Whale watch: Impact on BNB as tokens worth $100M see a move

- A whale dumped 200,000 BNB tokens worth $103 million on the world’s biggest cryptocurrency exchange.

- Despite the massive token dump, BNB is moving above the 200 EMA, showing bullishness in the chart.

The overall cryptocurrency market is experiencing extreme selling pressure due to continuous Bitcoin [BTC] sell-offs by whales and the governments of the United States and Germany in recent days.

Amid this ongoing selling pressure, on the 8th of July, Binance [BNB] whale capybara_bnb deposited a significant 200,000 BNB tokens worth $103 million to Binance, as reported by Wu Blockchain.

Whale dumps $103 million worth of BNB tokens

This massive deposit by the whale has gained significant attention from investors and institutions amid this ongoing selling pressure in the cryptocurrency landscape.

Despite this substantial BNB deposit, this whale still holds a notable 204.6K of BNB tokens worth $105 million in its holding.

In addition to this BNB deposit, the market has experienced notable dumps of other tokens, including 1,000 Bitcoin by the government of Germany and 809 BTC by whale address “3G98jS.”

This continuous dumping of tokens in the market signals significant selling pressure.

Meanwhile, a recent report highlighted that the crypto fear and greed index has plummeted to its lowest level since early 2023, showing extreme fear in the market.

However, if this dump doesn’t stop, we may see more sell-offs in the coming days.

BNB technical analysis and key levels

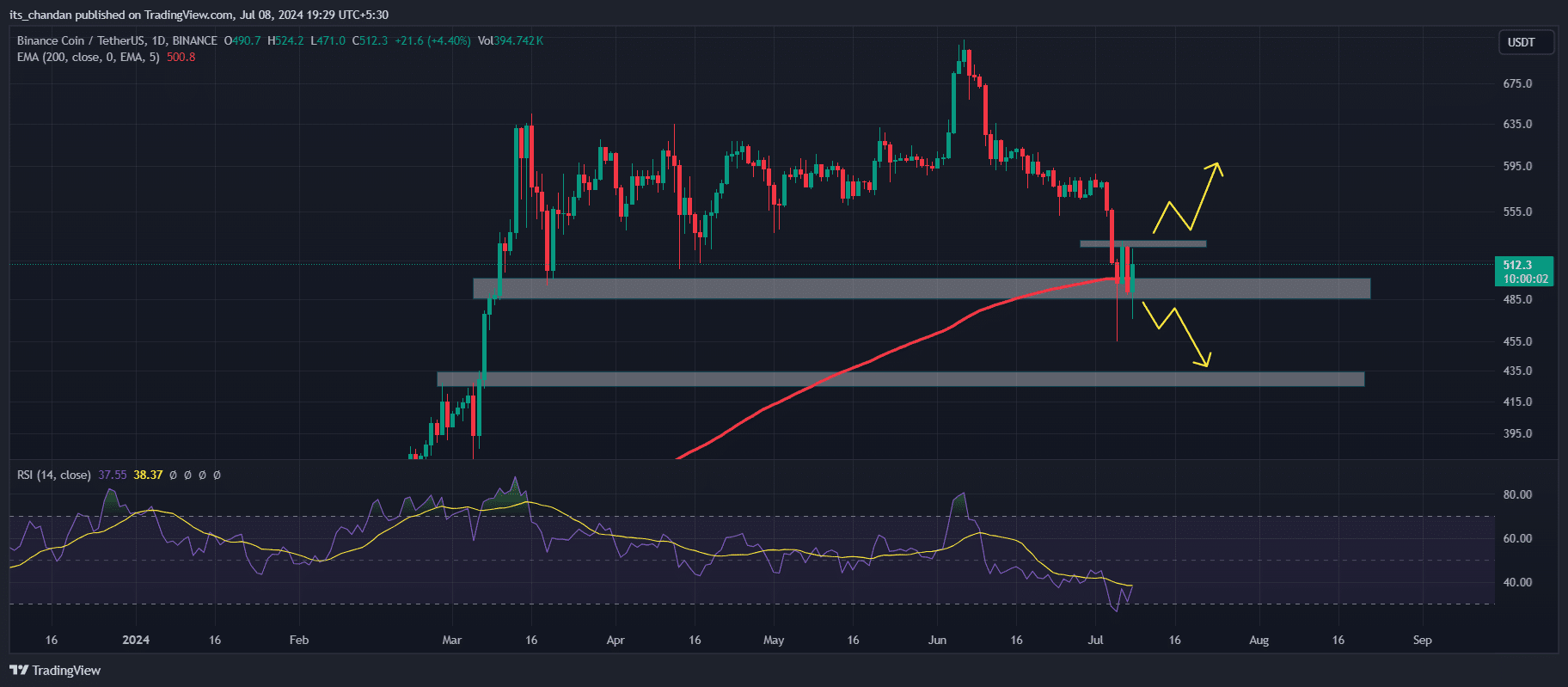

According to expert technical analysis, BNB was at a crucial support level of $500 at press time, and moving above 200 Exponential Moving Average (EMA) on a daily time frame.

The price BNB above 200 EMA indicated that the asset was still in the bullish zone.

If BNB on a daily time frame gave a candle closing below 200 EMA and below the $500 level, then there could be a high possibility of BNB experiencing a massive sell-off.

Additionally, BNB may reach the $430 level, which is its next support level. However, the Relative Strength Index (RSI) also signaled a potential sign of recovery, as it was in an oversold area at press time.

BNB price-performance analysis

Despite the bullish outlook following the recent dump, the Open Interest (OI) of BNB increased by 1.4%, signaling slight trader and investor interest.

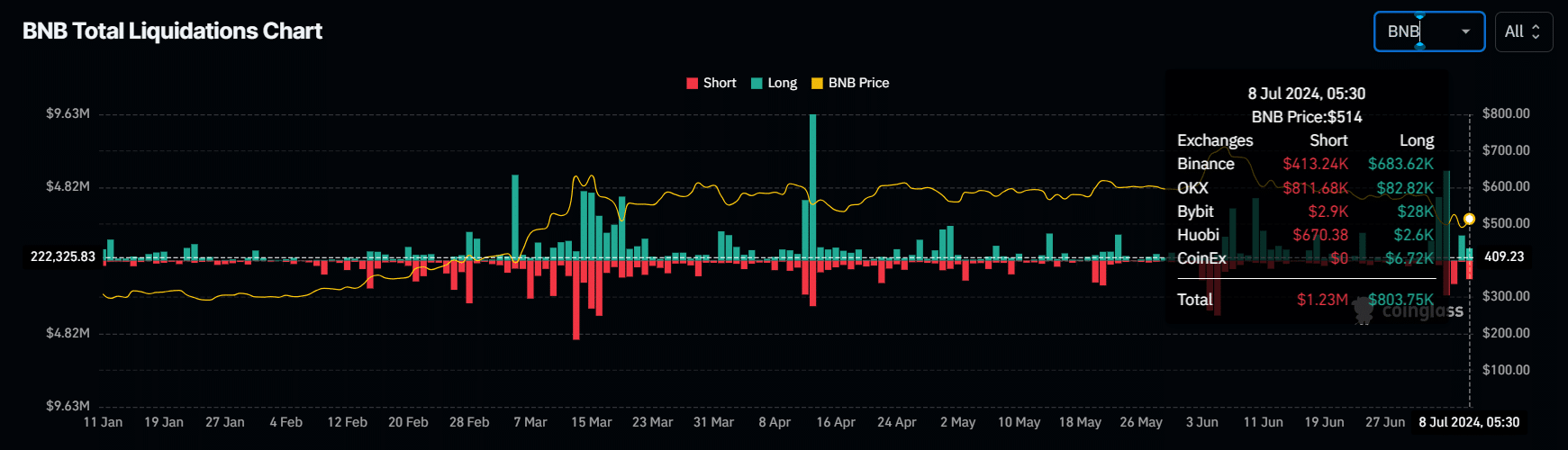

Meanwhile, in the last 24 hours bulls, have experienced a liquidation of over $803k and short sellers have experienced a liquidation of $1.23 million, according to an on-chain analytic firm Coinglass.

As of this writing, BNB was trading near $513, having experienced a 3.2% upside momentum in the last 24 hours.

Realistic or not, here’s BNB’s market cap in BTC’s terms

Whereas, trading volume in the last 24 hours has increased by 26% indicating higher investors and traders participation in BNB amid this bearish sentiment.

If we look at the performance of BNB over a longer period, in the last seven days, it has lost 11% of its value. This translated to a 25% loss in its value over the last 30 days.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)