Whales like MATIC, but is that enough for the altcoin’s price?

- Whale transactions on the Polygon network spiked amid price fluctuations

- Despite institutional interest, MATIC’s price might slide below $0.47

Polygon [MATIC] whale interest was the subject of discussion some days ago due to a spike in transactions. Typically, trades valued at $100,000 or more are considered whale transactions.

According to IntoTheBlock, MATIC whale transactions climbed by over 1000% and were valued at over $100 million. When things like this happen, it is a sign of institutional interest in a token. And most of the time, it affects the token’s price.

Over $100 million exchanged, but MATIC stays sober

For MATIC, the price was $0.49 at press time. This constituted a 4.19% fall in the last 24 hours. However, earlier in the week, the value of the token climbed to $0.52 on the charts. Therefore, the decline implies that holders of the token booked profits off the initial hike.

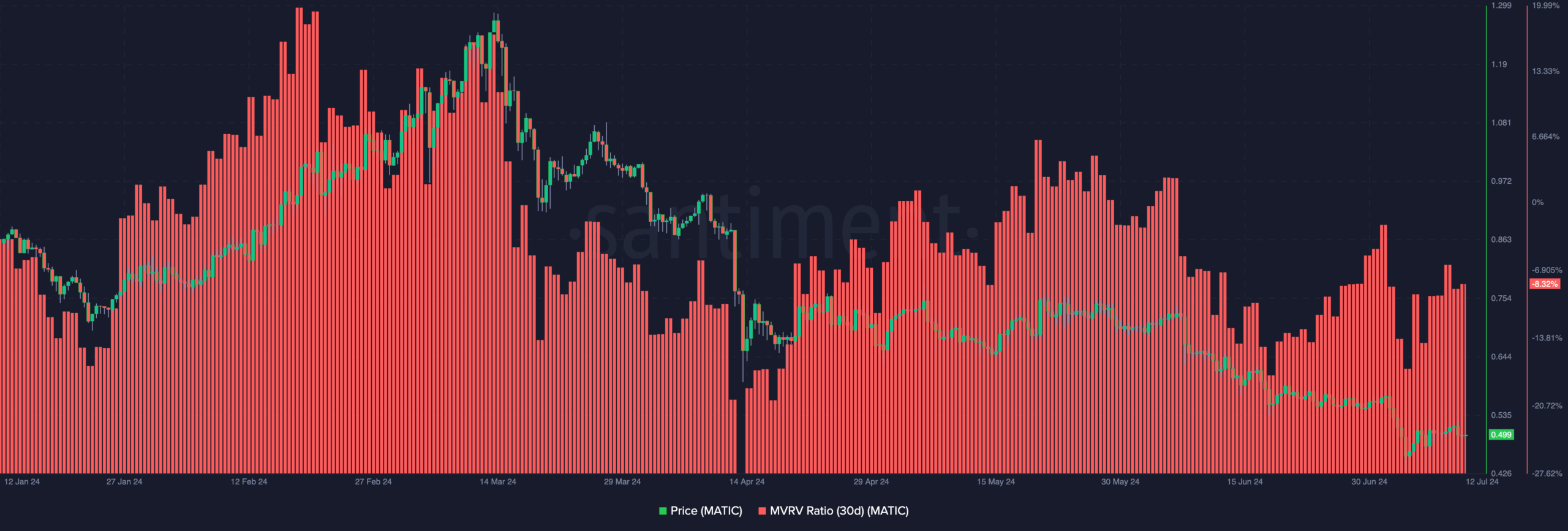

Hence, the question – Will MATIC’s price hike if another round of whale interest appears? Let’s start by looking at the Market Value to Realized Value (MVRV).

This ratio used profitability to measure if a cryptocurrency has reached its top or is at the bottom. In most cases, the higher the average profits, the closer a token is to its top.

However, when there are a lot of unrealized losses, it means it is close to the bottom. At press time, MATIC’s 30-day MVRV ratio was -8.32%. This simply means that if holders of the crypto sell at the current price, the weighted return will be a 8.32% loss.

Considering the performance of other altcoins, MATIC could be deemed close to its bottom. If the price retraces again, the ratio will decrease, and might provide better buying opportunities.

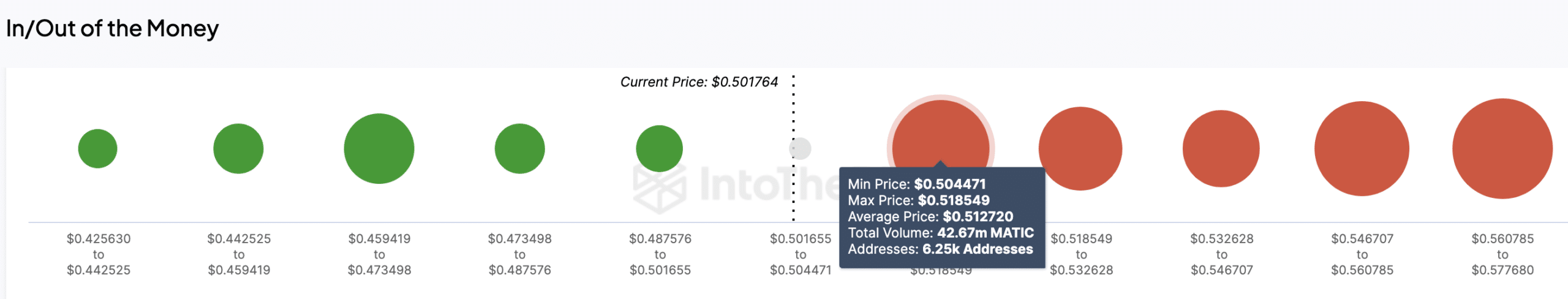

However, apart from the ratio above, the In/Out of Money Around Price (IOMAP) is one factor that can tell if MATIC price will appreciate or not. The IOMAP classifies addresses based on the price they purchased and if they are in profits or not.

No more respite?

As a result, this metric can act as support or resistance. When there are a large number of addresses that purchased at a price range, the region will be the support or resistance.

If the larger addresses are out of the money, it would be resistance. On the other hand, if they are in the money, it would be support.

According to IntoTheBlock, 6,250 addresses purchased 42.67 million MATIC at an average price of $0.51. This cohort is currently out of the money. On the other hand, 1,060 purchased 58.97 million tokens at around $0.49.

Realistic or not, here’s MATIC’s market cap in ETH terms

Since a higher number of addresses seemed to be positioned above the press time price, it meant that MATIC faces resistance on the charts. Therefore, there is a chance that holders at $0.51 might decide to break even once the price revisits the level.

If that happens, MATIC might retrace and the next decline could be below $0.48.