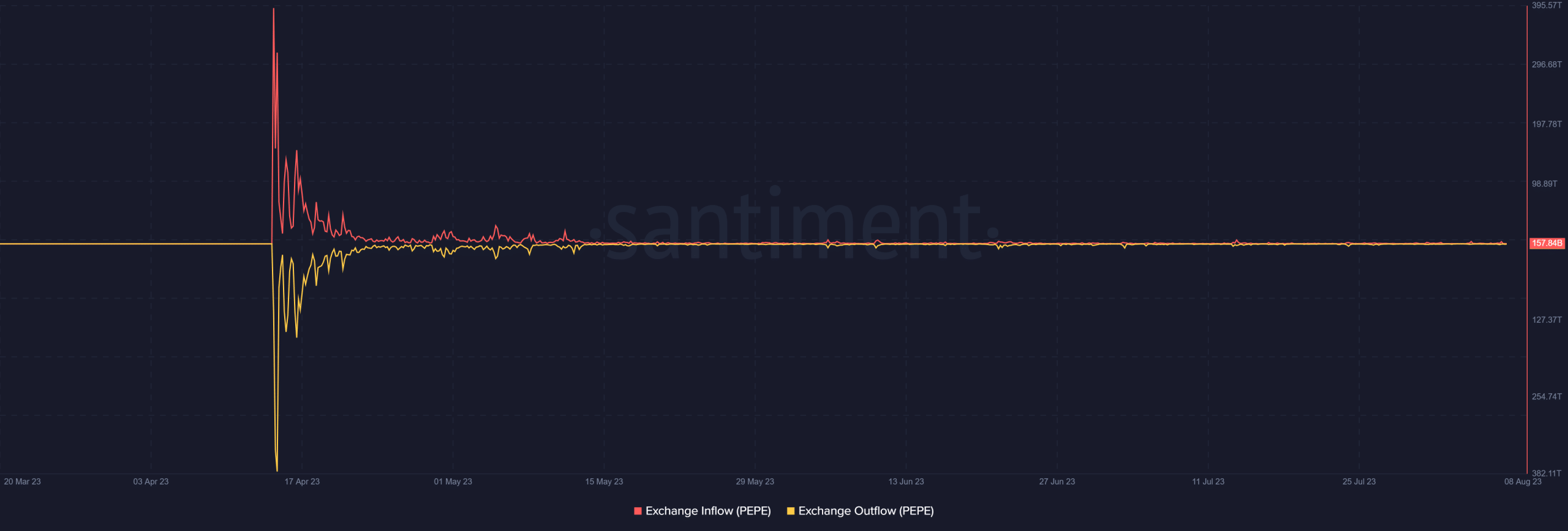

Analyzing the exchange flow

According to Santiment’s exchange flow data, the recent weeks and months have seen a higher outflow volume than inflow. This suggested that many Pepe holders leaned towards retaining their holdings rather than engaging in sales.

As of this writing, the recorded inflow was approximately 158 billion, whereas the outflow surpassed 425 billion.

Source: Santiment