Whales gear up for Altcoin season: Will this time be different?

- CryptoQuant founder claims that whales are getting ready for altcoin season.

- Another market analyst, Benjamin Cowen, cautions for such calls amidst rising BTC dominance.

There’s another round of Alt season calls right at the beginning of August, just weeks away from a potential first Fed rate cut in September. The latest call is from CryptoQuant, a crypto data intelligence platform.

This isn’t the first altcoin season call from market analysts and might not be the last. We’ve observed these calls since this cycle started late last year, but none have materialized.

Will whales make this Alt season call different?

So, what makes this latest Alt season call different? Whales, also known as smart money.

According to CryptoQuant founder Ki Young Ju, whales are positioning themselves in a big way for the next altcoin season.

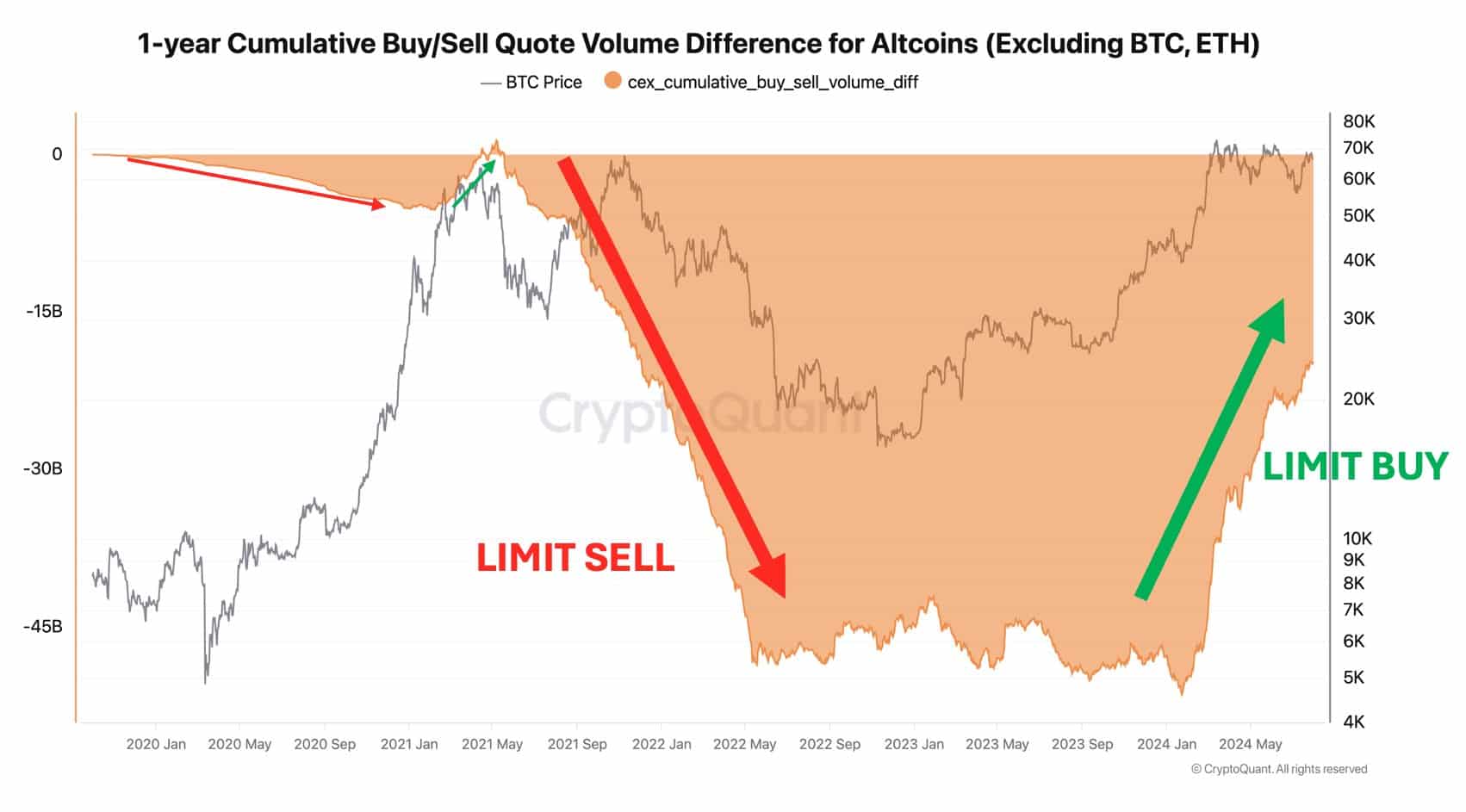

Ju’s projection was based on increasing the 1-year Cumulative Buy/Sell Quote Volume Difference for Altcoins.

This metric tracks the altcoin demand from whales and institutions. A rising trend suggests strong demand from whales, while a declining trend underscores less demand.

The attached chart shows that the metric is rising, indicating a massive whale appetite and position for a possible altcoin season.

SwissBlock, a crypto market insight firm led by Glassnode founders, shared a similar Alt season outlook. The firm’s analysts said the current altcoin market mirrors the late 2020—early 2021 trend, which led to a 400% rally for altcoins.

The analysis was based on correlation with US Small Cap (Mini Russell 2000 Index Futures). Notably, other analysts, like Quinn Thompson of Lekker Capital, have cited the positive correlation between Small Caps and crypto.

However, not all analysts are boarding the Alt season call.

A renowned crypto analyst, Benjamin Cowen, offered a cautious outlook, citing that increasing Bitcoin dominance could hit 60% by the end of the year, which could drag the altcoin market.

‘You can see that #BTC dominance continues to slowly go higher, despite proclamations just about every week for “alt season”

Cowen added that ALT/BTC could drop lower, exposing Alts to more risks. According to Cowen, this trend was seen in 2019, a month before the Fed rate cut, and could repeat.

In short, not all market observers heeded altcoin season calls, at least as of press time. In fact, according to current readings of 22 from the Altcoin Season Index, the market was still firmly in Bitcoin season.