Shiba Inu

Whales abandon Shiba Inu: What’s next for SHIB price?

The short to mid-term future for SHIB looks bleak and here are the reasons why.

- SHIB risks dropping to $0.000014 as a lot of addresses keep selling some of their holdings.

- Activity on Shiba Inu dropped even as the network became overvalued.

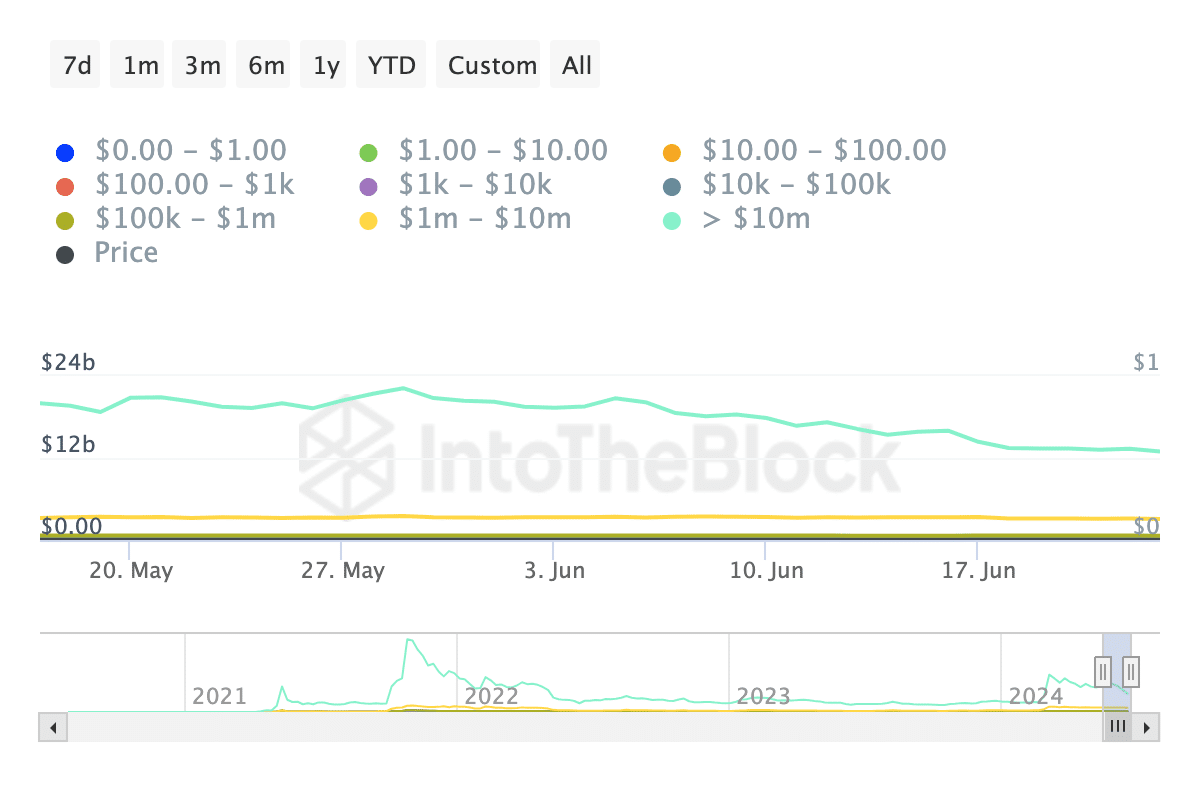

According to AMBCrypto’s on-chain analysis, Shiba Inu [SHIB] might find it challenging to recover from its recent downturn. This was after we looked at the Holdings Distribution of the memecoin.

Specifically, the focus was on the Balance By Holdings. This metric shows if existing holders are adding to their positions or letting go of some of their holdings.

No one wants the memecoin

At press time, both retail and whale investors in Shiba Inu were reducing their balances. However, while some parts of the retail cohort added some tokens, none of the whale group did.

For example, those holding SHIB valued more that $10 million reduced their balance by 35.22%. This happened within the last 30 days.

Another proof was shown in the $10,000 to $100,ooo cohort who plunged their holding by 31.68%. The $1 million to $10 million group dropped their balance by 4.56%.

Whales are entities who hold large amounts of a cryptocurrency. As a result, they have a big influence on prices. With the recent decline, Shiba Inu’s price could be looking at another price fall despite what it had faced recently.

At press time, SHIB changed hands at $0.000016. This value represents a 14.88% decrease in the last seven days.

In the event that the holdings continue to decrease, the price of the token might fall further. If this is the case, SHIB’s price might drop to $0.000014. The NVT Ratio was another metric predicting a price decrease.

Is SHIB overpriced?

NVT stands for Network Value to Transactions (NVT). This helps to determine if coins are overvalued or undervalued.

If the NVT Ratio is at a high level, it means that the market cap is outpacing the transaction volume. In this case, the network and token could be termed overvalued.

However, when the NVT Ratio hits a low point, it means that the network is undervalued. In this case, it means that transactions on the network is outrunning the market cap.

For Shiba Inu, the metric spiked to a high point on the 22nd of June. This meant that SHIB was at an overvalued point. Therefore, this prediction to $0.000014 could come to pass.

Meanwhile, the 24-hour active addresses on Shiba Inu’s network was at a very low point. Active addresses measure the number of users participating in transactions on network.

Is your portfolio green? Check the Shiba Inu Profit Calculator

If the metric increases, it is a bullish sign. However, a decrease implies that users are leaving the network, and this could puts the price at risk of a decline.

For SHIB, the low number implied that demand for SHIB was also minimal. Therefore, it could be challenging for the price to hit higher levels in the short term.