Solana

Whales buy Solana worth $23.86M: Is $400 in sight for SOL?

A whale recently purchased 100K SOL worth $23.86M. What could this mean for Solana’s price?

- Solana whale recently purchased 100K SOL worth $23.86M

- Solana recorded $311M in stablecoin inflows over the last 24 hours, the largest inflow ever.

Solana [SOL] has held the $230 support level, rising by 2.01% in the past 24 hours. This was driven by heightened volatility as Bitcoin hit an all-time high of $99,000.

Meanwhile, Solana’s 24-hour trading volume has surged by 9.41%, reaching $7.31 billion. With analysts anticipating more bullish momentum in ‘Pumpcember’, the question remains: Can Solana achieve the $400 price?

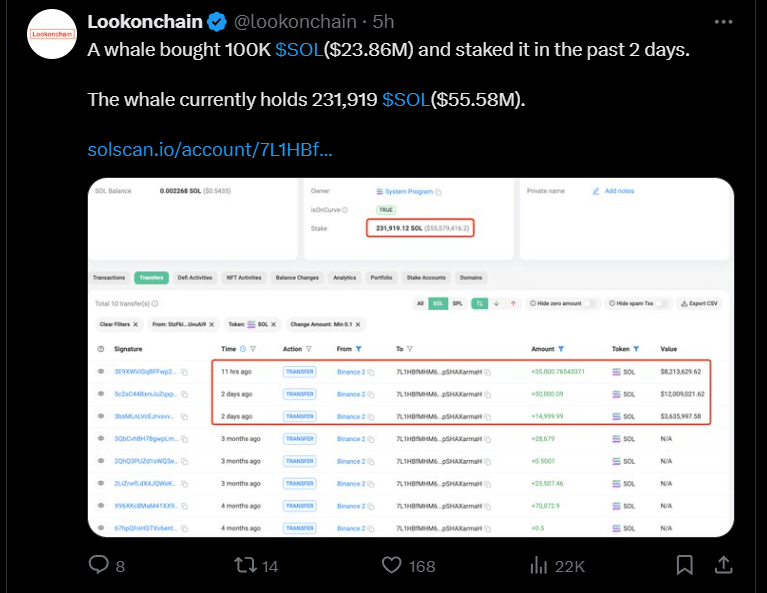

Solana whale staking continues

Lookonchain, a blockchain analytics platform, showed that a whale recently purchased 100K SOL, valued at $23.86 million, and staked it within the last two days.

This whale’s transactions show a strategic accumulation and staking of Solana tokens to maximize rewards.

The whale’s holdings now total 231,919 SOL, equivalent to $55.58 million, highlighting their significant confidence in Solana’s long-term potential.

The data shows that the transactions originated primarily from Binance accounts and were transferred to the whale’s staking address.

Notably, the latest transfer of 50,000 SOL, valued at $11.8 million, was completed a few hours ago, at the time of writing.

Solana hits record $310M stablecoin inflows

Solana has experienced unprecedented stablecoin inflows, with $310 million entering the ecosystem in the last 24 hours. This marked the largest single-day inflow in its history.

The surge has brought Solana’s total stablecoin market cap to $4.481 billion, reflecting a remarkable 15.67% increase over the past seven days.

The stablecoin landscape on Solana continues to be dominated by USDC, which accounts for 72.07% of the market.

This significant inflow underscores the growing confidence in Solana’s ecosystem, likely driven by increasing adoption and the network’s robust infrastructure.

SOL records +300% DEX volume than ETH

Solana has outpaced Ethereum Layer-1 in Decentralized Exchange (DEX) trading volume for the third consecutive day, recording nearly 300% more volume.

The chart illustrates a significant surge in activity on Solana, with stacked bar representations showing consistently higher DEX volume than other networks.

This consistent dominance indicates a robust adoption of Solana’s ecosystem, driven by its high speed, low fees, and increasing liquidity.

The dramatic increase in DEX trading volume highlights Solana’s growing role as a leader in DeFi, further consolidating its competitive advantage against Ethereum Layer-1.

$270 next for SOL’s 4-hour breakout

Solana was trading at $242.79, at press time, maintaining a steady upward trajectory, with key support at $234 and major resistance at $250.

The price recently broke out of a consolidation phase, surging over 10% before stabilizing. A successful breakout above $250 could push the price toward the next resistance level at $270, extending the previous breakout.

The MACD indicator showed a bearish crossover, with the MACD line dipping below the signal line, indicating slowing momentum or a potential short-term retracement.

Read Solana’s [SOL] Price Prediction 2024–2025

However, the narrowing histogram suggested fading bearish pressure, leaving room for a bullish reversal.

Meanwhile, the Chaikin Money Flow (CMF) remained positive at 0.10, reflecting steady net capital inflows and sustained buying interest.